From pv magazine ISSUE 09/23

When the world’s biggest solar manufacturers finally arrived at a consensus this year for a standard solar module size, the prospects of a similar agreement to unify the array of solar wafer dimensions available appeared far more distant.

Just as this article was going to press, however, six major solar companies – Longi, Tongwei, Risen, Canadian Solar, Das Solar, and Astronergy – announced unified rectangular solar wafer dimensions, stipulating that future devices will measure 182.2 mm by 191.6 mm, and 262.5 mm across the diagonal.

On July 7 this year, those six signatories – plus JinkoSolar, JA Solar, and Trina Solar – had announced their agreement on a standard size for rectangular-wafer based, mid-sized modules. Mid-sized panels typically feature 60 cells to 72 cells and a power output of 550 W to 700 W. Future mid-size modules will measure 2,382 mm by 1,134 mm and will feature longitudinal hole spacing at 40 cm, 79 cmm, and 1.4 m from the centre of the panel, on the long side.

Those nine solar manufacturers also agreed, back in July, that 182 mm wafer- and 210 mm wafer-based modules should follow the provisions laid down by trade body the China Photovoltaic Industry Association (CPIA) in its T/CPIA 0003-2022 technical specification for crystalline silicon terrestrial photovoltaic module dimensions and mounting holes standard.

With more than 80% global market share between them, these nine module-manufacturer signatories have established a de facto industry standard.

Problem solved?

The current variety of PV module sizes is caused, fundamentally, by the wafer dimensions adopted by different companies. Wafer size developed from the 12.5 cm by 12.5 cm dimensions of a decade ago, to 15.6 cm and then to 156.75 mm, by 2015. Since then, new dimensions have proliferated –including 15.8 cm, 158.75 mm, 16.1 cm, 16.2 cm, and 16.6 cm – due to the different technical routes followed by manufacturers. Since 2020, 18.2 cm and 21 cm wafers have been added to the list and these two formats have since come to represent most of the market.

At the same time, manufacturers were seeking differentiation in their module designs. With different-sized modules featuring varying dimensions of wafer, glass, backsheet, and film, solar projects ultimately ended up taking different forms. Each module format supported its own unique industrial system.

As those ecosystems became established, module size differences became entrenched, resulting in rising costs for coordinating upstream and downstream supply chains and throwing up significant barriers to entry for new manufacturers.

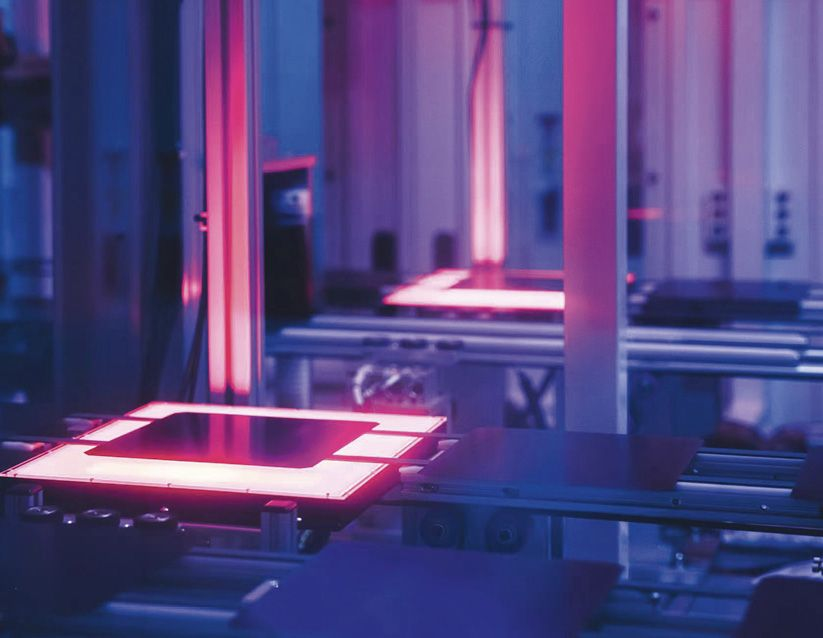

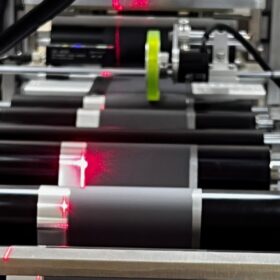

Production lines for silicon wafers, solar cells, and PV modules are usually worth millions, or even tens of millions of dollars. Having to buy different production equipment to match varying module-size needs drives up solar manufacturing investment costs. Adjusting production lines to meet the differing size needs of clients has caused problems in equipment adjustment, production scheduling, and the management of inventories of backsheets, glass, aluminium frames, film, and other auxiliary materials.

