A new report from solar and storage market analyst SunWiz reveals that residential PV remains the mainstay of the Australian solar success story with rooftop systems representing a combined 68% of the total solar power installed nationwide.

According to the latest Annual SunWiz Australian PV Report, 2.5 GW of residential solar power was installed in 2023, along with 0.9 GW of commercial rooftop systems – just 4% and 0.2% respectively down on the record levels rolled out in 2021. The STC commercial market grew by 25% in 2023 while the residential market climbed by 11%.

But while rooftop solar installations reached near record levels in 2023, it wasn’t enough to make up for a downturn in new large-scale solar coming online with Australia’s PV industry posting an overall annual contraction for the first time since 2013.

The amount of new solar power installed in Australia in 2023 was 4.6 GW in total, down on the 5.6 GW installed in 2022 and the lowest level since 2019.

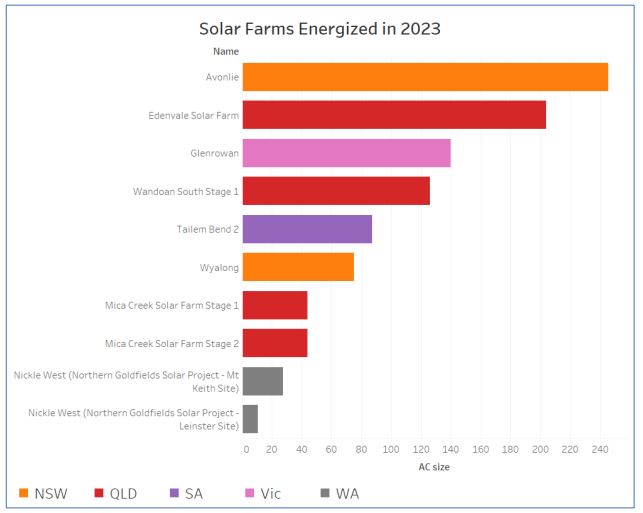

SunWiz said 10 new solar farms totalling 1.1 GW came online in 2023, a 60% reduction on the 2.9 GW that started producing energy in 2022, and the worst year for solar farms since before their rollout began in earnest in 2018.

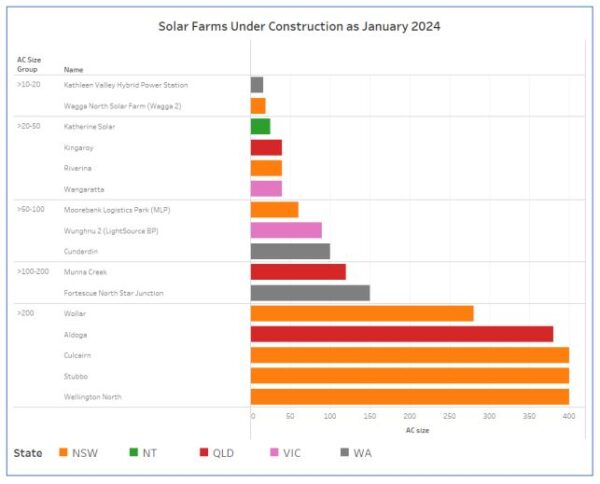

Queensland had the most solar farms energised in 2023 with four projects coming online in 2023, while NSW had two new solar farms start producing energy.

SunWiz Managing Director Warwick Johnston said while the figures are no surprise – the 2.2 GW under construction in January 2023 was less than half the 4.9 GW being built in January 2022 – they underline the need to rebuild momentum in the solar farm development pipeline.

Johnston said a “decade of inaction and blocking by the previous federal government,” combined with grid congestion and grid connection challenges have resulted in reduced construction activity.

“While we expect continued growth in rooftop PV deployment, the number of solar farms likely to come online in 2024 looks set to further contract,” he said.

“This demonstrates the need for federal and state governments to implement policy changes that accelerate the development and construction of solar farms, while swiftly acting to support the rollout of commercial solar power and home energy storage systems.”

Johnston said he expects all market segments to grow in 2024 but cautioned that the development pipeline of new solar farms remains sluggish.

The amount of large-scale solar under construction has increased marginally to 2.6 GW but there is little change in the volumes of committed projects, and a decreasing number of projects progressing through the various project development hurdles and obtaining the necessary approvals.

“Instead we see a growing volume of proposed projects, plus a leap in the volume of projects that have been shelved,” Johnston said, noting that Australia needs the low-cost bulk energy provided by solar farms to achieve its renewable energy targets.

Australia currently has 16 solar farms larger than 10 MW under construction that total 2.56 GW. Most of this capacity is in NSW. This is a modest increase on the amount under construction at the start of 2022 when work had started on 15 projects totalling 2.2 GW.

Australia’s cumulative total deployment of solar power has now climbed to 36.7 GW. Residential systems comprise more than 19 GW, or 52%, of this overall total.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.