A new report published by the Institute for Energy Economics and Financial Analysis (IEEFA) indicates consumers in Australia’s National Electricity Market (NEM) have paid nearly $1.2 billion more than necessary each year over the last eight years to have a stable electricity supply.

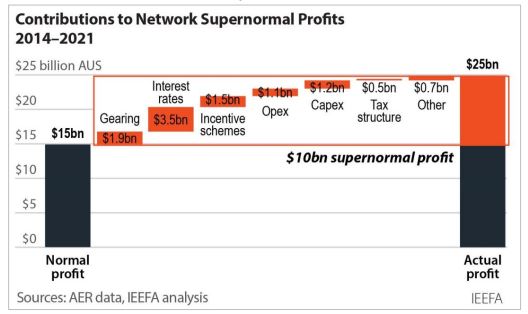

The Regulated Electricity Network Prices Are Higher than Necessary report, which analyses Australian Energy Regulator (AER) network productivity data, shows the profit that network service providers (NSP) extracted from electricity consumers in the eastern states over 2014-2021 was 67% higher than the “normal” level of profit.

The IEEFA said the regulatory system designed to prevent sustained excessive network monopoly profits has failed due to weak laws and rules regulating networks and a lack of transparency over the extent of monopoly profits. The IEEFA said the “persistent sector-wide supernormal profits” are out of step with national electricity laws and the regulator’s objective of ensuring that consumers pay no more than necessary.

Image: Supplied; AER data, IEEFA analysis

Report author Simon Orme said regulatory change must occur immediately and has called for an independent inquiry, warning that supernormal profits have hindered Australia’s transition to a low-carbon electricity system by diverting funds that could have been used to fund the energy transformation.

“Australia’s energy customers have been spinning golden silk for network providers for nearly a decade,” said the former New Zealand and New South Wales (NSW) Treasury officer. “They can’t be expected to fund super profits any longer. The extra burden must be removed.”

He noted that the inefficiencies from excessive network prices, and wealth transfers created by persistent sector-wide supernormal profits are also delaying the decarbonisation of the electricity system.

“The $10 billion in super profits extracted by electricity networks over 2014-2021 is approaching the capital cost of AEMO-identified regulated transmission projects necessary to support the closure of most coal-fired power generation,” he said.

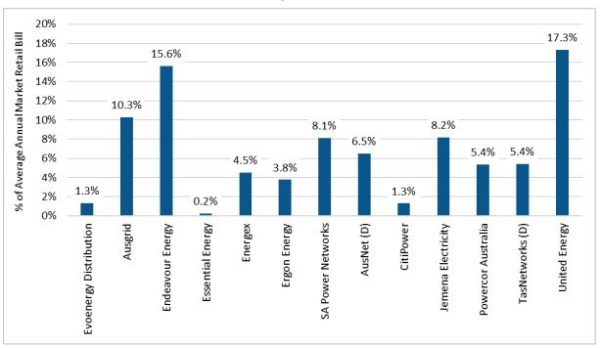

Image: Supplied; AER data, IEEFA analysis

The report shows NSPs, including United Energy, Endeavour, SA Power Networks and AusNet, have over the past eight years consistently been charging electricity consumers too much, with regulated network revenue for transmission and distribution networks nearly 11% higher than total network costs.

Orme said of the 18 NSPs analysed, 14 extracted profit above an expected range. He said this imposed an unnecessary extra cost of between $800 to $1,200 per energy customer over the eight-year period, depending on the state they live in, with no additional reliability benefits.

On average, across all networks, 6.8% was added to customers’ retail bills but the range was broad – from 0.2% for Essential Energy in NSW to 17.3% for United Energy in Victoria. The report shows that of all jurisdictions, only the Australian Capital Territory managed to constrain revenue close to costs.

Image: Supplied; AER data, IEEFA analysis

The IEEFA said the supernormal profits occurred because the current regulatory system, which is managed by energy market bodies including the AER, the Australian Energy Market Commission, the Council of Australian Governments Energy Council and the Australian Competition Tribunal, consistently overestimated the actual costs that network businesses would require to build, operate and maintain the network. Networks charged those overestimated costs to consumers via retailers.

Orme has called for the federal government to establish an independent commission of inquiry into the economic regulation of networks to ensure future profit excesses are reined in, warning there “is no time to waste”.

“The supernormal profits issue needs to be examined and rectified,” he said. “If this situation is not improved, energy consumers will continue to pay more than required for electricity distribution and transmission network services, and up to 43% more for new assets into the future, increasing the cost of the energy transition and deterring investment in low-carbon generation.”

Orme recommends the commission of inquiry should work to better reporting and monitoring of networks’ profits, make changes to the rules and laws to improve regulation, and remove barriers to have more consumers represented in the regulation process.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.