University of Newcastle signs 100% renewable electricity deal

NSW’s University of Newcastle has signed a seven-year contract to cover 100% of its electricity needs across its Newcastle and Central Coast campuses with renewable energy, specifically a mix of solar, wind and hydro power.

CECF directed to shift focus to more reliable, 24/7 power

Under a new Investment Mandate, the Morrison government has instructed the Clean Energy Finance Corporation (CEFC) to support the development of a market for firming intermittent sources of renewable energy and to prioritise investments that support “more reliable, 24/7 power“.

ARENA grants $1 million to Ausgrid’s Power2U program

The Australian Renewable Energy Agency (ARENA) is providing $1 million to Ausgrid to boost its innovative grant program for rooftop solar and energy efficient lighting. The program aims to reduce participating customer’s bills, as well as avoid costly network upgrades, in parts of Sydney with low renewables uptake.

CEFC tips $100 million into ARIF for equity renewable investment

The Clean Energy Finance Corporation (CEFC) is upping its equity investment in large scale renewables by almost 40%. The CEFC announced today a $100 million investment in the Infrastructure Capital Group’s (ICG) Australian Renewables Income Fund (ARIF).

Northern Territory launches $5 million Rooftop Solar Schools program

As part of its Roadmap to Renewables Plan and transition to 50% renewable energy by 2030, the NT government is set to roll out rooftop solar on up to 25 schools across the state over the next three years.

Pumped hydro: Snowy Hydro 2.0 approved by board, NSW plans 24 projects totalling 7 GW

The New South Wales government has launched its ambitious pumped hydro roadmap designed to back the rising level of wind and solar in the energy mix. Meanwhile, the board of government-owned energy provider Snowy Hydro has given the green light to its landmark $4 billion pumped hydro expansion project, Snowy 2.0.

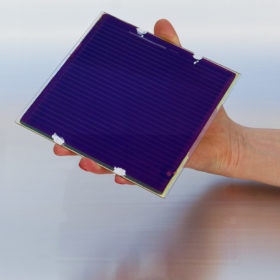

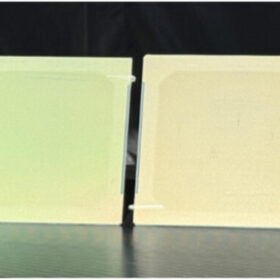

Greatcell Solar enters administration

Perovskite solar cell specialist Greatcell Solar has failed to secured refinancing for its activities and has been forced to appoint administrators. The company lays the blame at the federal government’s door, pointing to the R&D rebate changes and policy settings that are unsupportive of renewable energy investment as the reasons behind its downfall.

Eguana Technologies reports strong order book in SA

The Canadian battery manufacturer says its order book has crossed the $1.5 million mark in less than two weeks after joining the South Australian Home Battery Scheme.

South Australia’s Tesla big battery saves $40 million in grid stabilization costs

A new report analyzing the world’s largest lithium-ion battery’s performance in the first year of operation shows the Hornsdale Power Reserve has delivered on high expectations of its performance and market impact. It has helped stabilize the grid, avoid outages and reduce system costs, as well as triggered a surge in uptake of similar fast response systems across Australia.

Battery grant and loan scheme expanded by Queensland government as interest surges

After around 1200 applications were lodged for the original 1500 packages in as little as two weeks, the Queensland government has introduced an additional 1000 battery grant packages to help households and small businesses cut their energy bills with the help of solar and storage.