New Zealand has struck a deal with United States multinational BlackRock to develop a climate infrastructure fund with the goal of super charging investments in clean energy technology and making the nation one of the first in the world to transition to a 100% renewable energy-powered electricity grid.

NZ Prime Minister Chris Hipkins said “the first of its kind” net zero fund demonstrated the “huge economic potential of New Zealand being a climate leader and our goal of generating 100% renewable electricity.”

“This is a game changer for the clean tech sector,” Hipkins said. “This fund is a massive opportunity for New Zealand innovators to develop and grow companies.”

“I am absolutely stoked that we’ve been able to secure this world-leading investment in New Zealand businesses and it’s proof of our ambitious climate targets having the world’s attention.”

New Zealand has an 83% renewable energy penetration rate but BlackRock has estimated the transition to a 100% renewable electricity mix will require investment running to NZ$42 billion in renewable power generation and distribution, as well as battery storage.

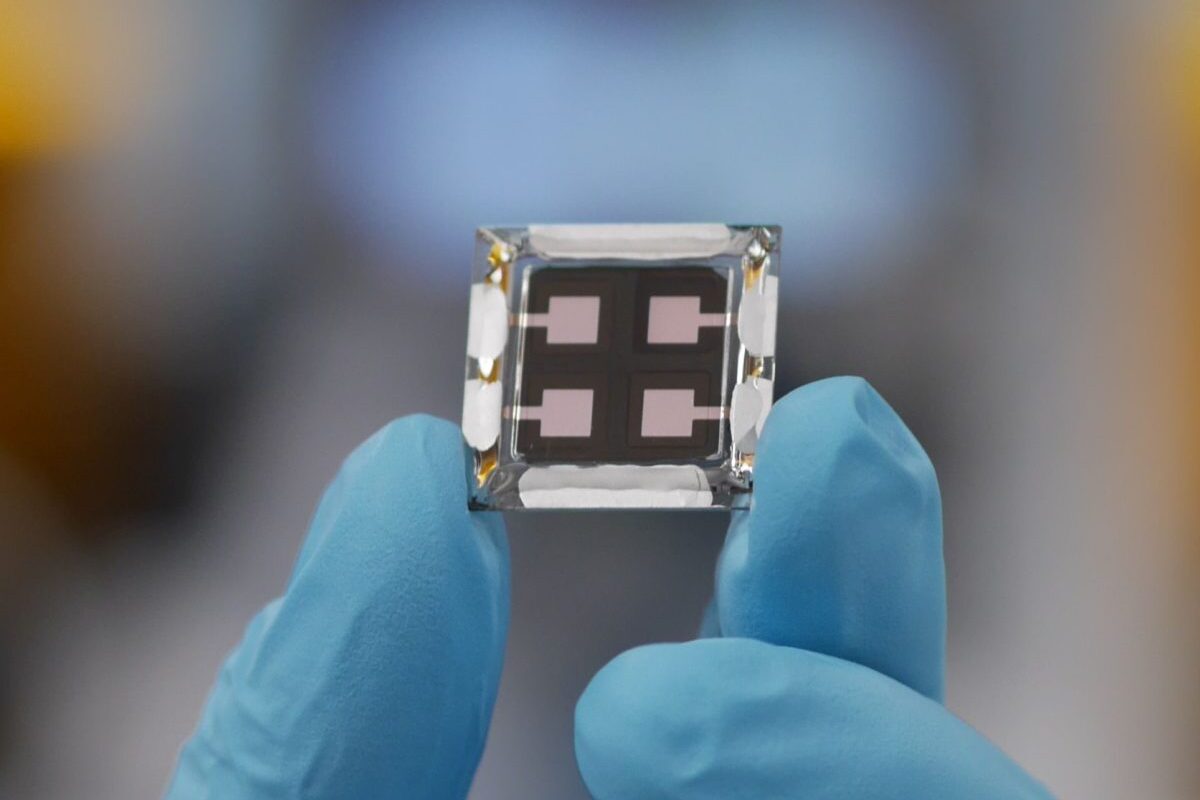

Image: ENA

Hipkins said the climate infrastructure fund will mean renewable energy intellectual properties can be developed in New Zealand, laying a broader foundation for the country’s energy transition.

“It’s the exact type of government and private-sector climate partnership that’s central to my vision for action on climate, partnering with and supporting industry to solve the climate crisis is a no-brainer,” he said.

“This investment will be a boon for Kiwi businesses and it will make New Zealand a hub for renewable tech expertise.”

BlackRock Chairman and Chief Executive Larry Fink said the fund is the largest single-country low-carbon transition investment initiative the investment management firm has created to date.

“It will enable New Zealand companies to access greater pools of capital to build out climate infrastructure across the country’s energy system including in wind power, solar power, battery storage, electric vehicle charging, and natural capital projects,” he said.

While no details have been provided about the net zero fund’s launch date, NZ Energy Minister Megan Woods said the fund will look to crowd in investment from Crown companies and entities, including superannuation funds, and private sector funds.

Woods said the fund will provide businesses in the clean energy sector with access to capital that will enable them to develop and grow.

“We’ve already making significant progress on New Zealand’s decarbonisation transition. This arrangement means we will get there faster,” she said. “This fund will allow New Zealand to go further and faster.”

For BlackRock, the initiative builds on its entry into the New Zealand clean energy market which was announced in September 2022 with the acquisition of NZ rooftop solar and battery energy storage specialist SolarZero.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.