From pv magazine ISSUE 10 – 2022

For some the notion of clean mining is almost a contradiction in terms. New research from the Technical University of Berlin and published in the Journal for Cleaner Production found that the environmental costs of the mining sector amount to as much as USD 5 trillion ($7.5tn) annually, with most of the damage attributed to greenhouse gases emitted in the mining of coal and iron ore.

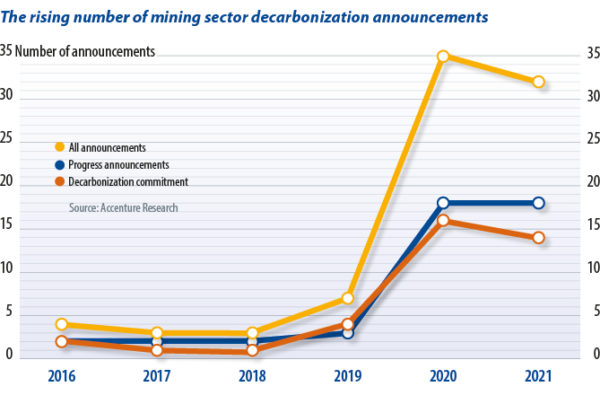

But while the mining industry has long been a laggard in all things sustainable and environmental, the sector is beginning to take up a new mantle as a crucial part of the transition to clean renewable energy sources.

Rebecca Campbell, global head of mining and metals for law firm White & Case, has argued that previously “the mineral commodities cycle has been out of synchronisation with the global macroeconomic cycle,” but “this time the cycles appear to be converging.” However, a recent report from the law firm warned that “softening commodity prices and economic headwinds may deter miners and metal companies from deploying the significant capital expenditure required to decarbonise.”

This fear is shared by Duncan Wanblad, chief executive of miner Anglo American, who in July 2022 said higher borrowing costs and political instability due to inflation were threatening to delay billions of dollars of investment in mining decarbonisation.

However, the September 2022 announcement of Fortescue Metals Group’s (Fortescue) fully funded USD 6.2 billion plan to decarbonise by 2030 presents a wholly different narrative. Fortescue Chairman Andrew Forrest announced the plan at the United Nations General assembly as part of US President Biden’s First Movers Coalition.

Mark Hutchinson, the CEO of Fortescue’s green energy arm, Fortescue Future Industries (FFI), told pv magazine the company’s plan demonstrates that if one of the world’s biggest iron ore miners can embark on such an ambitious decarbonisation target, anybody can. And what is more, far from balking at the price tag of decarbonisation in the midst of inflation like his Anglo American counterpart, Hutchinson believes the numbers are on his side.

Decarbonising mining

In much the same way that Roger Bannister showed the world a mile could be run in under four minutes, Hutchinson told pv magazine that since the announcement there has been an amazing response from other companies realizing that if a mining company can decarbonise, then anyone can.

This should come as no surprise, considering the recent findings of an Ernst & Young (EY) survey of global mining leaders. The survey found ESG issues, geopolitics, and climate change were the top three risks/opportunities facing mining and metals companies over the next year.

EY’s global mining and metals leader, Paul Mitchell, said that while managing ESG risk is becoming more complex, “miners who get it right can get an edge on competitors in many ways – from accessing capital, to securing license to operate, attracting talent and mitigating climate risk.”

Fortescue claims its multibillion-dollar investment will see the avoidance of 3 million tons of CO2 equivalent emissions per annum and provide cost savings of USD 818 million yearly from 2030, thanks to savings on diesel, gas, and carbon credits. Fortescue estimates it will have paid back its capital investment by 2034 while simultaneously derisking the company’s operating cost profile and establishing new opportunities through the production of carbon free iron ore.

“It proves to the world that we’re real [about decarbonisation], that we’re taking a mining company (and normally mining companies are the laggards) and showing that it can be done,” said Hutchinson.

He is the first to admit the USD 6.2 billion decarbonisation strategy is ambitious, but considering the company expects to save USD 3 billion in fuel costs alone before 2030, fortune may well favour the brave.

“The big learning for us was that companies get easily stuck in the mindset where fuel costs are fixed,” Hutchinson continued. “But if we look at our fuel spending for say, the next 10 years, and use that money for capital costs instead, we’ll save that money forever. And we realised that not only could you decarbonise but you could make money. We spend over a billion dollars a year on just diesel alone, but from 2030 we don’t pay any fuel costs at all, we own the house.”

Not only does decarbonisation derisk the company, added Hutchinson, but it also gives it continued access to capital markets, which are now shifting toward a greener end of the spectrum. This is no small benefit, after all, consulting firm McKinsey has estimated that the cost of capital can be 20% to 25% higher for miners with the lowest ESG scores.

Nevertheless, working out the numbers and making the plan work are two very different beasts. “It’s certainly not simple,” said Hutchinson about Fortescue’s pathway to net-zero emissions. “But solar is very helpful for us and we do already have some solar on our sites.”

