Wood Mackenzie has shared five predictions for the global hydrogen market in 2026.

The analysts’ “Hydrogen: 5 things to look for in 2026” report says that following the optimism of 2024 and sobering reality of 2025, 2026 will be a “year of reckoning for the hydrogen sector”, marked by a “fundamental reassessment of what drives project economies.”

“Projects advance where policy and offtake align, and stall where either remain uncertain,” explained Murray Douglas, Wood Mackenzie’s Vice President for Hydrogen and Derivatives Research. “2026 will separate viable hydrogen markets from those built on policy ambition alone.”

Among Wood Mackenzie’s predictions is for at least three large-scale hydrogen projects supplying European buyers and using renewable fuels of non-biological origin (RFNBO) to reach a final investment decision this year. These projects are expected to have a combined capacity over 50 ktpa.

The analysts explain that while Europe’s strict RFNBO rules have been widely criticized as incompatible with a timely ramp-up of green hydrogen supply, adding costs to producers around $1-$2/kg, the publication of the Low-Carbon Fuels Delegated Act in November 2025 provided clarity for non-RFNBO hydrogen producers.

“We expect this shift in sentiment to accelerate policy support for low-carbon hydrogen through expanded funding eligibility or new support schemes,” Douglas said. “This policy shift will enable faster project development, more offtake deals and an uptick in allocated funding.”

Wood Mackenzie is also predicting EU Member States will abandon a 2030 target for 42% of hydrogen to come from renewable sources, as outlined in the bloc’s Renewable Energy Directive III (RED III).

Douglas said the mandate is failing to gain traction, with only three member states setting quotas by the end of last year and the EU’s largest hydrogen consumer, Germany, confirming it will not impose binding industry mandates.

“The European Commission will face a choice: enforce compliance through infringement procedures or accept Member States’ retreat from industry targets,” Douglas said. “Precedent suggests the latter. Without binding mandates, green hydrogen developers targeting industrial use will need to reassess project economics.”

In the Middle East, Wood Mackenzie is anticipating at least three-large scale projects will be cancelled or significantly scaled back this year.

The report explains that as projects in the region are mostly export-orientated, they have felt large impacts from policy delays in Europe, such as the transposing of RED III, and Southeast Asia.

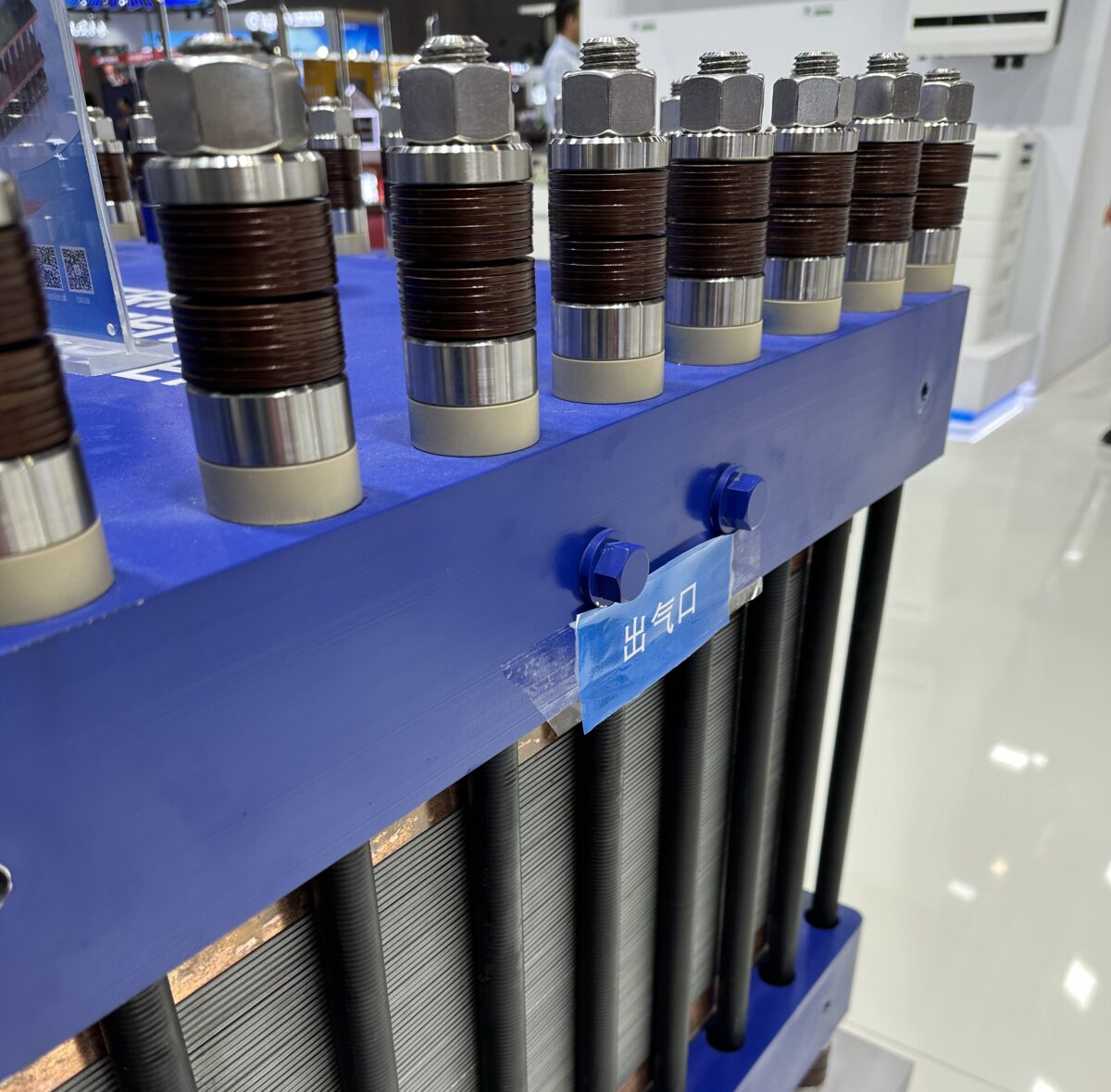

Elsewhere, industrial-scale ammonia crackers are expected to start reaching final investment decisions this year. Wood Mackenzie says at least three industrial-scale ammonia cracker projects, expected to service steel, refineries and high-temperature process heat applications, will reach the milestone in 2026.

The analysts predict two will be in northwest Europe and one in northeast Asia, with a cumulative investment of approximately $600 million.

Wood Mackenzie’s final prediction expects 439 ktpa of India’s auctioned ammonia capacity from its 725 kpta domestic ammonia supply auction will be commissioned. Winners of the auctions were revealed in late 2025 and with bids at USD 550 to USD 700 per tonne, were competitive with blue ammonia prices from the US and Middle East.

Wood Mackenzie also expects bids from ACME, Onix Renewable, Suryam International and SCC Infrastructure to materialise but says that the rest, accounting for 285 ktpa, face steeper odds.

“Oriana Power, Jakson Green, NTPC RE Limited, and SCC’s Madhya Bharat Agro Products deal cannot access brownfield economics, while greenfield development would force them to build 800 ktpa plants to service sub-100 ktpa contracts – an untenable risk without additional offtakers,” Douglas said. “Our call is that these deals will collapse.”

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.