From pv magazine ISSUE 11/23

An efficiency of 23.9% and power output of 741 W are numbers that are worthy of attention. Those results were presented by Chinese solar manufacturer Risen Energy for its latest, Hyper-ion module series, which deploys “G12” (210 mm), HJT half-cut cells in a large format for large scale solar applications. Risen is also producing a “55-cell” version of the same module, for commercial and industrial application. At a hefty 41 kg, the “66 cell” version of the module is no lightweight.

In mass production, the Hyper-ion doesn’t quite reach the lofty figures of its champion of the series. The modules available on the market have a power output of 680 W to 705 W with a module efficiency of 21.9-22.7%. Risen’s results still rival the best-performing modules, however, and speak to the potential of HJT.

Behind the dual-glass encapsulation there is a hint of the future of HJT in the Risen product. The company has deployed a notable innovation – busbarless cell interconnection, which it calls Hyper-Link. The approach replaces traditional busbars with a wire mesh that bonds and forms an electrical contact with the cell without the use of conventional high-temperature soldering.

Hyper-Link uses 24 metal wires for cell interconnection, beyond the 18-20 multi-busbars used in the latest high-performance products. While Risen has revealed some of the technical tricks behind its Hyper-Link busbarless technology, it is far from being an open book.

Busbarless more generally is termed zero-busbar or “0BB.” In one sense the approach is novel, in another it is well known. What is clear is that it is emerging at a scale not seen before in PV manufacturing. Risen alone wants an annual production capacity of 15 GW of its heterojunction modules by the end of 2023.

“There is very strong and valuable IP [intellectual property] being developed for specific implementation of the busbarless technology,” said George Touloupas, director of technology and quality at solar technical advisory Clean Energy Associates (CEA). “There is a tremendous amount of secrecy. In fact, there are barriers in front of the stringers [on production lines] and you are not allowed to see them. Internally, they make people sign very strict NDAs [non-disclosure agreements] and non-compete [agreements] – because it is so critical.”

As Touloupas notes, there are various techniques being explored for busbarless cell interconnection. The one with the longest track record involves wires embedded into a plastic film, with electrical contact occurring in lamination. Other approaches use an epoxy resin to hold the wires in place, with an encapsulation layer added in a secondary process.

“In China, almost all the HJT markers are trying and testing this technology,” said InfoLink chief analyst Corrine Lin. “There are several zero busbar solutions,” see table below.

Back to the future

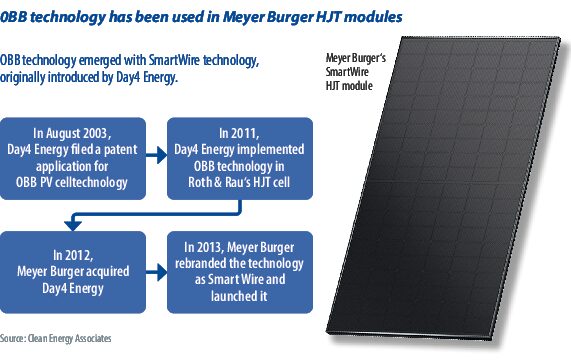

As is so often true in PV technology, what’s old is new and this also applies to busbarless technology. The approach was first developed by now-defunct Canadian manufacturer Day4 Energy in 2003 and was promoted, under the SmartWire label, by Meyer Burger after its acquisition of the technology, when the Swiss company was a pure-play production equipment supplier.

“When Meyer Burger started developing heterojunction technology around 2010, the company immediately snapped up an IP from Day4,” said Touloupas. “Meyer Burger saw it as a perfect fit for heterojunction technology.”

A review by research institute Fraunhofer ISE – commissioned by Meyer Burger and published in 2020 – noted that “Meyer Burger has extensive patent families on HJT and SmartWire production processes, systems and products; some of these patent families will not expire until 2039.”

While HJT was a natural match to SmartWire, Meyer Burger sold some 500 GW of its busbarless lines to HJT and non-HJT manufacturers in 2016-2017, according to the company’s then chief commercial officer, Michael Escher. At the time, Escher spoke to SmartWire’s ability to reduce silver consumption, “to only 80 mg, instead of 300 mg per cell.”

Both silver consumption and busbar technology have come a long way in the interim period. Silver paste and screen-printing technology have made great strides in reducing the amount of silver used in metallisation, delivering cost savings without the use of busbarless interconnection. Multi-busbar (MBB) technology, of which the latest generation has been badged “super multi-busbar,” has moved into mainstream production with alacrity.

“When Day4 developed the technology, the advantage versus two- or three-busbar modules would’ve been far greater,” said Tristan Erion-Lorico, vice president for sales and marketing at PV Evolution Labs (PVEL). “With some manufacturers now going to a 20-busbar module, the performance gap isn’t so big.”

