A world-first blockchain solar energy trading trial that lets households set their own electricity prices has found the technology is feasible, popular with consumers and valuable for network operators faced with increasingly decentralized energy systems. The trial, funded in part by the Australian federal government, ran between December 2018 and January 2020 as part of the RENeW Nexus Project and involved using Power Ledger’s blockchain technology to track the transactions of rooftop solar energy traded between 48 households in Fremantle, Western Australia (WA).

The trial was led by WA’s Curtin University in cooperation with Murdoch University, Landcorp, CSIRO/Data61, CISCO, Synergy, Western Power, Water Corporation, and energyOS. In addition to the P2P trial, the project also includes a study of a distributed Virtual Power Plant (VPP) as well as a microgrid with a 670kWh battery that will service homes within the East Village development in Fremantle.

Using the existing electricity network and working with the local energy retailer, Power Ledger’s platform enabled households to buy and sell excess rooftop solar energy in near real-time at a price agreed between them, with residents able to view electricity usage in 30-minute intervals. As noted in a report into the project prepared by Power Ledger, Curtin and Murdoch Universities and released on Friday, the trial showed that P2P energy trading is technically feasible and desired by customers.

The report also found that energy trading is able to provide a potential price signal instrument to deliver localized energy markets that can contribute to lower-cost grid stability in what would be a major win for network operators. However, it also noted that under the current electricity tariff structure in WA, some participants’ financial outcomes were largely dependent on their daily energy consumption rather than trading volume.

Results and recommendation

Namely, Phase 1 of the RENeW Nexus trials led to a financial loss for a majority of the participants. Seventeen of the 18 households experienced higher costs than they would’ve received under Synergy’s A1 residential tariff. Since energy generation costs in the WA electricity market make up only 15-20% of an electricity bill, participants that consumed less energy, that is below 11.5 kWh/day, were worse off due to inflexible tariffs. “Unbundled tariffs that reflect system costs via a high fixed-supply charge favour higher energy consumption because higher energy use brings down the per-unit cost,” the report found.

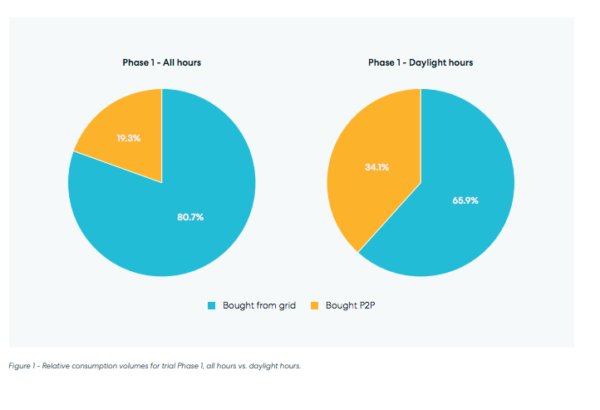

Another contributing factor was the suboptimal ratio of prosumers and consumers (70% prosumers to 30% consumers), which led to limited demand for P2P energy resulting in more rooftop solar electricity being sold to the retailer. Participants in Phase 1 purchased 19.3% of their energy from peers, with the remainder purchased from the retailer.

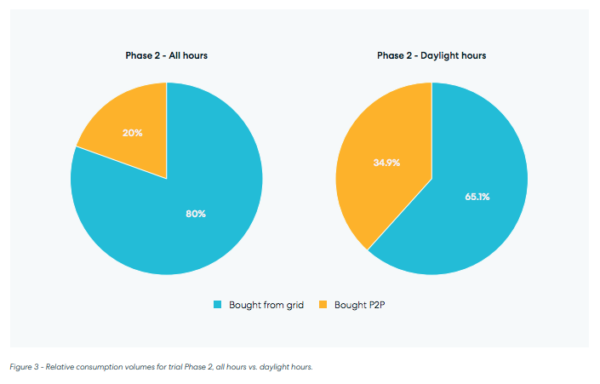

The outcome was different in Phase 2 that resulted in a financial benefit for a majority of participants: 18 of the 29 participant households (62%) experienced lower costs than if they’d been charged the A1 tariff whereas 11 participants experienced higher costs. In this phase, the prosumer to consumer ratio was reversed, with the new cohort initially consisting of 20 consumers and 10 prosumers. All recruited participants had a historical average consumption of 11-16 kWh/day, which aimed to cover the $3.30 total daily fixed costs when compared against using the A1 tariff. As a result, energy bought from peers rose to 38%, while the remainder was sold back to the retailer for the default buyback rate.

