The country’s newly introduced federal battery subsidy has catalysed an extraordinary surge in retrofit demand, shifting design priorities and driving strong differentiation in product-market fit.

SunWiz’s latest data reveals that stackable battery designs, hybrid inverter architectures, and retrofit-friendly solutions are now decisive factors in market success — and these trends may soon inform product strategy in other maturing global storage markets.

Retrofit boom reshaping system design priorities

Australia reached a significant milestone in May 2025: for every PV system installed, 1.4 battery systems were sold — an unprecedented ratio.

But the most interesting dynamic is occurring within the retrofit market:

- ESS-only sales are growing faster than PV+ESS combined installations.

- Existing solar owners are driving this demand, leveraging the federal subsidy to add storage to their pre-existing PV arrays.

This shift elevates the importance of system components that integrate seamlessly into retrofit environments, where existing inverters, metering setups, and space constraints must be considered.

Stackable v monolithic: The retrofit advantage

Battery architecture matters.

Australian consumers are not simply adding batteries — they are upsizing them:

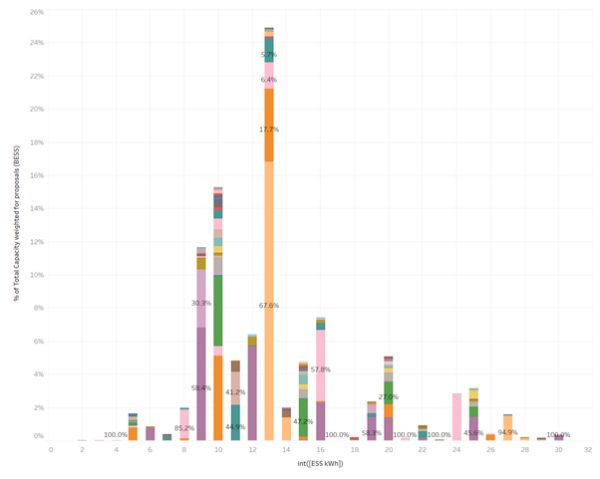

- The average installed battery size jumped to 15 kWh in May.

- The federal subsidy allows buyers to obtain ~50% larger capacity for a similar out-of-pocket cost.

Stackable battery solutions have a clear market advantage here:

- They allow customers (and installers) to add modules to achieve the desired capacity with minimal system rework.

- In contrast, monolithic batteries are typically harder to scale beyond their base capacity, often requiring additional major components or reinstallation to increase size.

Preliminary SunWiz data shows stackable systems dominating key size categories in the Australian market — a pattern that is likely to become entrenched as retrofit demand continues.

Hybrid inverters gaining market share

Inverter selection is another critical factor in retrofit success.

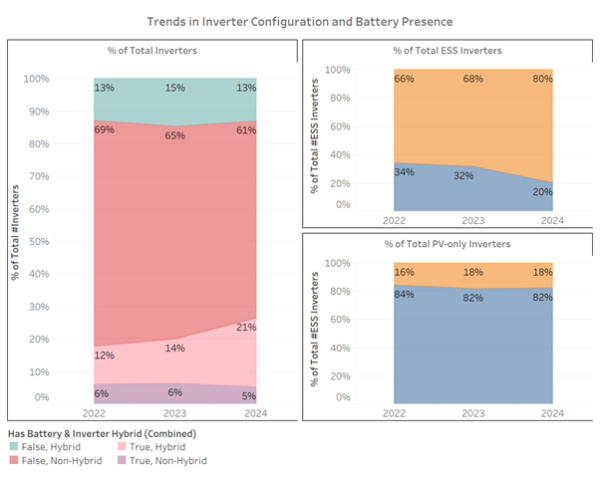

In 2024:

- 80% of ESS installations used hybrid inverters.

- 18% of PV-only installations also used hybrids — effectively future-proofing those systems for easy battery integration.

- Overall, hybrids made up one-third of all combined PV and ESS installations.

This trend highlights two opportunities:

- Manufacturers with hybrid offerings are better positioned to serve both retrofit and PV+ESS markets.

- Installers and distributors can future-proof new PV deployments by choosing hybrid inverters today, reducing friction for future battery add-ons.

Why product-market fit is now about system architecture

Australian battery market dynamics offer a sharp lesson: product-market fit is now determined as much by system architecture as by brand reputation or price point.

Winning designs exhibit:

- Modularity — stackable capacity to align with customer value optimisation under the new subsidy.

- Retrofit flexibility — compatibility with diverse PV legacies and installer workflows.

- Hybrid readiness — supporting both retrofit paths and integrated PV+ESS sales strategies.

Conversely, brands and system architectures that lack these characteristics are seeing reduced competitiveness in today’s market.

For example, compare the market share of Tesla, which captures two-thirds of the most popular Australian ESS size (13kWh), in the process netting it 17% overall market share. In contrast Sungrow has similar overall market share, just spread across multiple sizes. Sungrow, along with other modular batteries, are better positioned for consumers to increase battery sizes by 50%.

Implications for global storage markets

As other countries introduce or expand battery incentives — and as early PV markets mature globally — retrofit dynamics similar to Australia’s are likely to emerge elsewhere.

Manufacturers and system designers should be proactively aligning their roadmaps with these realities:

- Stackable designs are becoming essential, not optional.

- Hybrid architectures will dominate inverter choice.

- Retrofit flexibility must be a core design priority, not an afterthought.

The Australian market is providing a live test case of these trends. Global players would be wise to study it closely.

Author: Warwick Johnston, Managing Director, SunWiz. SunWiz provides the most detailed monthly tracking of the Australian battery market, including brand performance by architecture, system size, and installation type.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.