By their nature, renewable energy projects look to take advantage of certain climactic conditions and correspondingly are increasingly being built in locations at risk of extreme weather events. Consequently, for owners of renewable energy assets, this results in more scrutiny over appropriate insurance policy terms and conditions, as insurers seek to mitigate the potential impact of natural catastrophe events and resultant claims activity. Accordingly, insurers are focusing more than ever on understanding these perils, analysing the likelihood of such events happening as well as the potential losses that may result.

We partnered with Berkshire Hathaway Speciality Insurance (BHSI) to understand insurers’ methodologies for underwriting natural catastrophe peril exposures and analyse the criteria that influences capital deployment and policy terms and conditions.

BMS

Modelling natural catastrophe perils

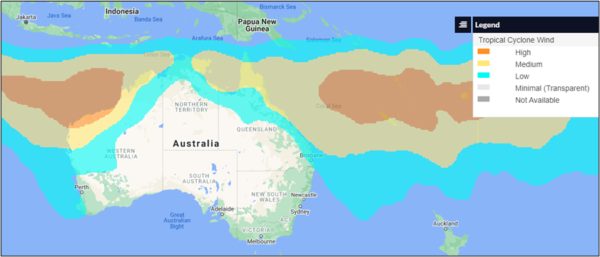

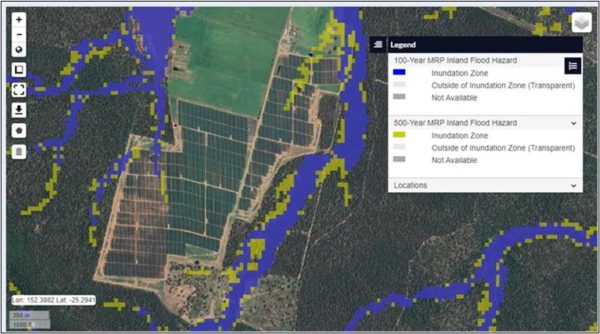

Every project site will have unique exposures to a variety of hazards, including the major perils of flooding and windstorm, and the so-called “secondary perils” of lightning, hail and bushfire. As such, underwriters require site-specific data to build a detailed understanding of a given project or location’s risk profile, including accurate and comprehensive location data to eliminate the possibility that natural catastrophe exposures which cross asset boundaries are not inadvertently missed due to the project spanning over several hundreds of hectares.

Natural catastrophe perils are typically low-frequency, high-impact events which can cause significant insured losses. Therefore, insurance companies invest considerable resources into understanding exposure to these perils so as to ensure adequate capitalisation for expected losses. Consequently, they make use of several different catastrophe models to quantify and understand the risk. Many of these models are based on historical data, which provides valuable insights into past events; however, there is a need to look beyond historical records which are typically too short to fully indicate localised hazards. This is especially true in Australia, where the low frequency of natural catastrophes mean historical data is sometimes insufficient in predicting potential future losses.

An often-cited example is the hail damage to a large proportion of photovoltaic (PV) modules at the 178-megawatt Midway Solar Project in Texas in May 2019. From a natural hazard perspective, the magnitude and intensity of the hail was well within expectations but since the area is largely unpopulated there was a lack of historical data regarding building or other asset damage. The insured losses reached US$70 million with losses arising from damaged PV modules and undamaged PV modules that had suffered “micro-cracking”. As a result of the hailstorm, insurers specialising in the renewable energy sector have sought to adjust their underwriting criteria to mitigate the impact of these unexpected events by virtue of specific coverage restrictions.

BMS

In the case of the Texas solar project, historical-based modelling was not sufficient to predict the impact of such an event. In contrast, using probabilistic models enables insurers to better account for the impact of future events. A probabilistic methodology looks beyond historical data, considering all realistic possibilities that could occur within a set timeframe. It’s a robust approach that quantifies the likelihood of an event happening in a certain year, as well as the ramifications of such an event.

Impacts on terms & conditions

As the market develops and insurers embrace higher standards of data, analytics and insights into a location’s true exposure, it may drive increased insurer confidence in the risk exposure resulting in more competitive pricing of insurance and allow for broader coverage for insureds. Insurers will be able to differentiate their appetite to underwrite projects through the terms and conditions they offer and the premium levels they charge.

As natural catastrophe events are expected to occur ever more frequently as a result of climate change, this will continue to impact insurers’ underwriting decisions and criteria will tighten. This in turn will mean that owners of, and investors and financiers in, renewable projects will need to provide more granular, detailed data regarding a site location’s risk profile. As an example, when it comes to flooding events, the fact that a site has a known propensity to flooding does not make it uninsurable. Rather it requires evidence of adequate risk mitigation initiatives such as having a flood management plan in place, storing equipment on high ground and building equipment above designated flood levels.

BMS Australia

For all perils, the level of coverage offered will reflect the site-specific risk and the mitigation methods being implemented by the owner or developer. The more an underwriter understands regarding both the physical risks present and the procedures in place to manage these, the better the outcome or solution will be for all parties. One of the most significant challenges for those seeking insurance is a request for more detailed project information relating to exposure that has not been accounted for or is not readily available. Having this information already at hand quickens the process and limits the likelihood of there being an adverse impact on policy terms and conditions which could in turn negatively impact a project’s financials.

An effective and timely approach to risk assessment and insurer engagement process is one of the best ways a project owner or developer can make sure that they have the appropriate insurance, for the best possible price. There will always be risk, the goal is not to eliminate risk but rather to ensure that insureds are prepared for the risks that are applicable to them. Not only does this save on potential premium costs, but it also supports the underwriting methodology of insurers, allowing them to optimally deploy their capacity. Comprehensive risk assessment enables insurers to be adequately capitalised and to quickly allocate that capital in the case that an insurable event does occur. Insurers, brokers, developers, owners and investors all must work together to provide the best possible data to ensure the best possible outcome for all involved.

*Source: Insurance Journal – ‘Insured Losses for March’s New South Wales, Queensland Floods Estimated at A$916M.’

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.