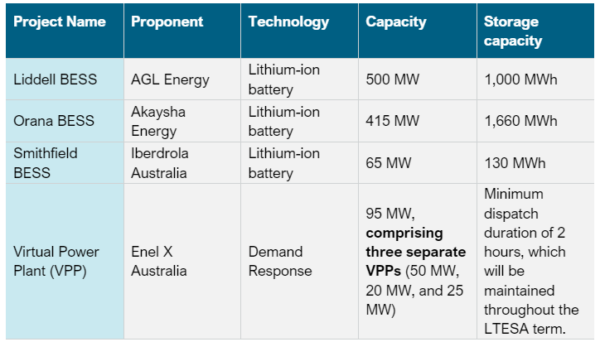

The winners of Australia’s biggest storage tender to date have been announced by the state and commonwealth governments, who opted to join the LTESA (Long-Term Energy Service Agreements) and Capacity Investment Scheme auctions into one super tender. It eventuated in six projects being selected to deliver a total of 1,075 MW of firmed capacity and 2,790 MWh of storage at a project value of $1.8 billion.

The six winning projects include:

- Akaysha Energy’s 415 MW / 1,660 MWh Orana battery. To be located in Wellington in central-west NSW, the battery system will provide firmed capacity to the state’s first Renewable Energy Zone and four hours of storage.

- AGL Energy’s 500 MW / 1,000 MWh Liddell battery. Located in Muswellbrook at the site of AGL’s shuttered Liddell coal plan, the battery delivers two hours of storage.

- Iberdrola Australia’s 65 MW / 130 MWh Smithfield Sydney battery, located in Western Sydney.

- And Enel X Australia is set to deliver three separate virtual power plants through a demand response project totalling 95 MW capacity with minimum dispatch duration of two hours.

All these projects are targeting commercial operations by December 2025 – the year the state’s biggest coal plant, the 2.88 GW Eraring, is currently scheduled to close. Its closure is set to open up a major energy supply and reliability gap in the state and was the focus of much attention earlier this year when the state’s new Labor government was elected and entertained the possibility of extending the plant’s life. NSW Energy Minister Penny Sharpe said specifically of these six projects that they will help ensure “we do not need [Eraring] to be open one day longer than they need.”

Image: AGL

The successful projects are required to deliver at least half their capacity in the event of a supply shortfall declared by the Australian Energy Market Operator (AEMO). The projects from this tender alone are equal to 8% of the total 2022/23 NSW summer peak demand. They are underpinned by a 10-year agreement with government.

At a press conference on Wednesday, Minister Sharpe said part of the reason why the governments expect these projects to be able to be commercially operating within two years is because “they don’t rely on those very big transmission projects that we’re working with.”

In the last years, shuttered power plants like Liddell have become extremely populate sites for battery proposals due to their infrastructure and grid connections.

The tender was run by AEMO Services, acting as the NSW Consumer Trustee. The auction originally sought 380 MW of firming infrastructure and demand response from the market but was expanded to 930 MW after the federal government came onboard to support an additional 550 MW through its own storage tender scheme, known as the Capacity Investment Scheme.

Enel X’s Demand Response Virtual Power Plants

Few details of Enel X’s successful virtual power plant projects, or VPPs, has been included in the announcement. During her press conference, Minister Sharpe provided only an overview of the technology, which will aggregate distributed technologies like rooftop solar and battery systems to provide a total of 95 MW of capacity.

The three successful VPPs are part of Enel X’s Demand Response Project, which looks to create flexibility to respond to demand peaks and troughs in the grid. Enel X has been playing in the VPP space in Australia for quite some time and has a number of projects currently on the go.

Demand response is an interesting way to help manage the grid as it relies on using power differently (flexibly) rather than a more classic pathway of generating power, storing it and then dispatching it when required. The approach needs less infrastructure and technologies, but is inherently complex as it requires the orchestration of privately own assets like home batteries.

“We need innovative thinking and new funding models to avoid the risk of blackouts,” Carl Hutchinson, Country Manager of Enel X Australia, said. “The result of this highly competitive tender proves that demand response is a cost-effective solution to meet this challenge. Using energy assets intelligently at key times keeps the lights on and rewards businesses.”

Akaysha Energy

Akaysha Energy was acquired by US investment giant BlackRock in 2022. Since then, it has kicked goals in the NSW storage segment, awarded the contract to build the state’s 850 MW / 1,680 MWh Waratah Super Battery Project. The project is intended to act like a giant “shock absorber” and is underpinned by novel contracts with transmission company Transgrid and the state government’s EnergyCo. It too is being built at the site of a decommissioned coal-fired power station, Munmorah, near Doyalson north of Sydney.

Image: Akaysha Energy

The Orana BESS is the company’s second major storage goal – with the company noting it will be Australia’s first gigawatt-scale four-hour battery. “At Akaysha Energy, we are bullish on longer duration systems such as this four-hour system. Our in-house markets modelling, engineering and technical teams have all combined to provide us a strong view that four hours is the new normal for BESS duration in Australia,” Nick Carter, Chief Executive Officer & Managing Director at Akaysha Energy, said.

Alongside the Orana and Waratah big batteries, Akaysha is also developing the Elaine battery project in Victoria’s southwest. The project is set to have four hours of duration, with the company most recently saying the project would have 1,244 MWh of storage.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.