Sydney-based renewable energy and storage developer Genex Power will open its books after receiving an improved takeover offer from Farquhar’s Skip Capital and US equity firm Stonepeak Partners.

On August 1, Genex turned down the consortium’s initial bid to buy out the company at 23 cents per share, representing a total valuation of more than $300 million. Now the consortium have come back offering 25c a share through a scheme of arrangement (a valuation sitting close to $350 million) and Genex has given the green light to progress to the due diligence stages.

“The Board considers that it is in the interests of Genex Shareholders as a whole to engage further with the Consortium,” Genex’s board said this morning. “Accordingly, the Board has decided to provide the Consortium with the opportunity to conduct confirmatory due diligence in order to assist the Consortium to provide a binding proposal to the Board.”

The Genex board said given no better offers emerge, its current intention is to unanimously recommend that Genex shareholders vote in favour of the new bid.

Image: Tesla

Skip Capital, through its Skip Essential Infrastructure Fund, has already built up a 19.99% stake in Genex after a series of transactions in late July. Skip is an investment firm founded by Scott Farquhar, who cofounded Atlassian with Mike Cannon-Brooks, and his wife, former Hastings Funds Management executive Kim Jackson.

Huge few weeks for Genex

On top of the takeover, in the last fortnight Genex announced it had achieved record revenue last financial year, totalling more than $26 million.

Last week the company also announced its acquisition of Queensland’s Bulli Creek storage project, which comes 2 GW of development rights. The company purchased the project from Solar Choice and says it plans to develop the site in five stages – the first of which will include a 400 MW / 1,600 MWh big battery.

The developer has honed in on storage projects, noting Australia’s recent energy crisis has highlighted the urgent need for such assets.

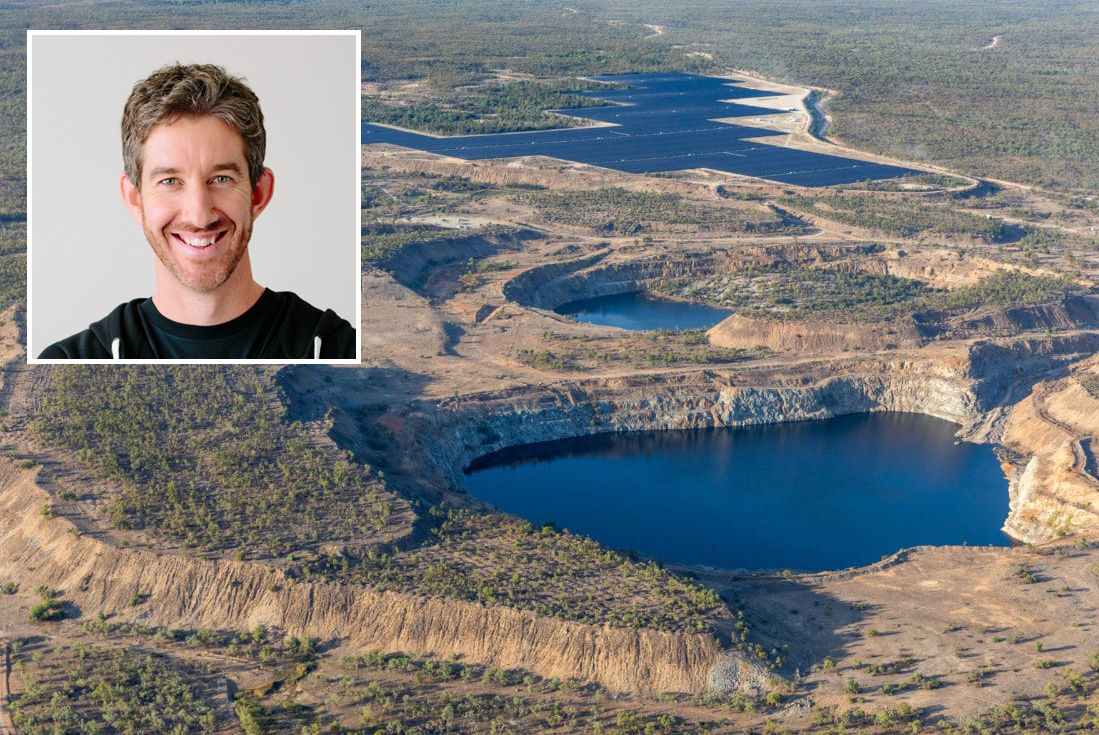

Image: Solar Choice

Genex’s portfolio already includes the Kidston Pumped Hydro Storage Project being developed in the mid-north of Queensland as well as the 50 MW / 100 MWh Bouldercombe Battery, it the state’s mid coast. The company also owns the 50 MW Kidston Solar Farm – consistently one of Australia’s best performing solar farms, as well as the 50 MW Jemalong Solar Farm in New South Wales.

Takeovers trending

Australia has seen massive private takeovers and takeover bids these last year – including by Farquhar’s associate Mike Cannon-Brooks who earlier this year moved to takeover Australia’s largest “gentailer” AGL. Those bids proved unsuccessful, though his 11% stake in the company via Grok Ventures was enough for Cannon-Brooks to prevent AGL’s controversial demerger plan via a shareholder campaign.

In terms of actual takeovers, in the second half of last year Canadian asset management group Brookfield took over Victoria’s electricity transmission network, AusNet. Likewise, Spark Infrastructure – which owned major stakes in Powercor, CitiPower, SA Power Networks, Transgrid – was bought by a North American consortium led by private equity giant Kohlberg Kravis Roberts & Co.

In terms of renewable developers, Tilt Renewables was taken over in 2021, while the year before saw Infigen Energy acquired by Spain’s Iberdrola.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

You need an update from NAIF’s Chair and CEO.

Ask them if they have an opinion from the Solicitor-General.