China is now in position to end new coal power additions before 2030. Since China is responsible for more than 96% of coal power under construction worldwide, this has profound implications for global transition.

That’s the key finding of the Climate Energy Finance’s (CEF) new report released this week, Power Shift. Based on extensive new modelling, the CEF forecasts coal power generation will peak and decline in China before 2030. Despite a projected increase in total electricity demand fueled by robust economic growth and the country’s multi-decade-long electrification of everything strategy, the share of thermal power in the overall energy mix will diminish as renewables take centre stage.

Coal will relinquish its longstanding dominance in power generation. Instead, it will transition into a supplementary role as backup ‘insurance’ in China’s national energy security over the coming 16 years to 2040.

Our model forecasts a decline in thermal power generation share to just 50% by 2030 and 30% by 2040, compared to the 70% share observed in 2023.

This transition is led by a staggering rate of wind and solar capacity additions, which means the country could reach its 14th Five Year Plan (FYP) target of 1,200 GW of installed solar and wind capacity by 2030 as early as this year, six years ahead of schedule.

After rapid wind and solar power deployments added a record 293 GW in 2023, by the end of the year China’s total installed wind and solar capacity had already reached 1,050 GW.

This momentum has continued during the first quarter of 2024, with 61 GW of new wind and solar capacity added to the grid. If China sustains this rate, it can reach 1,294 GW of total wind and solar installed capacity by the end of 2024 – easily beating out its 1,200 GW 2030 target. This is over four times the total installed wind and solar capacity in the United States.

Sustaining this momentum requires comprehensive attention to factors such as grid integration and stability, intermittency management, infrastructure development and grid expansion, energy efficiency measures and carbon pricing to further facilitate the transition.

In terms of global implications of China’s profound energy shift, we find that if the rate of installation of zero-emissions additions is maintained, China can achieve its ‘dual carbon’ targets – to peak carbon emissions by 2030 and reach carbon neutrality by 2060 – ahead of time.

It now has the opportunity to leverage its phenomenal global leadership to increase the ambition of its decarbonisation goals and target carbon neutrality by 2050, bringing it in line with the rest of the developed world.

This is of major significance if the world is to have any prospect of a global decarbonisation pathway aligned with Paris Agreement emissions reduction goals, as climate change escalates, and to help ratchet up the ambition of other leading nations.

China’s rapid pivot also underscores a decisive moment for Australia’s economic trajectory, as demand for coal inevitably declines.

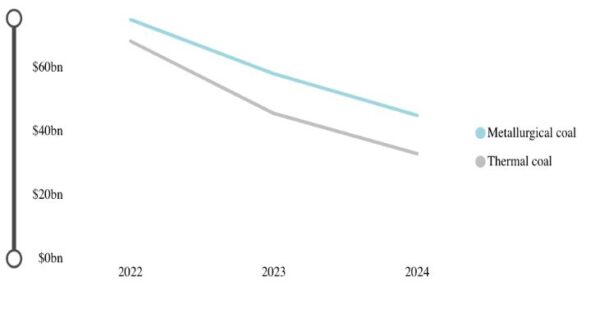

According to the Office of the Chief Economist, Australia’s thermal coal export value is expected to fall to $33 billion (USD 21.66 billion) in 2024 from $45 billion in 2023 and $68 billion in 2022, while coking coal coking coal exports are estimated to fall to $45 billion in 2024 from $58 billion in 2023 and $75 billion in 2022.

Image: CEF; source: Department of Industry, Science and Resources, Resources and Energy Quarterly, December 2023

China’s accelerating pivot only heightens the imperative for Australia to urgently diversify from its historic ‘dig-and-ship’ economic model of coal export dependency and increase the momentum of its transition towards future-facing industries.

We are well placed to grasp the once-in-a-hundred-year opportunity to become a zero-emissions trade and investor power in the new economic world order. We enjoy the world’s largest reserves of lithium and iron ore, for example, with potential to value-add our lithium pre-export, placing Australia higher up the global battery supply chain, and to lead the world in the production of green iron.

Key to this is enhancing partnerships and bi- and multilateral agreements in the Asian region – a central premise of the Albanese Government’s new Future Made in Australia Act – including with China. China’s immense investments in renewable energy and cleantech, while speeding its dometic decarbonisation and accelerating the global energy shift, also present unparalleled opportunities for Australia.

There is enormous potential to joint venture with China in Australia, by leveraging Australia’s abundant natural resources and expertise, collaborating in research and development, refining local resources such as quartz and lithium, and value-adding via onshore processing and manufacturing, from critical minerals to renewables components and technologies, powered by Australia’s superabundant, low-cost zero-emissions energy.

Rather than competing with China, Australia could, for example, strategically contribute to the global solar industry based on its own national strengths and interests by drawing on our decades of leadership in solar technology, which culminated in development of the world’s most efficient solar cell.

This approach would build our sovereign capabilities in cleantech supply chain, bolstering our energy security and our economic prosperity and resilience in a rapidly decarbonising world, as we consolidate our strategic relations with the world’s great green economic powerhouse undergoing an era-defining transformation.

Authors: Xuyang Dong, China Energy Policy Analyst, Climate Energy Finance; Annemarie Jonson, Chief of Staff, Climate Energy Finance

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.