From pv magazine Global

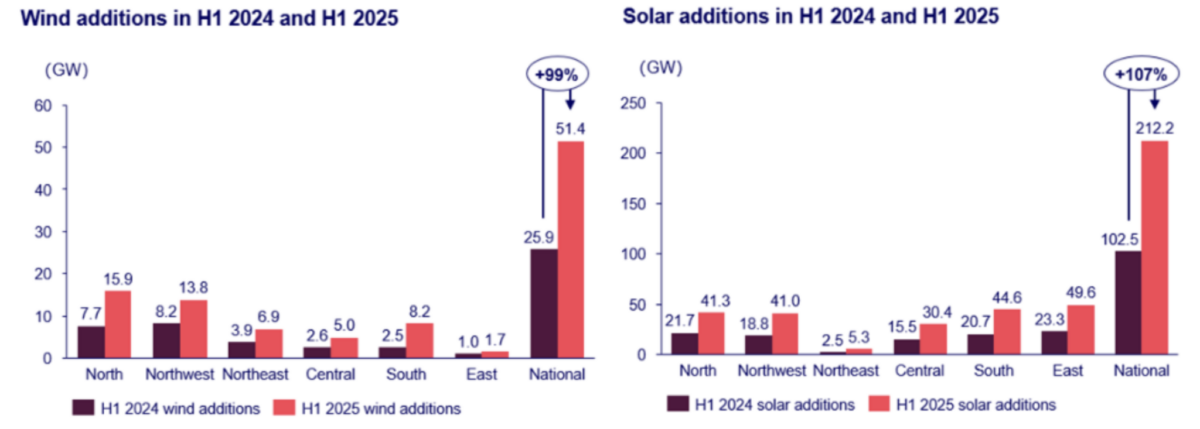

China added 212.2 GW of solar during the first six months of 2025, according to figures from Wood Mackenzie. The consultancy said solar additions more than doubled compared to the first half of 2024, as developers rushed to meet the deadline before the introduction of a new pricing policy.

Sharon Feng, senior analyst of the China power market at Wood Mackenzie, commented that the previous auction-free mechanism appealed to investors as it provided long-term price certainty and favourable generation coverage.

Feng predicted that the average project internal rate of return (IRR) for utility-scale solar projects installed during the first half of 2025 could reach between 8% and 11% under this mechanism, thanks to declining technology costs and an 18-year execution period.

The new pricing mechanism, which replaced the feed-in-tariff system with a market-driven pricing model, features shorter execution periods averaging ten years.

Wood Mackenzie said the first auction results under this new framework indicate that pricing pressures are ahead. In the Shandong province of eastern China, the inaugural auction recorded solar prices falling 32% below average settlement prices.

Wood Mackenzie said utility-scale solar IRR could fall to 6.3% in Shandong under the new mechanism, down from the national average of 8% under auction-free pricing.

“The Shandong results provide an early indication of pricing dynamics under the new competitive framework,” Feng noted. “Investors will be exposed to price fluctuation risk and curtailment losses due to incomplete lifecycle coverage under the shorter execution periods.”

Wood Mackenzie is expecting that average solar curtailment rates will exceed 5% in 21 provinces of China during the next ten-year period. Feng explained that provinces with high curtailment rates and volatile power prices will face challenges attracting investment under the new mechanism structure.

“Developers need to carefully evaluate provincial grid conditions and long-term price projections when making investment decisions,” she said.

The analysts noted that wind power projects may begin to attract more investment than solar projects due to better economics and lower curtailment risks.

Wood Mackenzie is forecasting that utility-scale solar projects will trail onshore wind projects by 43% in terms of average 10-year capture prices, while distributed solar could be restricted in provinces with grid connection limitations.

Feng concluded that the success of China’s pricing mechanism evolution will depend on managing grid integration challenges and maintaining investor confidence.

“After the breakneck addition of 264 GW of wind and solar in the first six months [of 2025], the renewable development will switch to a more sustainable growth pattern, focusing on quality over quantity,” she predicted.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.