Melbourne-headquartered non-profit advocacy organisation First Nations Clean Energy Network (FNCEN) has collaborated with United Kingdom-based accounting giant Ernst and Young (EY) to report on the benefits of clean energy project investment with First Nations groups in Australia.

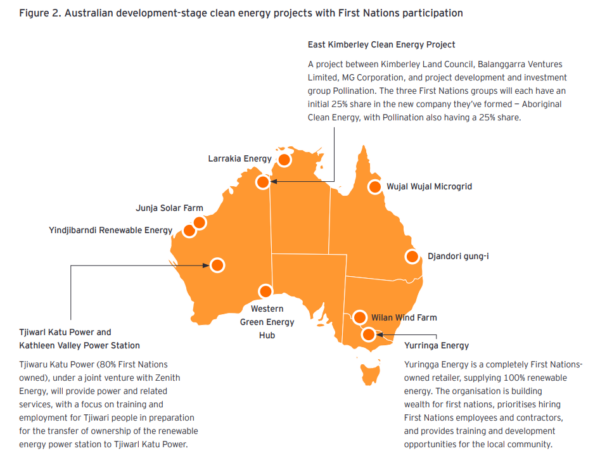

Targeted at international and domestic investors and clean energy industry leaders, the Investor benefits of First Nations participation in clean energy projects report shows nearly 50% of the clean energy infrastructure needed in Australia will be sited on First Nations lands and waters where First Nations have legal rights and interests.

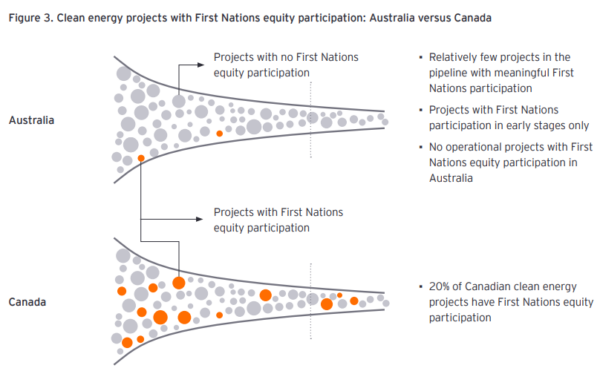

Twenty First Nations clean energy project partnerships in development demonstrate investment can be done with equity, and are realising investor benefits such as fast-tracking of approvals, greater access to pools of capital, strong social licence and reduced risk, cost and delay.

Image: First Nations Clean Energy Network and EY

Produced from domestic and international case studies and interviews with project developers and First Nations groups in Australia that have partnered on projects, the report aligns with First Nations people, communities and groups that are increasingly looking to co-design, lead and partner or own clean energy systems.

FNCEN Steering Group member Karrina Nolan said a good example of a majority First Nations-owned and led venture is Yindjibarndi Aboriginal Corporation’s partnership with ACEN Australia.

“They’ve got the right ingredients, including strong land tenure and 25-50% First Nations equity on all projects. They’ve been fast-tracked by the Western Australia (WA) government through approvals. They’ve attracted significant capital. They’ve got an offtake agreement with Rio. And they’ve got a really good history of good governance and negotiating good agreements,” Nolan said.

“Other First Nations clean energy equity agreements are being developed regardless of tenure and still offer strong benefit arrangements for communities.”

Nolan added, if investors earmark projects that are designed around what First Nations people need and want and aspire to, and enable First Nations ownership and benefit-sharing, they’ll get better outcomes.

“It unlocks mutual opportunities for economic development and project success,” Nolan said.

Image: First Nations Clean Energy Network and EY

The report says collaborations generate powerful, reciprocal benefits, ensuring project success and social equity and guarantees First Nation sustainable long term benefits through engagement, free, prior and informed consent (FPIC), co-design, recognition of rights, and prioritisation of local businesses.

FNCEN Steering Group member and University of Technology Sydney (UTS) Pro-Vice-Chancellor Indigenous Leadership and Engagement Professor Robynne Quiggin said compliance remains a critical matter for First Nations people, but incorporating First Nations peoples, rights and protocols enables not just mutual economic and social benefits but fairness and equity in Australia’s clean energy transition.

“Investors have at their disposal a plethora of tools and guidance enabling world-class excellence in First Nations engagement, consent, participation and collaboration towards real outcomes not yet seen in this county – First Nations equity, partnership and ownership of energy projects. Their implementation can ameliorate current and future risks for all of us,” Quiggin said.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.