Originally published by Cornwall Insight Australia.

The expectation across the market is that battery storage and fast ramping gas assets are best placed to take advantage of the new 5-minute settlement rules. This is premised on their ability to respond quickly to fluctuations in prices and capture large price spikes without being subjected to the averaging that occurred under 30-minute settlement.

Over the first two months, volatility in both NSW and VIC has been depressed with 5-minute energy prices creeping over $300/MWh on only 8 and 2 occasions respectively (in VIC both those prices were less than $1,000/MWh). Whereas in NSW at least two of those instances were over $12,000. QLD and SA, on the other hand, have been particularly volatile, with 384 and 37 periods respectively over $300/MWh (in QLD 13 have been over $12,000/MWh).

So how have gas and battery assets gone at dispatching during the highest priced periods?

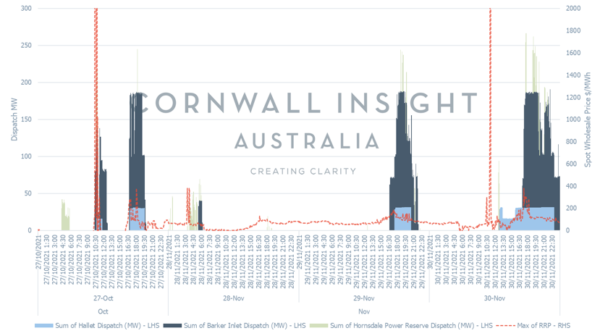

Image: Cornwall Insight Australia

Our analysis focuses on SA due to existing battery capacity and fast ramping and responsive gas assets. The graph isolates a few days across October and November with large wholesale price spikes to understand the responsiveness of Hallett (gas), Barker Inlet (gas), and the Hornsdale Power Reserve (battery storage).

On both 28 November early morning and 30 November mid-morning, significant price spikes were not captured by any of these generators. Suggesting that fast moving assets may not be able to capture the full value of the volatility presented at a 5-minute market. There was a 5 to 10 minute lag between the price spike and the asset ramping up to significant energy output in almost all cases. However, in most cases, the asset could still capture some value, just not the initial and biggest price period. It should be noted that these price spikes may (perhaps unlikely) be seen in pre-dispatch and therefore the bidding strategy to capture these price spikes are based around bidding strategies and game theory. What should also be noted is the ability of those assets to ramp down when prices crashed following the short price spikes, especially on 27 October, where prices quickly went negative. We see from the gas peakers (Hallett and Barker Inlet) that they are playing a probabilities game of being active (i.e. dispatching) in the market during the evening peaks where these events have traditionally occurred.

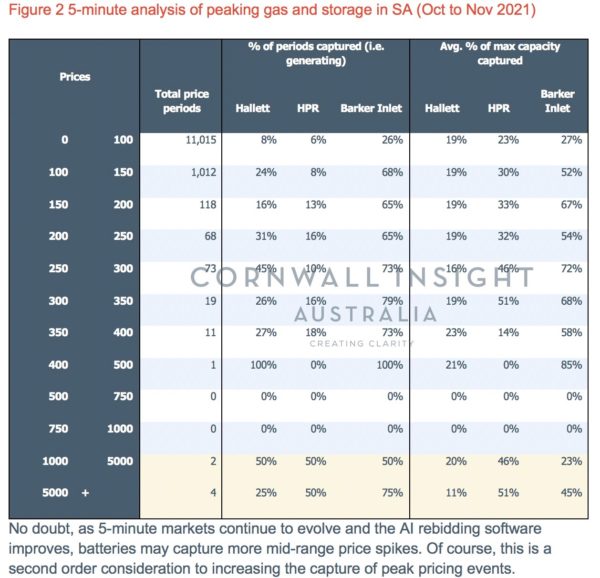

The table below sets out the number of 5-minute price periods that fell into each price band and the percentage of those total periods each asset was dispatched in.

We would expect HPR to have a lower number of overall periods captured compared to gas units in the central/high bands due to the fact that batteries are energy constrained and we see this is the table below. This is particularly true for those bands up to $200/MWh, but what is interesting is that even in those bands above $200/MWh there is significantly less capture when compared to the gas assets (this may be due to operation in other contingency and regulation markets as part of the trading optimisation of storage assets). What is very interesting is that at the top end at $1,000/MWh+, all units are relatively successful in getting dispatched but the volume at which they get dispatched varies significantly. The maximum capacity that each asset can leverage during these highest prices periods diverges with HPR seeing a much higher percentage of its maximum capacity being dispatched during those very high periods compared to the gas assets.

Author: Ben Cerini, principal consultant, Cornwall Insight Australia

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.