The Australasian Centre for Corporate Responsibility (ACCR), hot on the heels of dismissing the Minerals Council of Australia’s gimcrack Climate Action Plan, has filed a Shareholder Resolution for AGL Energy’s September meeting, requesting Australia’s largest emitter accelerate the planned closures of its Bayswater and Loy Yang A coal-fired power stations.

The shareholder advocacy group’s call for expediting the closure of said coal-fired power stations comes as a response to AGL’s hidebound policies demonstrable by its own modelling. By this modelling ACCR argues that AGL is breaching its fiduciary responsibility to its investors.

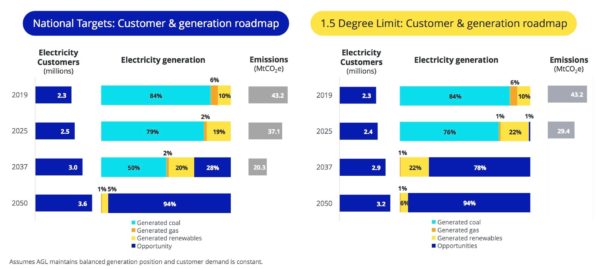

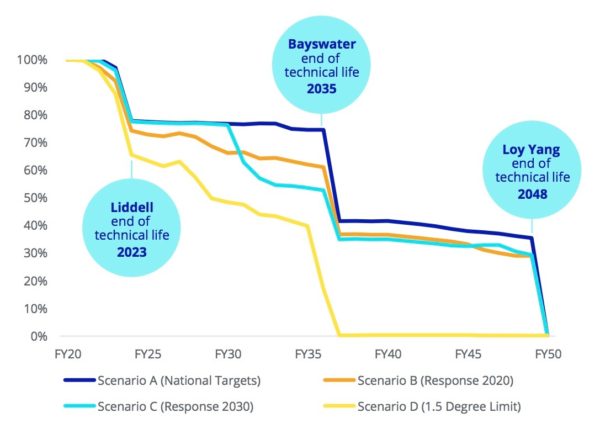

ACCR argues that, as AGL’s own FY2020 scenario analysis modelling shows above, if AGL is committed to the global 1.5 degree limit, it would need to close its three remaining coal-fired power stations by approximately 2036 – and not 2048, the date AGL currently plans to close Loy Yang.

Moreover, as can be seen in the above graph, AGL is actually committing to nothing but the technical lifespan of their assets, meaning the energy giant is taking no responsibility, taking nothing into account except its own best interests.

“Prudent capital allocation is a fiduciary responsibility of AGL to its investors,” said ACCA Director of Climate and Environment, Dan Gocher, “‘Sustaining’ capital expenditure has grown from 25% of total capital expenditure in FY2013 to 72% (estimated) in FY2020. This allocation of capital expenditure suggests AGL is maintaining its coal-fired power stations at the expense of accelerating its transition.”

Of course, such meretricious behaviour is now to be expected from AGL. Much like an apology without a behavioural change, AGL’s policies and public relations on climate change and the energy transition is mere manipulation. Shiny on the outside but full of rubbish like an Easter Show showbag.

“Investors must question whether this expenditure is in the long-term interests of shareholders,” continued Gocher. Norway’s $US1 trillion sovereign wealth fund recognised AGL’s short-sightedness already, selling its stake in AGL in May.

The same is true of last month’s updated Climate Statement, whereby AGL’s progressive position amounted to offering (or is it offloading?) a carbon-neutral option to its customers, and bragging about being the first major ASX company to link executive pay bonuses to climate goals, such as investing in renewable energy. This is to say, AGL’s executives have decided to give themselves bonuses for investing in the best and most financially viable sources of energy, also known as doing their job.

And yet, despite this highly mature Climate Statement, Gocher notes that “AGL continues to evade any substantive commitment to reduce emissions – and most importantly failing to bring forward the closure of coal-fired power stations, which investors have long been asking of AGL.”

ACCA says that AGL cannot simultaneously affirm its commitment to Paris targets (as it has said since 2017) while still operating its coal-fired power stations for the remainder of their technical lives. If you recognise your wrongdoing, you don’t continue to unload the whole clip.

Gocher points out that AGL makes up 8.1% of Australia’s total emissions, and is thus not to be taken lightly. “These coal stations are fossils in their own right,” said Gocher finally, “and as they age, their reliability declines and the cost of maintenance increases.” ACCR even went to the trouble of pointing out AGL’s increasing capital expenditure for the maintenance of its generators, increasing from 25% of total capex in 2012-13 to an estimated 72% in 2019-2020.

According to AFR, an AGL spokesman has confirmed the company has received the shareholder resolution and, upon considering, will respond in “AGL’s Notice of Meeting to be published in late August.”

The power of green investors

The Economist recently reported that the “role financial services can play must not be misunderstood or overstated.” This is to say, green finance is not the driver of climate action, but “its enabler, making it more flexible and better able to tap insights and capital from investors around the world.”

But, as evidenced BP’s recent 10-fold increase in low-carbon investment by 2030 and a shrinking of its oil and gas production by 40%, it is possible for energy giants to take responsibility and recognise the transition. Moreover, BNP Paribas’ issuance of $140 million in new green bonds through the ACT Index yesterday, met by a cornerstone investment of $60 million from the Clean Energy Finance Corporation (CEFC), demonstrates that it is not just the energy market that is transitioning green, it is the market entire. The market is shedding its old, fossilised skin, like a python, and as ACCA is making known, AGL’s investors are right to worry that the company might soon be left holding an empty sack as the market slinks away into the green scrub.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.