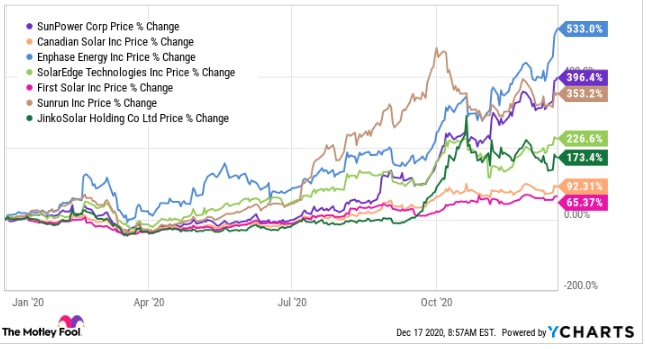

Shares of solar companies worldwide have more than doubled in value from December 2019, the International Energy Agency (IEA) reported in October. Now, as the year draws to a close with more global policy wins for renewables, the rally has only increased in force. The share prices of publicly listed renewable equipment manufacturers and project developers have outperformed most major stock market indices and the energy sector as a whole, the IEA noted.

Enphase Energy, a global technology company and solar inverter supplier, has been one of year’s most notable winners. It’s share price has increased 561% over the last 12 months, growing from US$26.81 on December 23, 2019 to being valued at US$177.27 today. Solar technology company SunPower has seen their share price make similar gains, coming close to a 500% increase. Jinko Solar, SolarEdge Technologies and Invesco Solar have all seen their share prices rise by about 240% over the same period.

Chinese company ReneSola Power, a solar project developer, has seen massive gains not only this year, but this week – almost doubling from December 17 to December 22, closing the day at US$12, up from just US$1.42 at this time last year.

Sunrun Inc, which provides residential solar panels and home batteries, has had a stock price increase of 380% in 2020, while Sunnova Energy International’s increased by 311%. First Solar and Canadian Solar share prices have also made substantial gains.

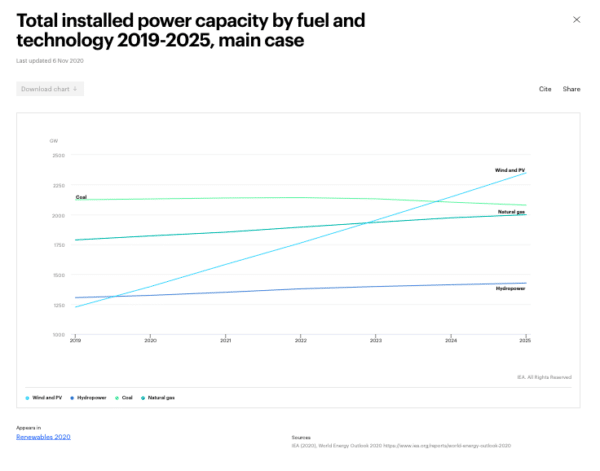

International Energy Agency

According to US investing advice company, The Motley Fool, the “outstanding” rally of solar energy stocks shows little sign of slowing, with the company saying there is still “incredible potential for growth.” Meanwhile, fossil-fuel companies have floundered on the stock market in 2020, struggling to recover from the collapse of oil prices in February.

A number of factors have contributed to renewable energy market’s rally, including worldwide political tides turning in favour of stronger climate action coupled with the rapidly declining costs of renewables. According to the International Renewable Energy Agency, solar PV energy costs dropped by 82% from 2010 to 2019, while the cost of concentrating solar power (CSP) almost halved, falling 47%.

Notably omitting Australia’s federal energy minster Angus Taylor – who was recently voted the Morrison government’s worst performing cabinet member by a poll of Australian Financial Review readers – world leaders have flocked to renewable projects to power the Covid-19 recovery, with solar often front and centre.

While there are questions around whether solar stocks have run too far, none of the forces behind bull market show signs of slowing. As it stands, the share prices of solar companies in 2020 bear out of the optimistic future many see for PV.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.