Solar is emerging as a critical driver of energy diversification across Southeast Asia. Falling module prices combined with stronger policy frameworks are accelerating the adoption of utility and distributed solar systems. Although solar has yet to deliver firm capacity at scale, integrating with battery energy storage systems (BESS) enhances grid flexibility and resilience.

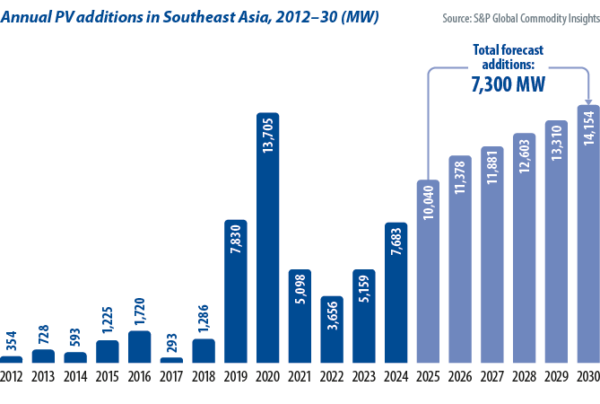

The Southeast Asia region will add more than 73 GW of new solar capacity between 2025 and 2030, according to S&P Global Commodity Insights forecasts (see chart below). Growth will be driven by expansions in established markets and greenfield developments in emerging markets. Additionally, surging electricity demand from data center investments will further support solar deployment in key markets.

Regional leaders

Vietnam, Thailand, and the Philippines lead regional solar adoption, leveraging feed-in tariffs, utility PV auctions, and strong investor interest. Malaysia is rapidly advancing rooftop solar deployment and corporate power purchase agreement (PPA) frameworks, with the commercial and industrial (C&I) sector driving demand.

Despite substantial solar power potential, Indonesia’s solar sector is still developing at a measured pace. Factors such as centralised utility planning, evolving regulations, relatively low retail electricity tariffs, and grid infrastructure readiness challenges project timing and scale.

In addition to these familiar markets, a second wave of solar growth is emerging in markets such as Laos and Myanmar, where growing policy support and demand for electricity creates opportunities in the medium term.

Myanmar needs solar

Myanmar’s solar market is experiencing rapid growth, driven by an ongoing energy crisis. In recent years, the country has been plagued by persistent power shortages, rising electricity tariffs, and the need to diversify its energy mix, which has traditionally relied on hydropower and gas. Severe blackouts, lasting up to 16 hours per day in some areas, have supported demand for distributed solar solutions, particularly in residential, commercial, and agricultural sectors.

S&P Global Commodity Insights forecasts that Myanmar will add approximately 700 MW of solar capacity in 2025, primarily in rural and off-grid regions with limited electricity access. This growth is evidenced by rising imports of solar modules and inverters, with the agricultural sector playing a significant role as farmers transition from diesel-powered irrigation to solar water pumping amid fuel price volatility and unreliable grid supply.

The market dynamic in Myanmar reflects a decentralised, needs-based adoption model, akin to trends in Pakistan, where chronic grid instability has spurred widespread rooftop and off-grid solar deployment. In 2024, Pakistan imported an estimated 17 GW of solar modules, highlighting the connection between energy insecurity and the uptake of distributed solar solutions. As Myanmar continues to expand its solar capacity, it is poised to address its energy challenges and enhance its energy security through increased reliance on renewable sources.

On the utility-scale front, Myanmar’s solar ambitions were highlighted by a 2020 tender that awarded more than 1 GW across 27 to 29 projects, mostly to Chinese developers. However, political instability following the 2021 military coup, currency depreciation, payment delays, and grid infrastructure challenges stall much of this pipeline. As of 2025, the Electricity and Energy Development Commission reports around 1 GW of solar capacity under development across 11 projects, signaling tentative recovery. Realisation of these projects will depend on concessional financing, investor risk appetite, and government policy clarity.

Laos exports

Laos is strategically positioning itself as a solar energy exporter, with the government actively spearheading project development to integrate solar into the national power mix. With approximately 12 solar projects in the pipeline, totaling around 650 MW, Laos aims to leverage its solar capacity to meet China’s energy demands. This focus not only enhances Laos’s role in regional energy dynamics, but also underscores its commitment to renewable energy growth. As these projects progress, Laos’s solar initiatives could significantly impact its economic and energy landscape, fostering stronger ties with neighboring countries and contributing to regional energy security.

Despite its ambitions, Laos faces challenges such as high debt levels, energy instability due to international ownership of power plants, and reliance on hydropower and lignite for most of its power generation. The country aims to achieve net-zero emissions by 2050 and has set a target for its power sector to reach 30% renewable energy by 2025. However, grid integrity issues and financial losses in the power sector pose obstacles to these goals. A 25-year agreement signed with China Southern Power Grid Co. in 2021 sees the energy company manage Laos’ power grid, but the country must strive to manage its own grid to increase the efficacy of its electricity exports and develop its domestic grid for greater power security.

Future path

Southeast Asia’s journey to harness its solar power potential is fraught with challenges, yet ripe with opportunity. The geopolitical uncertainties in developed economies may serve as a catalyst for Southeast Asia’s solar industry to draw investment and broaden its influence. As these emerging markets navigate the complexities of the global landscape, the expansion of solar generation capacity remains pivotal in satisfying the region’s burgeoning electricity demand and secure energy access. By adeptly leveraging these opportunities and addressing geopolitical hurdles, Southeast Asia is poised to cement its status as a frontrunner in solar energy adoption, thereby stimulating economic growth and fostering regional cooperation in the medium term.

To attract investment, Southeast Asia must prioritise the fortification of policy frameworks, ensure regulatory stability, and offer enticing incentives for renewable energy projects. The development of robust infrastructure and the enhancement of grid readiness are essential components in appealing to investors. Cultivating partnerships with international stakeholders and advocating for transparent, investor-friendly environments can also significantly bolster confidence and propel investment in the region’s rapidly expanding solar sector.

About the author

Baldesh Singh is a principal analyst for solar research at S&P Global Commodity Insights, focusing on demand forecasts for Southeast Asia, Central Asia, and India. He has more than six years of experience in the research industry and frequently shares his insights at key industry events.

Baldesh Singh is a principal analyst for solar research at S&P Global Commodity Insights, focusing on demand forecasts for Southeast Asia, Central Asia, and India. He has more than six years of experience in the research industry and frequently shares his insights at key industry events.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.