Shareholder meetings are not generally considered golden opportunities for rectitude, but BlackRock has managed to break ranks and exhort AGL Energy to hasten its divestment from fossil fuels. BlackRock, one of the world’s largest asset managers, announced in January that it would lead the way on fossil fuel divestment but until AGL’s annual meeting the asset manager had remained inveterate.

According to Majority Action’s report “Climate in the Boardroom: How Asset Manager Voting Shaped Corporate Climate Action in 2020” have continued “to undermine global investor efforts to promote responsible climate action at these critical companies – even as they publicly tout their commitment to addressing the climate crisis.”

Despite CEO Larry Fink’s warning in January #ClimateChange represented a risk to markets, @blackrock backed fewer environmental votes at AGM's this year than last. Time to walk the talk Larry https://t.co/4wnXIzQjoe #ClimateActionNow

— Carbon Tracker (@CarbonBubble) October 5, 2020

However, BlackRock seems to have responded to the criticism by siding with the Australasian Centre for Corporate Responsibility (ACCA), a shareholder advocacy group, which had called on AGL to accelerate coal station closures back in August. The ACCR, hot on the heels of dismissing the Minerals Council of Australia’s gimcrack Climate Action Plan, had filed a Shareholder Resolution for AGL Energy’s annual meeting, requesting Australia’s largest emitter accelerate the planned closures of its Bayswater and Loy Yang A coal-fired power stations.

The meeting, which occurred yesterday, saw the resolution voted down, but a definitive statement was made with the $7.3 trillion BlackRock, one of AGL’s top five investors, crossed the aisle and voted in support of ACCR’s proposal. According to the ACCR: “This resolution was based on AGL’s own FY2020 scenario analysis which shows that in order to limit global warming to 1.5°C above pre-industrial levels, AGL would have to close its three remaining coal-fired power stations by approximately 2036 – as opposed to the scheduled closure of Loy Yang in 2048, announced in 2015.”

ACCR Director of Climate and Environment, Dan Gocher, said “BlackRock’s support for this resolution embarrasses Australian super funds and asset managers who voted against the resolution. It demonstrates an increasing trend that European and US investors are more prepared to take critical action to address climate risk.”

Gocher called out Aware Super (formerly First State Super) for previously stating that climate change posed a significant risk to its investment portfolio over the long term and then voting against the resolution, claiming it was “not commercial” to close coal-fired power stations by the mid-2030s.

“Far too many Australian investors live in fear of blowback from a government committed to stalling progress on climate action,” continued Gocher. “Increasingly, European and US investors see through the bluster and vote for what is the best long-term interests of shareholders. As BlackRock rightly pointed out – AGL’s operational emissions cannot be taken lightly, they make up approximately 8% of Australia’s total emissions in 2019/20.

According to the Financial Times, BlackRock said it supported the resolution because AGL’s own analysis suggested it was possible to shut its coal-fired Loy Yang plant 12 years ahead of the current scheduled closure. “The proposal, and our support of it, affords the AGL board and executives the discretion to manage that timing to ensure an effective and safe closure at the appropriate time.” Moreover, BlackRock pointed out to FT that the scheduled closure date of 2048 would make Loy Yang more than 60 years old, increasing the risks of “operational concerns in relation to reliability and safety.”

According to Gocher, “Many investors have failed to grapple with the key issue facing AGL, specifically whether Loy Yang A will actually survive beyond the mid-2030s. Even though it was built at the same time as Bayswayer (1984-88), AGL plans to keep it open for 14 years longer. In 2018, AGL’s own executives admitted that 2038 was the more likely closure date.”

.@aglenergy Chair Graeme Hunt asked to explain how Bayswater has a technical life of 50 years, while Loy Yang A has a technical life of 64 years.

Hunt dodges again, says a range of factors.

— Dan Gocher (@justdanfornow) October 7, 2020

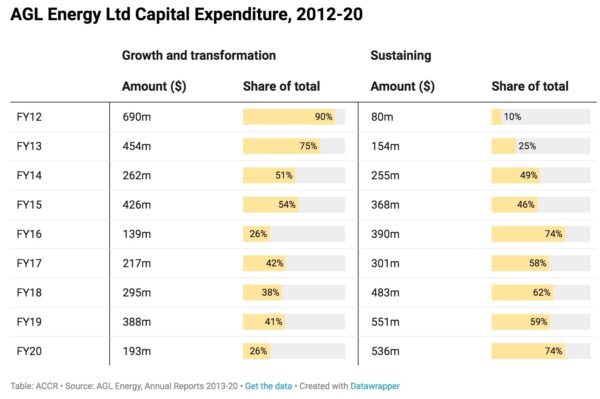

Moreover, Gocher points out that AGL’s capital expenditure has more than doubled in the last six years, a trend likely to continue as the costs of maintenance of these fossilised plants continue to eat into earnings.

“Investors appear to have missed the point that this allocation of capital expenditure not only affects earnings,” continued Gocher, “but limits AGL’s ability to fund a much quicker transition. The share of coal power generation in the National Electricity Market hit a record low last month. The more renewable energy grows, the more pressure is placed on ageing coal-fired power stations to be more responsive, which they are simply not designed to do.”

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

9 comments

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.