The plethora of module formats can be even more challenging for suppliers. For example, PV module glass – which is usually tempered or heat strengthened – can no longer be adjusted in size once production is complete. If an order changes, the original product can be cracked and discarded, resulting in a waste of materials.

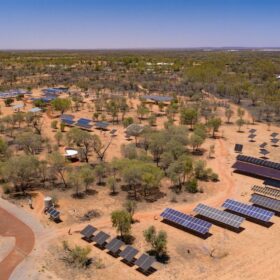

Down the production chain, module buyers can find it difficult to select the most appropriate dimensions for their projects. They need to consider differing electrical features and load performance and must match up modules with appropriately sized brackets and inverters. Such variety can cause a high ratio of mismatch and mis-mounting, which greatly raises power plant design cost and supply risk.

Difficult negotiations

That litany of problems and extra expense means the industry has considered standardising module formats for some time. The problem is, each of the big manufacturers wanted the size of their products to become the industry standard.

The CPIA, as a semi-official organisation, was an obvious choice to mediate the resulting negotiations as it not only coordinates communication between Chinese PV companies and the government, it is also responsible for formulating industry standards and coordinating dialogue and collaboration between its members.

From 2021, the CPIA organised several rounds of discussions aimed at setting a unified PV product size for major solar module and wafer manufacturers, as well as important supply chain participants such as glass, backsheet, encapsulant film, and inverter makers.

The trade body failed to find a critical consensus. Until May 2021, the CPIA was promoting the recommendations laid down in its T/CPIA 0003-2022 standard for modules featuring the various wafer formats. The industry’s big players would not come onside.

In April, at an industry seminar led by the CPIA, Trina Solar introduced the value concept of its 210R-based solar module, which uses a 21 cm x 18.2 cm rectangular wafer. The manufacturer suggested 2,384 mm by 1,134 mm as an industry-standard dimension for mainstream, mid-size modules.

The idea was approved by the CPIA and some of the seminar’s other participants. At the subsequent SNEC trade show, held in Shanghai in May, several leading solar manufacturers launched modules fitting those dimensions – or very near them, with 238 cm by 1,134 mm products also debuting – illustrating a possible appetite for convergence.

In June, under the coordination of the CPIA, leading manufacturers decided to sit down to substantially discuss the issue of a uniform module size. After several rounds of arduous negotiation, the participants ultimately decided on the 2,382 mm by 1,134 mm standard as it represented a mean figure of the two main alternatives for the dimension of the longer side. It was deemed an acceptable compromise by the big nine.

Progress had been slower on the wafer standardization front. In 2019, Longi proposed 16.6 cm wafers as an alternative to smaller sizes. TCL Zhonghuan then suggested 21 cm wafers, championing their performance gains. Longi, Jinko, JA Solar, and other companies with huge wafer production capacity, responded by proposing 180-something (18X) mm wafers – the largest size that could be accommodated by their existing equipment.

Module manufacturers, however, appeared to remain keen to differentiate their products by using bespoke wafer dimensions, a situation that currently means “18X mm” can mean numerous wafer size options.

Longi, Tongwei, Risen, Canadian Solar, Das Solar, and Astronergy appear to have reasoned that the unification of solar module dimensions presented the perfect opportunity to reduce the sort of material costs and management headaches that the variety of wafer sizes also represented. The manufacturers also stated an intent, in August, to try and find acceptance of their new wafer standard among their peers.

This begs the question: should we expect JinkoSolar, JA Solar, and Trina – the three signatories to the industry-standard module size – to follow suit on wafers?

–

Author: Vincent Shaw

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

And nothing is considered about the recycling …. Having so many “standards” impact definitively the ability to easily deal with the End of Live panels.

Same old song-n-dance 50 years later…

When the “Battle of a Unified Operating System” and hardware interfaces etc.. was blazing in the 1970’s… IEEE tried desperately,

Apple surreptously atteneded these meetings, then quietly developed and launched it’s OWN STANDARDS… and the rest .. is History..!!

You have an Apple World and Rest of World..!!!

Similar wars were waged for DVD Players, etc… where a dominant “market player” breaks the agreed to rules and standardisation never happens… and consumers around the world, have to face the Confusion… !!!

Here, the PV Cell Standard will be decided by the Communist Govt. of China.. Thetefore, the best is for the ROW (Rest of World) is to produce a REAL GLOBAL STANDARD.. with or without China.. Does IEEE have the “clout” & leadership it once since the 1900″s.. ???