New figures published by Australian solar analyst SunWiz reveal a record 5 GW of solar power systems – equivalent to almost 15 million average solar modules – was installed across the nation in 2020.

With every state and territory except Tasmania smashing records in 2020 for the volume of solar modules and system size installed, Australia now has 20 GW of solar capacity nationwide – up from 15 GW in 2019.

SunWiz managing director Warwick Johnston said Australia had led the world in uptake of solar on a per-capita basis in 2020, following on from a record year for installations in 2019.

Johnston said the annual growth rate for rooftop solar PV across the nation has exceeded 33% for the past four years and accelerated in 2020.

“The number of Australians installing rooftop solar systems increased by 40% compared to 2019 levels,” he said.

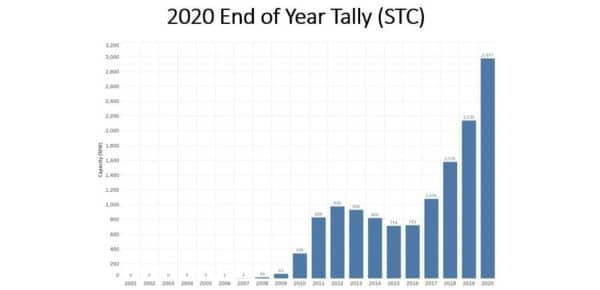

Image: SunWiz

The sub-100 kW market exploded in 2020 with a record 2.9 GW installed nationally, including a record 324 MW in December. In the same month, the average system size in the small-scale technology certificate (STC) market increased to 8.7 kW, driving the average system size for the year to a record 8.0 kW.

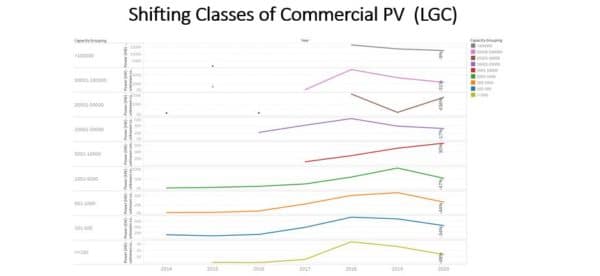

Records were also toppled in the large-scale generation certificate (LGC) market with the 5-10 MW sector, a blend of solar farms and behind-the-meter installations, continuing to grow with record deployments in New South Wales, Victoria, and Western Australia but it wasn’t enough to offset an overall decline in the over-100 kW market.

The capacity commissioned in the LGC market was down on 2019, with SunWiz attributing the drop in part to a decline in solar farms over 50 MW while the sub-10 MW LGC market was down 29% on the previous year.

Image: SunWiz

SunWiz conceded that some projects installed in 2020 had not yet been registered and may come to light in 2021, but said it is unlikely there will be sufficient volume for growth to have occurred in the LGC market.

Johnston predicted the LGC market would continue to face challenges in 2021 with the commercial sector “most likely to be somewhat steady in 2021” delivering an estimated 250 MW of sub-10MW LGC projects, while the development of solar farms has slowed.

“When compared to the start of 2020, there’s currently reduced levels of solar farms under construction and in advanced stages of development,” he said.

“This means the capacity of solar farms commissioned in 2021 is likely to reduce by an amount dependent upon when the largest projects complete. A reasonable guess would be 1.5 GW of projects over 10 MW.”

Despite concerns for the LGC market, the overall market is expected to continue growing at record rates, driven by the small-scale installations although Johnston tempered expectations, saying the STC market would more likely be ‘consistent’ in 2021 as opposed to seeing ‘continued growth’.

A ‘continued growth’ market would deliver another 40% growth in the sector, to 4.2 GW but Johnston

“We see this as optimistic due to increasing headwinds in the industry,” he said.

A ‘consistent’ market would mean sustaining the levels set in the second half of 2020. This would equate to 3.2GW annually.

“This seems reasonably achievable,” Johnston said.

“A contraction could come due to any combination of feed-in tariff reduction, increased hurdles to network connection … (but) there’s no observable wall the industry is about to hit. Therefore the contraction should be at worst 10% reduction on 2020 levels,” he said.

“Our best estimate is for a 3.35 GW STC market in 2021.”

“This would produce another record year,” Johnstone said. “However, this is heavily influenced by growth levels of residential PV.”

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.