From pv magazine ISSUE 12/23 – 01/24

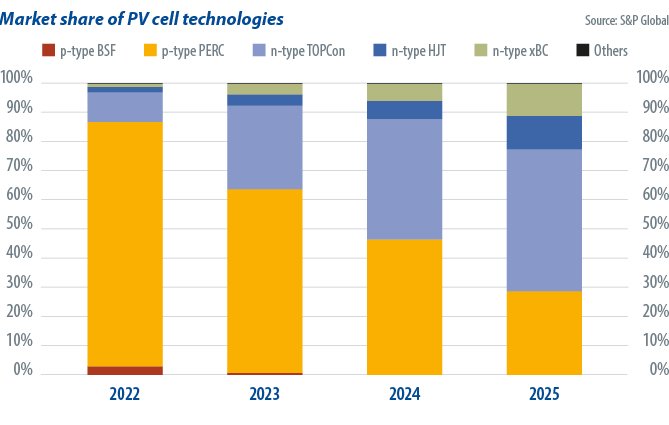

As passivated emitter rear contact (PERC) solar technology is approaching its theoretical efficiency limit, the transition from p-type to n-type PV is inevitable. Leading module suppliers have tried to achieve mass production of tunnel oxide passivated contact (TOPCon) modules and made sizable shipments in the first half of 2023. This demonstrated the competitiveness of TOPCon modules and has driven growth in investment from other tier one and tier two manufacturers. By November 2023, more than 800 GW of annual TOPCon cell production expansion plans had been announced. Although some of those may not be realized, S&P Global Commodity Insights estimates that TOPCon will make up close to 50% of total capacity by 2025.

TOPCon is not the only cell technology forecast to grow exponentially in the next couple of years. Other n-type technologies are expected to grow, such as multiple variants of back contact technology, known collectively as xBC solar, and heterojunction (HJT) cells.

Going all in

Back contact is a technology championed by Longi Green Energy, the second-largest module maker in 2022, and has also been selected by a few other suppliers. Longi has announced it intends to go all-in on xBC technology and will have 33 GW of annual production capacity by the end of 2023 with an additional 60 GW planned in the following years.

Tier two manufacturers and new players outside China find HJT technology more attractive for their next-generation cell expansion plans. More than 200 GW of annual HJT manufacturing capacity has already been announced, of which 23% has come from non-Chinese companies. While TOPCon’s almost fully localised equipment is in mainland China, some of the machinery needed for HJT production lines, components, and machine consumables are still more advanced in western countries.

Overcapacity

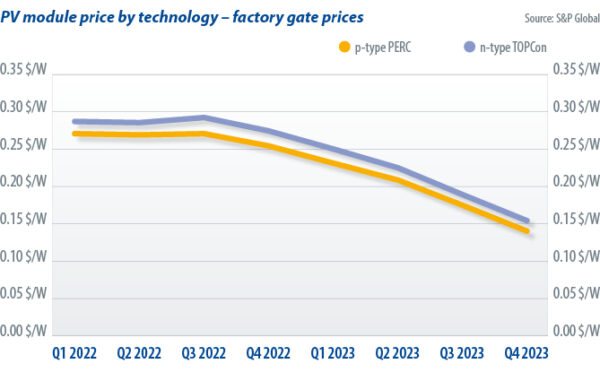

Severe solar production overcapacity and the technological transition for PV have resulted in a reduction in both the price and profit margin of modules.

The combined expansion of the three key n-type technological paths is expected to drive more than 500 GW more annual solar manufacturing capacity in 2024. In addition, there is another 500 GW of p-type cell manufacturing capacity that is not projected to be idle or replaced by n-type soon and could instead co-exist with new capacity, to exceed more than 1 TW of annual cell production capacity in the solar industry. Since PV installations are expected to be in the 400 GW to 500 GW range in 2024, most of next year’s demand can already be supplied with n-type modules.

That would leave p-type suppliers in a complicated situation, as far as selling modules is concerned. Significant discounts would most likely be required since buyers’ preference is for n-type products, due to the higher solar-project internal rate of returns they offer. Once n-type production capacity is fully ramped, in 2025, there will be very limited room to sell p-type modules and they will quickly be phased-out.

The much faster growth of manufacturing capacity, versus market demand, and the technology transition from p- to n-type have worsened the overcapacity situation. High inventories and slow demand ensured utilization rates through the module supply chain significantly declined in the second half of 2023, triggering a major price drop across the value chain. A staggering 76% year-to-date drop in the polysilicon price may not have contributed much to increasing module margins, since the module price decline has outpaced falling production costs.

Module suppliers are eager to clear inventories with floor prices. Prices of less than CNY 1 ($0.138) per watt of generation capacity have been quoted in some recent tenders on mainland China. That price is not sustainable. Even cost leaders cannot achieve module production expense equal to or less than CNY 1/W.

What’s next?

From 2024 onwards, the potential for additional price reductions for PERC modules is limited. However, there could still be lower-than-production cost quotes in the market for a few quarters, as manufacturers clear inventory.

By contrast, TOPCon modules are still in short supply in 2023 and have been able to command a higher price than PERC despite similar dollar-per-watt production costs. Commodity Insights projects that, with massive production capacity to be ramped next year, TOPCon will narrow its price gap with PERC and accelerate the phasing out of PERC solar.

About the author: Jessica Jin is a principal analyst for the clean energy technology research team at S&P Global Commodity Insights. She is responsible for research on the global PV module supply chain, from polysilicon and wafers to cells and modules, as well as analysis of market supply. Jin previously spent more than three years at a global market research firm, focusing on the solar supply chain.

About the author: Jessica Jin is a principal analyst for the clean energy technology research team at S&P Global Commodity Insights. She is responsible for research on the global PV module supply chain, from polysilicon and wafers to cells and modules, as well as analysis of market supply. Jin previously spent more than three years at a global market research firm, focusing on the solar supply chain.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Like the transition from propeller driven aircraft to jet engine aircraft changed the whole airline industry and many of the old companies like TWA, Pan American, Transocean, Cal Eastern and Western airlines, those that converted to the faster jets stayed in business longer. Like the cost of solar is rated by cents per watt, airlines were cents per passenger mile. Once the cheaper competition come online, they either changed to match or became history. Once the airline industry was de-regulated, just as government subsidies will end, only the least expensive, longer lasting solar panel sales will survive.