Sydney-headquartered Investor Group on Climate Change (IGCC) has completed research into Australia’s 2025 state of Net Zero investment.

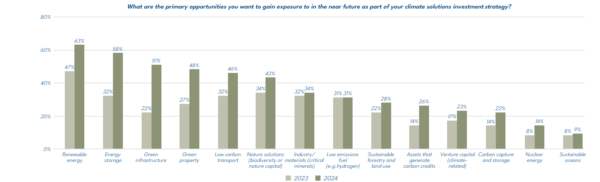

Based on data from 65 superannuation funds, retail funds, and fund managers the IGCC State of Net Zero Investment 2025 report found that 63% of respondents said renewable energy solutions such as solar, wind and hydro, are regarded as the top opportunity for investors, up from 47% in 2023, a jump of 16%.

The report also found investor appetite remains low in the blue economy (9%), nuclear (14%) and carbon capture and storage (22%).

Despite interest, formal commitments or targets to scale up investment has risen modestly from 2023 (50%) to 2024 (53%).

Image: Investor Group on Climate Change

The IGCC says the small progress suggests policy settings may not yet be providing necessary conditions to translate interest into action, recommending policymakers must actively shape an enabling investment environment.

On key policy priorities for investors in 2025, based on feedback about renewables for the report, 61% seek the scaling up of funding for climate technologies to accelerate commercialisation and deployment.

Investors told IGCC that the lack of investment-ready opportunities with the right risk-return profile remains a major barrier, with the proportion of investors concerned about a lack of suitable opportunities jumping 13% to 61% in 2024.

This highlights the need for targeted incentives and stronger collaboration between policymakers and investors to unlock capital deployment at scale, the IGCC said.

In 2024, 89% of respondents engaged in climate finance-related policy to progress the environment themselves, while strengthening their own climate commitments by publicly committing to a Net Zero target by 2050, with asset owners setting targets across their entire portfolio, from 68% in 2023, to 82% 2024.

Image: Investor Group on Climate Change

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.