BlackRock Real Assets, a subsidiary of the $14.8 trillion United States-headquartered investment giant, announced on Wednesday it had agreed to acquire SolarZero and will commit almost $90 million ($NZ100 million) over the next three years to accelerate the growth of the company’s solar and battery technology platform.

Founded in 2008, SolarZero has established itself as a leading provider of rooftop solar and smart battery energy storage systems in New Zealand, claiming a 40% market share of new residential rooftop installs.

The company has installed approximately 8,500 rooftop solar PV systems across the residential, commercial, and community sectors, linking them using its proprietary smart battery and energy management platform to build what is said is the largest virtual power plant (VPP) in the Asia-Pacific region.

SolarZero said the VPP currently generates more than 89 GWh of energy each year and with over 48 MWh of storage provides active support to the national grid by reducing peak loads across the country by 16 MW every day.

SolarZero founder and chief executive Andrew Booth said BlackRock’s acquisition of the company would allow it to build on its track record and drive its next phase of growth, with plans to invest $1 billion in new solar and battery systems across New Zealand over the next 10 years.

“BlackRock Climate Infrastructure team’s investment and backing will enable us to rapidly scale, grow our energy services network, and accelerate the transition to a 100% clean energy future,” he said.

“By 2030, 50% of the world’s energy will be generated in the Asia Pacific region. The window to prevent the worst impacts of the climate crisis is closing fast and the power couple of solar plus storage is one of the few true paths to energy security, stable power prices, prosperity, and a liveable planet.”

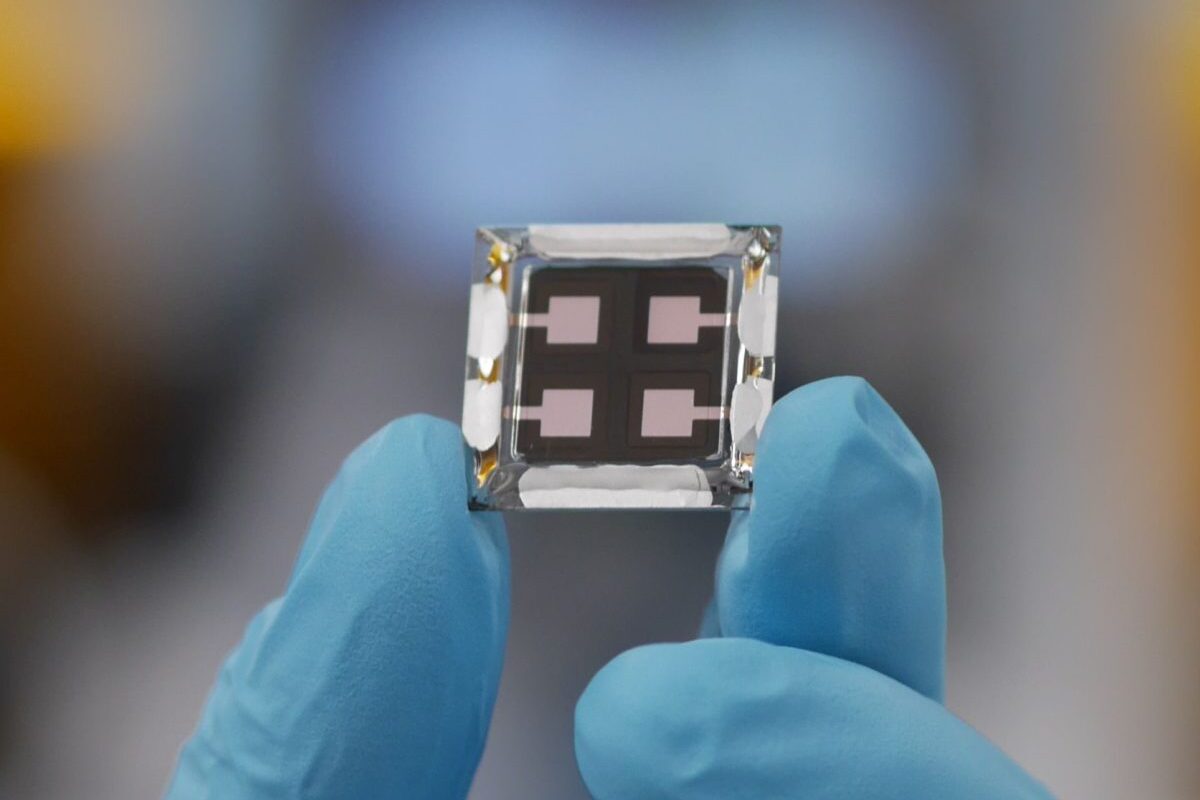

Image: SolarZero

New Zealand has set a target of 100% renewable electricity generation by 2035 and to be a carbon-neutral economy by 2050 but with rooftop solar penetration currently at 2% and the expected demand for electricity in the nation to double by 2050, there is a clear need for additional residential solar.

BlackRock’s co-head of climate infrastructure for the Asia Pacific region, Charlie Reid, said the acquisition of SolarZero is the United States-headquartered company’s first investment in New Zealand and its first residential solar investment in the Asia Pacific.

“Our move into New Zealand demonstrates BlackRock’s commitment to invest in attractive markets as part of our broader efforts to offer a flow of addressable global climate investment opportunities for our clients,” he said.

“SolarZero is a global pioneer, and we look forward to supporting its expansion into other Asia-Pacific markets and, at the same time, to accelerating New Zealand’s net zero journey.”

The acquisition is subject to various conditions including approval by the New Zealand Overseas Investment Office.

The investment in SolarZero follows BlackRock’s recent acquisition of Melbourne-based battery storage developer Akaysha Energy and its portfolio of nine projects in the national grid.

BlackRock renewables portfolio in the Asia-Pacific region also includes recent investments in Taiwanese solar energy firm, New Green Power, Korean renewables energy developers, KREDO and Brite Energy Partners, and Australian electric vehicle (EV) charging provider JOLT.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

9 comments

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.