From pv magazine Issue 10 – 2022

Battery energy storage system (BESS) transportation costs have been accelerating, with the price to transport a container from China to the West Coast of the United States costing an estimated 12 times as much as it did two years ago, while the time taken for the container to make that journey has nearly doubled.

These factors have helped to create a perfect storm. But there are actions that can be taken to mitigate the worst effects. For companies embarking on large-scale BESS projects over the next few years, there are several strategies that might help overcome the challenges involved:

Diverse suppliers

The pandemic served as a wake-up call for many corporations around the world to improve the resilience of their supply chains, including by building more diversified portfolios of suppliers across all tiers. Never has this been more important. While some tier 1 suppliers may be sold out for the next few years, if your purchasing volume is less than 1 GWh, you could consider a smaller tier 2 supplier. Whereas larger buyers can leverage their scale to secure batteries from tier 1 suppliers, mid-sized or smaller players need to find the right-sized supplier. Many tier 2 suppliers have high-quality products, but buyers should protect their investment with strong contract terms and an end-to-end, independent quality assurance program.

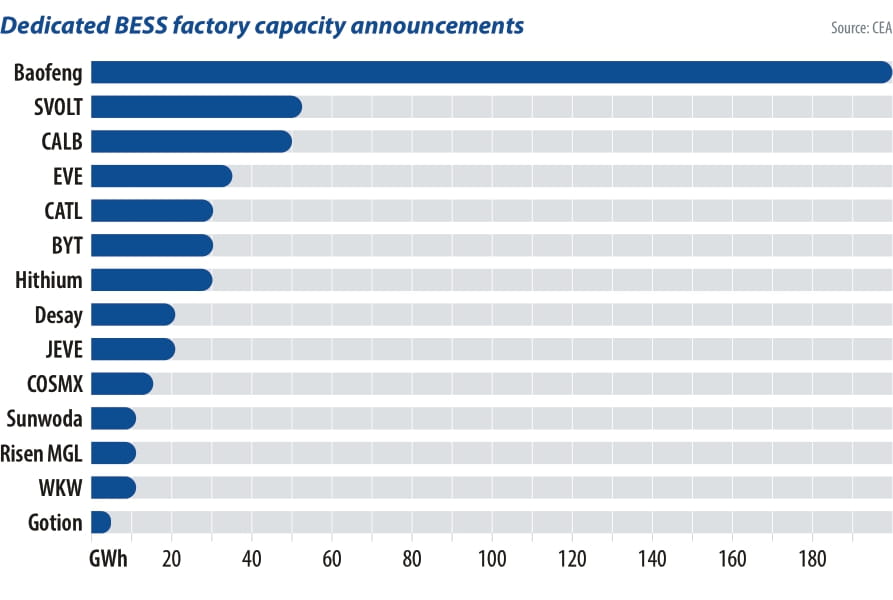

BESS-only factories

Many factories produce batteries for both electric vehicles (EVs) and stationary energy storage systems, and this can create challenges. The EV industry purchases ten times more battery capacity than BESS buyers, and EV buyers often offer long-term contracts with guaranteed volumes. As battery manufacturers struggle with lithium shortages in the face of rapidly growing demand, EV industry buyers therefore tend to find themselves in an advantageous position in terms of the allocation of scarce capacity. Most small to mid-sized BESS buyers are less able to compete. What is the answer? There are a growing number of factories, including a combination of tier 1 and tier 2 suppliers, that solely manufacture BESS, eliminating direct competition with the EV industry. Consider sourcing from these facilities. Many of these factories aren’t yet built but will be up and running in the next 18 months, so now is the time to secure supply agreements. As raw materials costs increase, sourcing from local suppliers and fixing costs early is essential.

Non-lithium options

Although it is difficult to predict the future in such a dynamic and fast-changing environment, near-future contracts might reserve scarce lithium supplies for mobile applications, pushing stationary applications to migrate to other chemistries as EV demand accelerates. During this short-term supply crunch while the EV sector is consuming much of that lithium, there are other alternatives such as zinc and iron-based chemistries to consider. BESS buyers who do their diligence on these newer chemistries now will be in a much better position than those who wait.

Supply chain integration

If you are considering a tier 2 manufacturer, it can be reassuring to see multi-level upstream supply chain integration, including module, cell, and raw material supply. Although you won’t face the EV sector competition as much if you go to a BESS-only factory, supply chain integration should help ensure access to raw materials.

Safety first

Safety incidents in the industry have been all too common. When considering a new supplier, buyers should carefully check the company’s safety credentials and industry certifications, as well as the possible failure modes with the battery type they supply, and how these are mitigated.

BES systems have orders of magnitude more stored energy than an individual EV, making the potential scale of a fire significantly different. It will provide some reassurance to know that tier 2 battery suppliers use the same technology and follow the same best practices as the tier 1 suppliers. Stringent thermal safety tests, however, are essential.

These are some strategies you can use to overcome battery system supply chain challenges and that can help alleviate the frustration of not being able to find cells available on short notice. Learning more about the options and incorporating the insights into your implementation plan as it evolves from year to year can help you avoid further disruptions along the way.

About the author

Cormac O’Laoire is senior manager of market intelligence for Clean Energy Associates. His work spans the entire lithium-ion battery supply chain including metals and mining, material refining, cell production, and pack integration. He holds a Ph.D. in chemistry (Li-ion batteries) from Northeastern University in Boston.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.