Australia and Germany tip $100 million into green hydrogen projects

An Australian cleantech company that claims its technology could enable hydrogen production of below $1.50 per kilogram by the middle of the decade is one of four green fuel projects to share in more than $100 million (USD 78 million) funding awarded as part of a collaboration between the Australian and German governments.

Solaray Energy acquired as part of German startup’s $100 million Australian growth strategy

A German startup led by European heavyweights and backed by major institutional capital continues its aggressive acquisitions strategy in Australia, taking a majority stake in Solaray Energy – its second major APAC buy following Natural Solar. Company 1Komma5 is seeking to consolidate Australia’s residential solar sector to become the largest provider of home renewable technologies, devoting $100 million (USD 70m) to “strategically” acquire a number of businesses here within the year.

Administrators move swiftly to settle future of Sun Cable

Two of Australia’s richest people are expected to be rivals in the bidding process for Sun Cable, the developer of what would be the world’s biggest intercontinental solar and energy storage project, with administrators indicating the sale process could be completed within three months.

JA Solar to build new vertically integrated solar factory in China

JA Solar says it will build a new manufacturing facility in Inner Mongolia, China. The plant will produce everything from polysilicon to solar panels.

Nextracker to go public

Singapore-based electronics giant Flex announced that its subsidiary, Nextracker, has publicly filed a registration statement for an initial public offering.

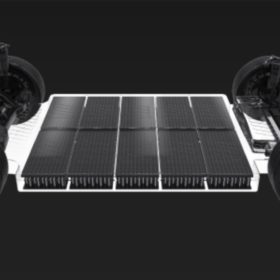

Brisbane battery casing startup with ‘tremendous potential’ lands support from ReNu

Queensland-based ReNu Energy will acquire up to a 20% stake in fellow Brisbane company, startup Vaulta, which has developed battery casings designed for reuse and recycling. Vaulta will use the eventual $1 million (USD 700,000) investment from ReNu to scale its manufacturing capability and expand domestic and offshore sales.

Origin grants Brookfield buyout consortium more due diligence time as concerns grow

“Gentailer” Origin Energy has granted the consortium behind its $18.4 billion (USD 12.8b) takeover bid, led by Brookfield Asset Management and US private equity firm EIG Partners, an extra week of exclusive due diligence. Neither reason nor timeline were offered by Origin’s brief ASX statement, fuelling concerns about the highly-priced deal.

Albo tips Queensland hydrogen hub to help unlock $50 billion

The Australian government has unveiled a $70 million (USD 49 million) investment to aid the development of a green hydrogen hub in the north Queensland city of Townsville as it looks unlock the benefits of an industry which it says could inject an additional $50 billion (USD 35 billion) into the economy by 2050.

Governments upbeat about Sun Cable project despite financing feud

The Northern Territory government remains upbeat about the future of the $30 billion-plus (USD 20.7 billion) Australia-Asia PowerLink project despite the company behind what would be the world’s biggest solar and energy storage project having abruptly entered voluntary administration.

ACEN Australia plans to accelerate rollout of renewables portfolio

Philippines-based energy company ACEN Corporation plans to capitalise on Australia’s “unparalleled renewables potential” after securing a $277 million (USD 191 million) loan facility which it says will be accelerate the delivery of an 8 GW clean energy portfolio that includes solar, wind, battery storage and pumped hydro.