Silver reduction

The performance boost delivered by SmartWire, which can be extended to other busbarless approaches, is in part that there is reduced shading of the cell surface both by the busbars themselves and by the metallisation paste. It is likely in the implications for metallisation where the busbarless and HJT combination truly shines.

By reducing “ohmic losses,” SmartWire facilitates “fine-line metallization” and therefore “a drastic reduction in silver usage by 85% or more,” according to researchers from the Centre Suisse d’Electronique et de Microtechnique (CSEM), in a 2014 paper presented at the EUPVSEC conference in the same year.

The CSEM was a long-running partner in the HJT equipment and process development of Meyer Burger and hosted a pilot line on its campus in Neuchâtel, Switzerland. The paper, “SmartWire solar cell interconnection technology,” concluded that the cell interconnection approach represents a “key enabling technology for competitive silicon heterojunction modules as it permits to lower the constraints on cell metallisation conductivity.”

Chinese manufacturers echoed the interest of the Swiss researchers. “The Chinese have been working on this for years and everything is better [with busbarless technology] – lower cost and higher efficiency,” said Alex Barrows, head of PV at solar manufacturing consultancy Exawatt. “The cost is lower because of reduced silver usage and there is higher efficiency because of less shading. If a manufacturer can make it work, it is a very neat solution and in the long run it is almost inevitable that we will move to something similar for HJT.”

Barrows noted that the implementation of silver-coated copper paste, for HJT cell metallisation, dilutes some of this advantage, “and because of that maybe there was less of a rush to adopt zero-busbar as it already did some of the work in taking the cost out of HJT,” he said. The benefits remain sizeable nonetheless.

Risen claims that by deploying its Hyper-Link along with silver-coated copper paste, it can achieve a silver content of 10 mg/cell in its Hyper-ion modules. By comparison, the 14th edition of the “International Technology Roadmap for Photovoltaics,” published in March 2023, concluded that in 2022, average positively-doped “p-type” silver consumption stood at 11 mg/cell.

“I have seen in the roadmaps that zero-busbar could bring the HJT silver cost down to [that of tunnel oxide passivated contact] TOPCon [solar],” said CEA’s Touloupas, noting that HJT is not a competitor with p-type passivated emitter rear contact (PERC) solar, but rather with n-type TOPCon.

Bismuth bother

There is, however, a material challenge. The technology’s development was enabled, in part, by the use of bismuth in interconnection wires.

“One of the main innovations achieved by Meyer Burger 10 years ago, was to replace the lead on the ribbon coating with bismuth, as bismuth-tin alloy is low-temperature,” said Touloupas. “That means that the soldering is happening in the laminator at around 150 C when the alloy melts and achieves contact.”

Bismuth consumption is potentially problematic. In a 2021 study, researchers from the University of New South Wales, in Australia – alongside Amrock Consulting and Trina Solar – concluded that available bismuth would limit production to 330 GW – far greater than Risen’s targeted 2023 consumption but a potential bottleneck as the global solar industry rapidly expands toward terawatt scale.

The paper is titled “Design considerations for multi-terawatt scale manufacturing of existing and future photovoltaic technologies: challenges and opportunities related to silver, indium and bismuth consumption.” It concluded that “significant material consumption reductions are required to meet the target production rate for sustainable multi-TW scale manufacturing in about ten years from now.”

Keeping cool

Low temperature processing is a necessity for HJT cells, as standard firing or soldering can damage delicate passivation layers. “MBB technology typically uses infrared soldering, which is too hot for HJT,” says PVEL’s Erion-Lorico. While busbarless interconnection achieves contact in the lamination process at far lower temperatures, challenges remain.

“Something we’ve mentioned in the PVEL Scorecard is that we’re still seeing some struggles with thermal cycling results for some HJT manufacturers, in that the range of thermal cycling results is higher for HJT than for PERC – some are doing it well and some are struggling,” said Erion-Lorico. “The low temperature soldering can be an issue.”

Despite the great progress that is being made, the adoption of any new material or processes in PV manufacturing at significant scale is something that could manifest new risks.

“Whatever solution is chosen, and there are several, the most important thing is reliability,” said Touloupas. “We hope to have the tools – extended tests – that can identify the losers among busbarless technology implementation. We need to understand the failure mechanisms and hopefully they are the same as those found in conventional soldering.”

Meyer Burger did not respond to requests for an interview regarding the company’s SmartWire technology. It is currently deploying SmartWire in its module manufacturing in Germany.

This article was amended on 30/11/2023 to remove reference to the Day4 Energy patent.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.