From pv magazine ISSUE 11 – 2022

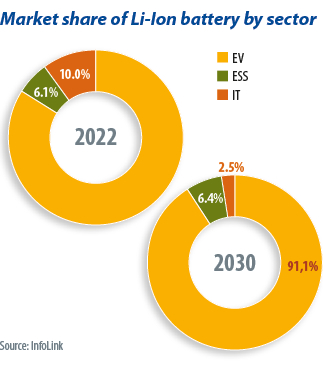

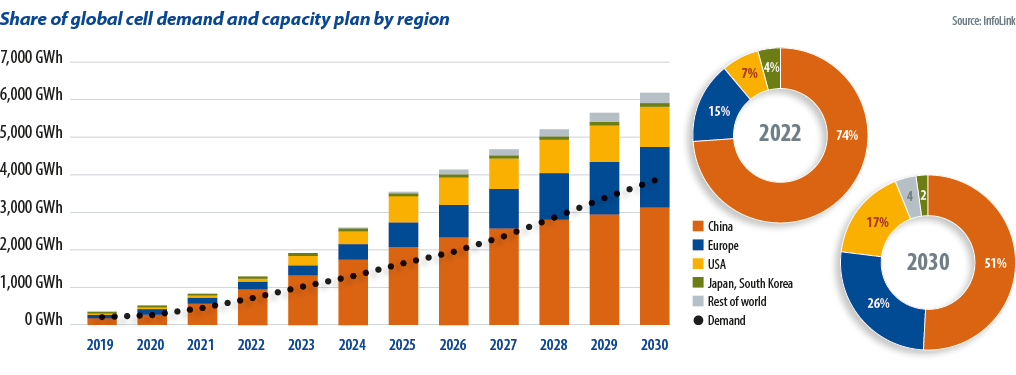

InfoLink expects the global lithium-ion battery market to post a compound growth rate of 24% through 2030. A market today of more than 400 GWh is expected to surpass 1 TWh in 2023, 2 TWh in 2026, and 4 TWh in 2030. Driven by demand for clean power, the energy storage portion of the market will increase from today’s 45 GWh to more than 80 GWh in 2024, to become the second biggest part of the lithium-ion picture behind EV batteries, pushing consumer electronics into third place.

China, the world’s largest automotive market, is poised to see the penetration rate of EVs reach 20%, the highest in the world, underpinned by supportive policy, widespread charging stations, and supply chain advantages. Europe, where some countries have planned a ban on the sale of new fossil-fuel cars, will see lithium-ion battery demand grow rapidly as the EV penetration rate reaches a level close to that of China, due to surging energy prices and higher environmental awareness. The United States, on the other hand, has an EV penetration rate of just 6% and will continue to trail China and Europe, even as the recent Inflation Reduction Act helps drive transport electrification.

Against this backdrop, InfoLink estimates EV penetration rates in China, Europe, and the US will reach 60%, 80%, and 50% by 2030, respectively, and vehicle-related batteries may constitute more than 90% of total lithium-ion demand. By the end of the decade, lithium-ion demand in the three largest markets will come in at 1.3 TWh, 900 GWh, and 680 GWh in China, Europe, and the US, respectively.

Energy storage will contribute around 6% of lithium-ion battery demand in 2022 and the figure will stay flat, at 6% to 7%, through 2030.

Why the shortage?

Most of the world’s 1.3 TWh of lithium-ion battery cell production capacity is concentrated in China, at 950 GWh, with the rest made up by South Korea and Japan. This year will have brought demand for only 700 GWh, but the shortages experienced, nevertheless, occurred because InfoLink estimates factories only operated at 50% to 60% output. This is due to limited supplies of lithium and nickel, price rises since the second half of 2021, and shortages of key components, as well as delayed manufacturing project lead and construction times. With those headwinds set to continue, battery shortages will not ease until beyond 2023.

In light of this, cell manufacturers are rapidly expanding. InfoLink expects global capacity to increase from at least 1.3 TWh this year to around 6 TWh in 2030, a compound growth rate of 20%.

In 2024, the figure will exceed 2.5 TWh, but global demand will come in at only 1.3 TWh, ensuring surplus production capacity. Meanwhile, as nickel capacity grows and related materials prices return to normality, the supply chain will stabilise, enabling cell factory utilisation rates to recover. With competition between cell manufacturers set to intensify from 2024 as a result, the acquisition of lithium and related materials will become even more critical. More and more cell makers, and even carmakers, will form partnerships, sign long-term orders, and co-invest with key manufacturers. For example, EV brand Tesla is eyeing investing in, or mining its own lithium. Battery companies CATL and BYD are also expanding into the upstream mining sector, as manufacturers that secure mineral resources will have stronger bargaining power. Upstream supply security is key for the business plans of new players, existing cell manufacturers, and battery cell users.

Supply chain moves

Of the current lithium-ion cell production capacity, Europe has 195 GWh and the US 85 GWh. With China hogging more than 70% of the world’s battery production lines, cell supply outside China is set to remain tight even during the anticipated surplus in 2024, and the situation will be at its most severe this year and next. Policymakers in Europe and the US are stepping up efforts to diversify their supply chains as a result.

Cell supply outside China is expected to pick up, partially as a result of Chinese and South Korean cell makers planning to build up capacity in the US and Europe, partially a result of Tesla’s ramp up, not to mention European battery startups such as Northvolt and Freyr. Southeast Asia is also expected to see more cell capacity come online in 2025. However, this growing diversity will remain in tight balance.

Against that backdrop, the EV and energy storage sectors are already competing for cells, but InfoLink expects China’s domination of the market to lessen this decade as growing awareness of national energy security and circular economy measures makes building local lithium-ion battery supply chains a trend. For instance, cell makers wishing to expand into the US have started searching for sites or planned the first phase of assembly plants as part of localisation efforts. InfoLink expects China’s global share of cell capacity to decrease from 70% this year to 52% in 2030, while that of Europe and the US will increase, from 14% and 6% this year, respectively, to 27% and 18% in 2030.

About the author:

Yuan Fang-wei is a senior analyst with more than six years of experience in R&D in lithium-ion battery and related materials. With expertise in battery storage development, materials, and market forecasting, Yuan provides comprehensive data and insights of energy storage industrial chain, and conducts research on supply and demand, policies, and market size.

Yuan Fang-wei is a senior analyst with more than six years of experience in R&D in lithium-ion battery and related materials. With expertise in battery storage development, materials, and market forecasting, Yuan provides comprehensive data and insights of energy storage industrial chain, and conducts research on supply and demand, policies, and market size.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

I would be expecting to see other battery types edging into the stationary storage niche as Kg’s per MWatt/hr is not as critical. Demand for lightweight and dense energy storage for the booming vehicle market is going to keep the price high. Cost consciousness and supply chain concerns will be driving the change to different battery chemistries.

Stackable Integrated Battery’s most popular products in Europe in 2023

https://lithiumvalley.com/household-energy-storage-system/