From pv magazine print edition 11/24

As it did with lithium-ion batteries, the automotive sector looks set to become a demand driver and transformational force for a crucial aspect of the global energy transition. Carmakers are emerging as the first large-scale purchasers of green steel. With the automotive industry responsible for 12% of global steel demand, according to the World Steel Association, the scale of this demand is kick-starting efforts by manufacturers to ramp up emission-free manufacturing of this key commodity.

The logic behind automotive demand is clear. As carmakers vie for position in a marketplace in the throes of a rapid transition toward electrification, utilising green steel can strengthen the environmental credentials of the automakers, and may be a key differentiator, particularly for environmentally conscious electric vehicle (EV) buyers. With a cost premium of some 20% to 30%, according to Simon Nicholas, the lead analyst for Global Steel at the Institute for Energy Economics and Financial Analysis (IEEFA), green steel is not prohibitively expensive for many carmakers.

“In terms of the price of a car, considering how much steel is actually in a car, it doesn’t make much difference to the overall price,” said Nicholas. “It does impact the customer but we’re talking hundreds of dollars rather than thousands.”

Increased demand for green steel from automakers is coming at a critical time in the development and adoption of processes required for its production. This demand points to a virtuous circle formed by green steel and renewable energy. Large amounts of renewable energy generation capacity will be required by green steel makers to supply electric furnaces and green hydrogen electrolysers. As the energy transition accelerates, fast-growing solar and wind, plus electricity network expansion will require large amounts of green steel.

Carbon-intensive process

Steel production has been and remains a carbon-emission-intensive endeavor. Steel production is broadly considered to be responsible for anywhere between 8% and 11% of global CO2 emissions. Market intelligence company Wood Mackenzie finds that 3.6 billion tons of CO2 were produced for 1.89 billion tons of crude steel in 2023.

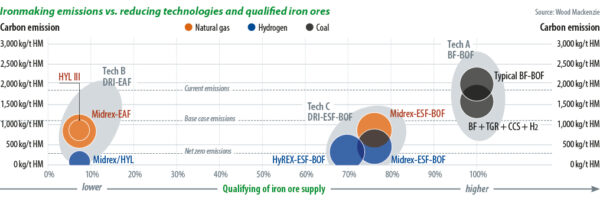

Steel is predominantly produced via two methods, either from integrated blast furnace-basic oxygen furnaces (BF-BOFs) or from electric arc furnaces (EAFs). Blast furnace operators, which account for roughly 70% of global production, make steel from iron ore and use coal as a reducing agent – extracting the iron from the ore and providing the carbon required by steel. The International Energy Agency, observing that the steel industry is not on track to meet its Net Zero Emissions by 2050 (NZE) scenario, describes blast furnace operators as being “highly reliant on coal.”

The EAF process is a far better candidate for decarbonisation as electricity networks are increasingly supplied with renewable energy. However, the electric furnaces cannot process ore. Instead, they are used to melt scrap metal and/or steel precursors such as direct-reduced iron (DRI).

While promising, there are a number of challenges to EAF replacing emissions intensive blast furnaces, according to market intelligence provider S&P Global. When using scrap metal, production is inherently limited by the availability of the scrap itself, which is “growing only slowly worldwide and its prices are increasing.”

According to S&P Global, while shaping up to be “a winner in this [green steel] race,” DRI also faces significant challenges. It traditionally uses methane gas to reduce ore pellets to a material that can be processed by an electric furnace. The gas can be replaced by green hydrogen, representing a promising path to full decarbonisation. However, green hydrogen development remains at a nascent level and the clean energy carrier is currently expensive.

IEEFA’s Nicholas confirms that DRI technology providers are supplying their systems in a “hydrogen-ready” state so that the switch to green hydrogen can be made when and where supply becomes available. He notes that the technology is mature and that projects at commercial scale are beginning to emerge.

However, there is an additional challenge to DRI scaling rapidly, and that is the raw material itself. “DRI plants currently need a higher grade of iron ore than blast furnaces use and there isn’t that much of the high-grade stuff around,” said Nicholas. He did, however, point to plans to increase the supply of high-grade ores as being promising.

Key projects

Europe is seeing some progress toward “truly” green steel production. Formerly known as H2 Green Steel, Stegra, in Sweden, is currently developing a DRI facility that will run on green hydrogen from the outset. It plans to commence operations in 2025 and targets production of 5 million tons of green steel per year by 2030.

