Australia’s Origin Energy has again extended the exclusive due diligence period for its takeover consortium comprising of Canada’s Brookfield Asset Management and United States-based gas supplier MidOcean Energy, managed by US investment giant EIG Partners.

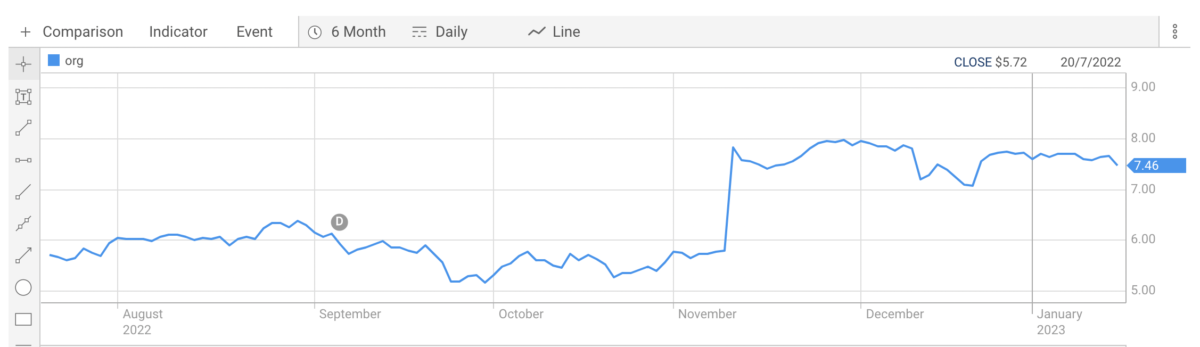

Image: ASX

In November, the consortium announced its $9-a-share cash offer, which continues to represent a significant premium on Origin’s current share prices. At the time, Origin’s board said it would “unanimously recommend” shareholders vote in favour of the $18.4 billion takeover bid, which would rank among the biggest private-equity-backed buyouts of an Australian company.

However, concerns around the deal are growing, given this is the second time the consortium’s exclusive due diligence period has been extended. It was first extended in December, and that period will now push out to January 24.

Origin’s brief statement to the Australian Stock Exchange (ASX) offered no reason for why the extension was requested, nor any timeline for when Brookfield and EIG are expected to finalise.

As part of the takeover, the consortium said it planned to divide Origin’s business and invest another $20 billion by 2030 to support the gen-tailer’s transition to clean energy.

In the split, Brookfield would take Origin’s energy generation and retailing businesses while MidOcean would acquire Origin’s gas business, including its 27.5% a stake in Australia Pacific LNG.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.