Further details of the National Energy Guarantee (NEG) were released today by the Energy Security Board (EBS). It used the opportunity to persuade state governments to sign up to the Turnbull Government’s energy policy.

Against the backdrop of growing anticipation ahead of the COAG Energy Council’s meeting on August 10, when the state governments will be required to vote on the NEG, the ESB sought to warn against any delays in putting the new policy into effect.

“Any delay, or worse a failure to reach agreement, will simply prolong the current investment uncertainty and deny customers more affordable energy. The average household bill is expected to be $550 lower each year through the 2020s than it is now, and $150 of those savings are because of the Guarantee,“ said the Chair of the ESB, Kerry Schott.

For the NEG to go ahead, it needs to get a green light from all state and territory energy ministers. Victoria, Queensland and the Australian Capital Territory have showed considerable reluctance about the proposed policy, voicing concerns it would undermine their local renewable energy agendas.

However, the additional details included in the Final Detailed Design are hardly convincing.

Two scenarios: “No policy” and “Guarantee”

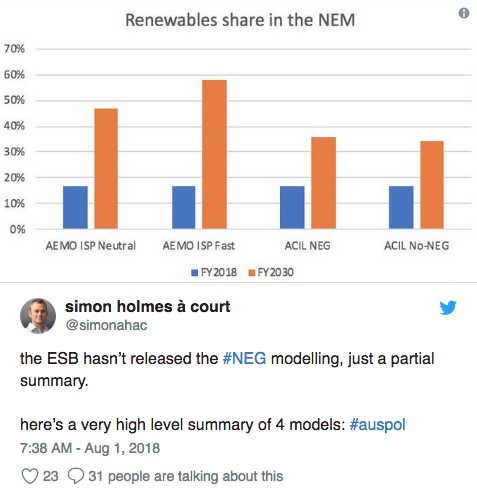

The ESB document shows the NEG scheme will not make a considerable difference in terms of the renewable energy share in the national electricity market, as it guarantees an increase from 17% in 2017/18 to 36% by 2029/30, which is only 2% up from the no policy scenario.

This two percent should come from a further commitment under the NEG of only 1,000 MW of new renewable generation by 2030.

Both scenarios suggest that coal powered generation is expected to account for over 60% of all generation in 2029-30.

In terms of emissions, the ‘no-policy’ modeling suggests that annual emissions in the NEM will decrease from around 151 MtCO2-e in 2017-18 to around 133 MtCO2-e by 2029-30, whereas under the NEG annual emissions are projected to 130 MtCO2-e by 2029-30 – the difference which is expected to guarantee the achievement of the 26% emissions reduction target by 2030 on the 2015 levels.

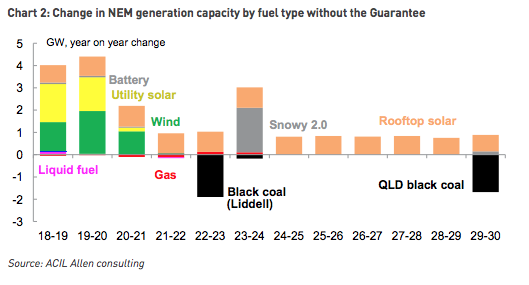

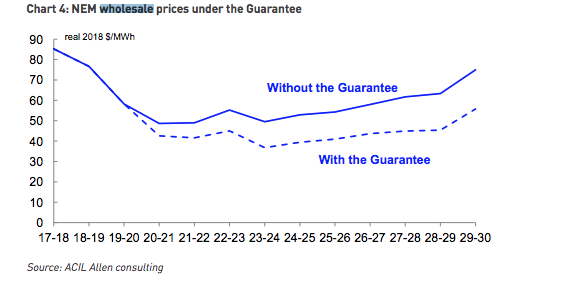

The ‘no-policy’ modeling projects that wholesale prices in the NEM will decrease by 31% from the current $85/MWh to around $50/MWh by 2020-21, noting that this is primarily due to an expected increase in NEM capacity of around 7,800 MW over 2018-19 to 2020-21, owing to the addition or completion of committed utility scale wind, solar and battery storage projects and stage 1 of the VRET and QRET schemes.

Under the Guarantee scenario, increased contracting is expected to result in 20% lower electricity prices beyond 2020 compared to no policy scenario. The contracting increases under the NEG are projected to drive a significant decrease in spot prices, resulting in a drop in contract prices and wholesale electricity prices.

The document also says that the Federal Government may introduce higher emissions reduction targets at a later stage of operation under the NEG, coupled with strong disincentives against non-compliance, including a penalty of up to $100 million.

The target flexibility has already been mentioned by Energy Minister Josh Frydenberg, who tried to lure in the state governments into a NEG consensus, offering the possibility to review the emissions reductions target after five years, instead of being fixed for a 10 year-period.

“Once implemented, the Guarantee will produce a clear investment signal so the cleanest, cheapest and most reliable generation can get built in the right place at the right time,” said ESB’s Schott, noting that fifteen years of climate policy uncertainty had impeded investment, affected the security and reliability of the power system, and increased prices for households and businesses.

This is, however, in sharp contrast to the survey findings released by the Clean Energy Council a day earlier, showing that CEOs and senior executives across the renewable energy and storage industry are very confident about short-term investments, but wary of making longer term investment decisions against the background of policy uncertainty under the proposed NEG.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.