Following months of due diligence extensions, the potential takeover of Australia’s second biggest “gentailer,” Origin Energy, remains on track with a bidding consortium led by Canadian investment giant Brookfield Asset Management revising its offer down, albeit by a modest 1.1%.

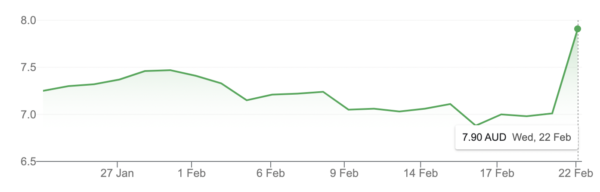

The fractional drop came as a relief to the market with Origin’s share prices jumping almost 14% in early trading.

Image: ASX

Origin’s board welcomed the revised and still conditional offer, saying it considers the proposal could deliver “significant value to shareholders.” Origin intends to continue discussions with the consortium, which includes US gas supplier MidOcean Energy, managed by US investment giant EIG Partners, alongside Brookfield Asset Management.

In a separate statement, the bidding consortium said “all parties are expeditiously working towards the signing of a Scheme Implementation Deed.”

Specifically, the revised share-buying scheme will see the consortium offer $8.90 (USD 6.09) per share for the first 100,000 shares, and $4.33 per share plus USD 3.19 per share for the remainder.

The bidders noted the inclusion of a US dollar as part of the offer reflects the exposure of Origin’s LNG business to the currency.

If Origin’s takeover is realised, it would be hugely significant for Australia. Brookfield, the lead bidder and the company set to take on all of Origin’s energy generation and retailing businesses, has reiterated its commitment to investing an additional $20 billion by 2030 to build new renewable capacity and storage in Australia.

Brookfield is currently creating the world’s largest fund for renewable investments, the Brookfield Global Transition Fund, which is headed up by Mark Carney, one of the world’s most influential climate change power brokers.

However, the takeover remains in the balance, with the deal still subject to approvals from the Australian Competition and Consumer Commission and the Foreign Investment Review Board.

Given Brookfield’s recent takeover of Victorian network, AusNet Services, the Australian competition regulator’s review could prove a hurdle.

Trojan horse transition

In 2022, Brookfield shocked Australia by teaming up with tech billionaire Mike Cannon-Brookes to put in a surprise bid for AGL, Australia’s biggest “gentailer” and carbon emitter.

The “Trojan horse” move would have been the world’s largest decarbonisation project, but ultimately couldn’t be realised. Despite that, both Brookfield and Cannon-Brookes have continued to pursue Australia’s two biggest gentailers, AGL and Origin, separately.

Cannon-Brookes has since bought a significant stake in AGL and has successfully managed to shift the company’s decarbonisation strategy, blocking its demerger plan and electing a number of people to its board.

Meanwhile, Brookfield has opted to pursue Origin as its vehicle for energy transition. If the takeover goes through, Brookfield will use the Origin platform to build a portfolio of solar, wind and storage assets in Australia, selling this energy via Origin’s established retail platform.

Under the proposal, consortium partner MidOcean would acquire Origin’s gas business, including its 27.5% a stake in Australia Pacific LNG.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.