Generation plans

Across Fortescue’s five major mine sites in Australia, it plans to install 2.5 GW of predominantly wind and solar, shored up with significant amounts of storage. This storage may come in the form of batteries, but thanks to the natural elevation of the Pilbara, Hutchinson says the company is also seriously considering pumped hydro.

However, due to current PV market conditions and alleged practices, Hutchinson told pv magazine that while solar will play a part, the decarbonisation strategy will rely heavily on wind in the short term. “Solar will be a big part, but there is this issue which I think a lot of foreign companies have at the moment. Whereas China has 90% of the world’s PV, there are some issues in China that make it very difficult to buy, and also to finance as many financiers just won’t support PV coming out of China until you can do a proper audit, and that’s not happening at the moment.”

Hutchinson remained firm that the company would like to install more solar over time and was optimistic that PV manufacturing will burgeon in other parts of the world like India and the US. “Even if it’s more expensive, you’re not going to have a choice. You don’t want anywhere to own 90% of your supply chain for any product,” Hutchinson added.

It should come as no surprise then that FFI acquired a 60% stake in High yield Energy Technologies (HyET) Group in 2021 and provided the financing for the expansion of HyET Solar’s Dutch solar factory. And the upstream solar investment won’t stop there.

“There’s not enough wind turbines made in the world, not enough solar, not enough electrolysers,” continued Hutchinson. “We don’t want to get caught up in the supply chain, but in PV particularly there are some players around the world thinking differently, the United States in particular.”

The presence of subsidies in the US means FFI “will absolutely manufacture PV in the US as well. We’ve learned a lot about security of supply from Covid-19, particularly about the benefits of manufacturing in-country,” said Hutchinson.

The larger message Hutchinson was keen to get across when it comes to decarbonisation is that you can’t wait for anyone else to do it for you. “Don’t always rely on the OEMs,” but do it yourself, and get on with it, he said. After long discussions with many OEMs in which some of the earliest estimates for delivery of carbon-neutral vehicles to decarbonise FMG’s mining operations were in 2035, “we decided to do it ourselves,” said Hutchinson. “You have to take a much more aggressive view.”

To that end, FFI acquired Williams Advanced Engineering (WAE) in January 2022. UK-based WAE, an offshoot of the Williams F1 team, is now providing FFI with the kind of critical battery technology it needs to decarbonise its mining vehicles now, and not in 2035.

Perhaps the most interesting product of the WAE acquisition will be FMG’s “Infinity Train,” which uses gravity braking to charge 70 MWh batteries on its 3.5 kilometre-long iron ore freight trains as they descend from the company’s Pilbara mine sites to the coast. These batteries, Hutchinson explained, then drive the train back up to the mine to form a clean loop.

H2 Go

While Fortescue’s ambitious decarbonisation announcement made headlines in September, the company and its outspoken chairman have been making more regular headlines in recent years due to their ambitions in the green hydrogen sector.

In the past 18 months, the company has agreed to billions of dollars of supply deals for green hydrogen and its derivatives (ammonia, synthetic methane), and more recently said it would double its green hydrogen spending as its push to replace natural gas in Europe accelerates. On Oct. 4, 2022, Fortescue partnered with Tree Energy Solutions (TES) to supply 300,000 metric tons of Australian green hydrogen to Europe via TES’s planned import terminal in Wilhelmshaven, Germany.

“Germany has picked Australia for a reason,” said Hutchinson. “Getting gas from Russia hasn’t turned out so well and they realise now that security of supply is important.”

For Europe, green hydrogen couldn’t come quickly enough. But the passing of the Inflation Reduction Act (IRA) in the United States has already turned the burgeoning green hydrogen sector on its head.

“What has happened in the US is amazing,” said Hutchinson, in reference to the passing of the IRA. “USD 3/kg for green hydrogen makes it competitive with grey hydrogen, now. Every investment dollar you have you should put in America … It’s ironic really, from being the laggards now they’ve leapfrogged everyone.”

In more bad news for Europe, the US is unlikely to be an exporter of the green fuel, considering its domestic demand. “Europe is the place that really needs it,” said Hutchinson. “But it’s dithering around a bit. I really hope Europe can do something similar to what the Americans have done.”

Hutchinson likened the IRA to the kind of seismic policies which helped spur the PV market. “There were enormous government subsidies,” he recalled. “And you can include China as one giant subsidy, but that’s how they got the costs down. And this is going to be the same when we think about electrolysers.”

Who dares wins

Some armchair skeptics have declared Fortescue’s plans overly ambitious, though at this stage one wonders what the point of any ambition short of global decarbonisation would be. For Hutchinson, it was the audacity of Fortescue’s plan and strategy that convinced him to join. And that “purely audacious” mindset, he said, “is what Andrew Forrest is.”

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.