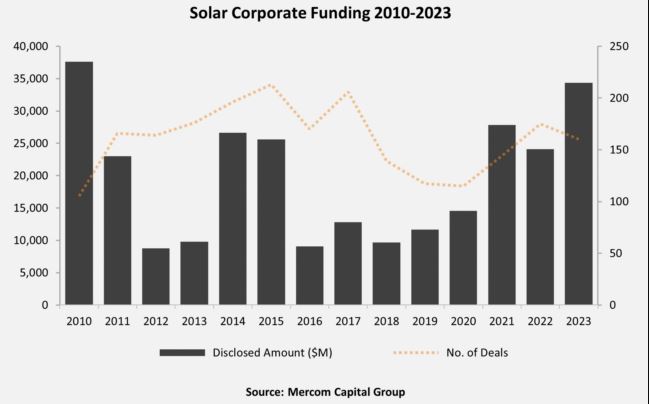

Solar companies raised $51.95 billion (USD 34.3 billion) in corporate funding last year – the largest amount in a decade, according to Mercom Capital Group’s latest report on funding and merger and acquisition (M&A) activity for the sector.

The overall figure accounts for 160 deals globally and represents a 42% year-on-year increase from 2022, when $36.5 billion was made across 175 deals.

Funding from private marketing financing reached $11.21 billion last year, a 45% increase on the year prior and the second highest figure since 2013. Meanwhile, solar companies raised $30.29 billion in debt financing, a 67% increase from 2022 and the highest amount in the past decade. Mercom Capital Group said securitisation activity was a key contributor, with $5.15 billion in 11 deals.

Funding from solar venture capital activity was down 1% on 2022, reaching $10.45 billion across 69 deals in 2023. From that figure, $7.12 billion, or 68%, went to 42 solar downstream companies. Solar companies raised $2.89 billion, balance of system companies raised $473 million and service providers raised $48.7 million.

Mercom Capital Group CEO Raj Prabhu said investments into solar continue to defy expectations.

“Driven by the Inflation Reduction Act, the global focus on energy security, and favourable policies worldwide, solar continues to attract significant investments,” he said.

While funding activity was strong, M&A activity declined 25% year-on-year, with 96 corporate transactions in 2023, compared to 128 in 2022. The largest transaction was by Brookfield Renewable, which acquired Duke Energy’s unregulated utility-scale commercial renewables business in the United States for approximately $4.26 billion.

“Higher borrowing costs have put a damper on M&A transactions, with cautious investors biding their time for more favourable valuations,” Prabhu said. “Solar projects continue to attract interest, but high valuations and a lower risk appetite, compounded by unpredictable project completion timelines due to interconnection delays, labour shortages, and scarcity of components, have all contributed to a drop-off in project M&A activity.”

There were 231 large-scale solar project acquisitions in 2023, down from 268 deals in 2022. In 2023, almost 45.4 GW of solar projects were acquired in 2023, compared to 66 GW in 2022, down 31% year on year.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.