The project involves “three factories in one,” the company claimed – namely a DRI process for green iron production, steel production via EAF, and a “giga-scale electrolyser” that the company said will be the largest of its kind in Europe. Fueled by the abundant hydro power that is available via the local electricity network, the three processes will result in steel production with a more than 95% reduction in CO2 emissions, Stegra reports.

On Sept. 19, 2024, the Swedish Energy Agency announced that it was supporting the Stegra project with a grant of roughly €100 million ($162 million), under its Industrial Leap program. The funds were part of more than €260 million approved by the European Commission under its post-Covid Recovery and Resilience Facility.

In October 2023, what is now Stegra signed a deal with Porsche to supply it with “near zero-CO2 steel” from 2025. “Porsche is working towards a carbon-neutral balance sheet across the value chain for its cars by 2030. CO2-reduced steel plays a key role in our sustainability strategy,” said Barbara Frenkel, executive board member for procurement at Porsche, in a statement. Stegra has announced additional deals with automotive companies including truck maker Scania and German parts maker ZF.

Spain is also attracting green steel production using the clean DRI and EAF combination. The world’s second largest steel producer, ArcelorMittal, is producing its XCarb steel, which is made with at least 75% recycled steel. The company reports that 100% of the electricity used in XCarb production comes from renewable sources.

ArcelorMittal operates an EAF furnace at its Sestao plant in northern Spain. The company is also looking into ways to further reduce the carbon footprint of this steel.

“This offering, which we call XCarb, is recycled and renewably-produced steel,” said Jerome Guth, of ArcelorMittal Europe – Flat Products. “It is available with the full offering of steel, including the [corrosion-resistant] coated Magnelis steel. And that’s available for all the markets and obviously for solar as well.”

Spain-based utility and renewable energy project developer Iberdrola is using XCarb steel in a 41 MW solar project in Portugal. The project is the first utility-scale solar array to use this type of low-emission steel on the Iberian peninsula. The company has also signed up to the SteelZero initiative, which targets using 50% low-emission steel by 2030 and zero emissions by 2050.

Green hydrogen link

On Sept. 12, 2024, Iberdrola and BP announced they had made a final investment decision on a 25 MW electrolyser that will be sited at the oil company’s Castellón refinery. The electrolyser will produce green hydrogen from emissions-free electricity contracted under a power purchase agreement. The project is expected to be operational in the second half of 2026.

The connections between green steel, hydrogen, and solar are myriad – with the endeavor of each industry and application supporting the other. Given these network effects, there may be reason to believe that green steel production could scale more rapidly than anticipated. Nowhere more does this confluence of activity come together than in the resource-rich state of Western Australia, where a particularly ambitious miner has kicked off a green iron project.

Fortescue Metals is active in the state’s Pilbara region, which boasts ample sunshine, strong winds, and vast iron ore deposits. Unfortunately for Fortescue, those deposits tend to be of the lower-grade iron ore suitable for blast furnaces. This is a challenge but one that can be overcome, said Nicholas.

“There are some decent efforts going on from the likes of Fortescue and BHP and Rio Tinto in collaboration together with [Australian steel producer] Bluescope Steel to try and sort these issues out,” he said.

On Aug. 16, 2024, Fortescue broke ground at its Green Energy Hub at Christmas Creek project, which saw it invest $50 million to produce approximately 1,500 tons of green iron metal a year. It hopes to commence production in 2025.

Fortescue Metals CEO Dino Otranto acknowledges that the hematite ore in the region poses a challenge but he remains confident.

“Currently, the more mature pathway for producing green iron uses ultra-high grade iron ore which, once reduced, produces a direct-reduced iron which can be used in an electric arc furnace,” said the chief executive. “Only a small fraction of the iron ore produced in Australia is compatible with this pathway and therefore Australia faces competition from higher grade iron ore produced in other parts of the world.”

“We have been testing the performance of our suite of iron ores in hydrogen-reduction for more than two years, all at small scale, in laboratories and pilot plants around the world.”

Fortescue has developed a 100 MW solar project adjacent to part of its operations in the region. It intends to expand that to 1 GW of installed solar capacity by 2030. The miner intends to power all of its operations emissions free in the same time frame.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.