The Clean Energy Finance Corporation (CEFC) is set for a $60 million cornerstone investment in an equity-linked green bond from financier BNP Paribas to support the Australian Climate Transition Index (ACT Index).

ACT Index

The ACT Index is the first Australian equities index to focus on climate change and the transition to renewable energies specifically. By using a methodology developed by a collaborative partnership between Monash University Centre for Quantitative Finance and Investment Strategies, ClimateWorks Australia, BNP Paribas, and sustainability analysts ISS ESG, companies likely to flourish in a changing climate and a changing energy market will be identified for the ACT Index, including 100 Australian companies from the ASX 300 which are supportive and adaptive to change.

“The ACT Index is an exciting market leading development,” said CEFC CEO Ian Learmonth, “mobilising the increasing scale of impact investment capital to benefit the Australian companies leading the emissions transition.”

Learmonth says the ACT Index gives investors an easy way to parse their ASX portfolios for climate and energy future risk. “At the same time,” continues Learmonth, “it gives emissions-focused ASX 300 companies a powerful incentive to accelerate their decarbonisation efforts.”

BNP Paribas issuing of $140 million in equity-linked green bonds is already a hot ticket, with not only CEFC committing $60 million as a cornerstone investor, but also First State Super and QBE Insurance. Of course, it is not surprising to see big super funds like First State investing in the safety of Australia’s long-term future. Late last month, Hesta, a leading industry superannuation fund trusted by 860,000 Australians, has joined a host of other major investment firms nationwide calling on the Federal Government to encourage large-scale renewable investment by setting an emissions target and cleaning up its strategy.

BNP Paribas’ Head of Global Markets for Asia Pacific, Pascal Fischer, said that “the long-term support of these three major Australian investors indicates a clear willingness and readiness for action among critical sectors in Australia.”

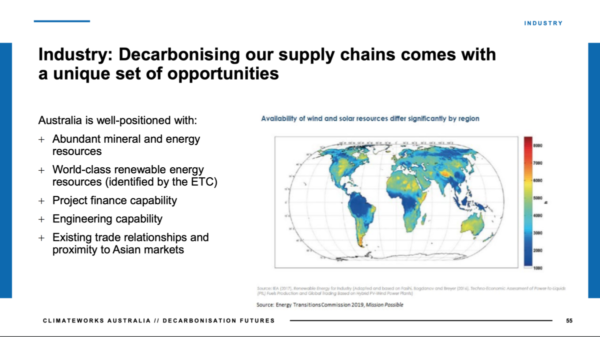

Critical to the ACT Index was the research detailed in the 2020 Decarbonisation Futures report by ClimateWorks Australia. In an op-ed published by ClimateWorks Australia’s Head of National Programs, Amandine Denis-Ryan, in pv magazine Australia, on the findings of the report, Denis-Ryan said “the modelling in Decarbonisation Futures shows that, to get to net zero in time to stay under global climate limits, we must accelerate deployment of mature zero-emissions solutions, and invest in the rapid development and commercialisation of emerging zero-emissions solutions in harder-to-abate sectors.”

Image: ClimateWorks Australia

“Stimulus funding could instead be directed to support the development, demonstration and deployment of energy productivity, renewable technologies, and nature-based solutions,” continued Denis-Ryan. “Such goal-oriented investment signals would thus facilitate the transition to a zero-emissions economy, while also bringing ‘shovel-ready’ projects into an economy needing a kickstart.”

According to CEFC Executive Directory Rory Longergan, the decarbonisation future shown in the report by ClimateWorks Australia is just what the ACT Index can help develop. “this can send a clear signal to the market that there is an emerging pool of capital dedicated to companies that are either supporting the climate transition, or well equipped to adapt to the transition,” he said.

Green Finance

The Economist has recently reported that the “role financial services can play must not be misunderstood or overstated.” This is to say, green finance is not the driver of climate action, but “its enabler, making it more flexible and better able to tap insights and capital from investors around the world.”

The carrion scent of decay on the fossil fuel industry may be more pungent now than ever before, but by The Economist’s calculations, “Less than a quarter of industrial emissions come from companies that can be influenced by investors in stockmarkets.”

Nevertheless, the incipience of green finance for renewable energy is cause for optimism in the fight to reduce emissions and transition to clean future. After all, the energy transition is not called “green” solely because of its environmental friendliness, but also because it makes money.

Investment in the firms and companies and technologists progressing renewable energies is, says The Economist, the most productive use of green finance for it is the only investment which hinders the grand profits of private emitters. This is to say, if emissions are to be curbed in any real sense, green investment initiatives cannot merely be additions to the existing market, they must become the new market entire.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.