Overall, “participants had a positive view of P2P energy trading and could see its benefits but stated that changes to the tariff structure would be required to make it attractive,” the report found. Therefore, the report recommended P2P coupled with a dynamic feed-in tariff as a way to deal with excess solar during the day so that prosumers would be able to monetize their excess solar at all times of the day, without any subsidy, and also provide services to the grid.

VPP bonanza

The report also found the potential for virtual power plants (VPPs) to give battery owners access to additional revenue streams and in doing so decrease the payback period on investment in a battery. A VPP could increase localized energy autonomy by approximately 30% with the current prosumer-consumer mix in the SWIS where battery system sizes were 15kWh, the report said. “Up to 68% local energy autonomy was possible when half the cohort were prosumers which would deliver a greater amount of system benefits at the same time,” it found.

As a result, the report notes, VPP energy trading could further reduce the excess solar during the day, thereby improving the resiliency of the grid, and then dispatch that electricity when the system actually needs it with households being financially better off even with a reduced feed-in tariff. Report co-author and Power Ledger Chairman Jemma Green added that “P2P and VPP trading is a viable alternative to curtailing the output of renewables, or needing more subsidies to encourage the consumption of excess solar during the day.”

“If governments around the world are serious about incorporating renewable energy into their future energy planning then it needs to be price-competitive,” said Green. “For markets that have or are retiring their feed-in tariffs, P2P and VPP trading market mechanisms can replace FiT income for households and at the same time facilitate a more stable grid, dealing with the grid problems that renewables can cause.”

The report recommends energy network and market operators should explore alternative methods and structures of charging for network usage to more accurately reflect the benefits to transmission and distribution delivered by P2P trading. To make this possible, network operators should improve metering infrastructure in their systems by installing advanced meters and designing systems for collecting and communicating the metering data to third parties.

“Australian network and market operators can learn further from the RENeW Nexus project and should monitor the next stage which will examine the East Village project involving a 670kWh battery,” the report said.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Hey this sounds great

I think this can be a new growth phase for solar energy

I can see how this would empower individuals against bigger energy companies

I can see how Australia as a whole will be going green thru these incentives

But when will this realistically be put into Practice

In my humble opinion “never” not because the idea is bad, or it not being profitable for the consumers

Big energy companies are now going solar as well they are developing hundred square kilometres at the time

So when the Australian government gets thru the red tape and approves this p2p trade for the Australian consumer, the big energy companies will already have made switch at will dominate the market again.

Here is in my opinion where scheme will crumble in Australia p2p trade represents fluidity in the energy market, where as the big energy companies represent a solidity in energy market.

Between the choice of a solid market and a fluid market any normal government which includes Australia will always choose to favour the more solid one over the more flexibility/fluid one

To make the government go for the p2p energy plan two simple things must be done.

One freeze the fluidity by creating “energy stratas” like it has been done in Freemantle there 48 people came to gather to sell an buy excess solar energy.

It worked due to the stability of number of people involved, it never varied one knew roughly when the “neighbour“ needed electricity and when the other neighbour had electricity.

Having wild elements coming and buying then selling would put this stability at risk a risk governments avoid.

The second thing is invest in secondary green energy source, micro hydro power plants or small to medium size wind turbines. not that having a 670kw battery as strata community battery is a bad idea, if anything this can act a glue that keeps the strata together, and stabilises the stratus electrical price.

No batteries are expensive, and should something happen to them probably would take time to replace, plus they are static and one will lose electricity in time.

A micro hydro farm can electrically pump up a hill water at peak solar productivity for two to three hours and then release it in a matter of minutes to provide the necessary electricity after dark.

The wind turbine could also provide electricity after dark but out put would strongly depend on the wind.

The wind turbine could also work in tandem with the micro hydro farm to bridge the morning electrical need fill up in the evening hours to then release it in a matter off minutes for the morning usage.

So to recap the idea is great of p2p selling of solar energy but it has to be put into stratas as the government will support a more solid System of energy trade to a fluid

Secondly solar is good but it cannot be the only thing a strata relies upon get battery to control the fluctuations of the energy market and use micro hydro farms and wind turbines to offset the peak hours outside solar peak operating hours this again would stabilises the strata.

Thirdly act fast the big energy companies are not contrary to popular belief sitting idly by

Sorry my English witting got sloppy at the end should have checked it for gramma.

Sorry I will re write if needed but I do think that my points get across.