Trina Solar unveils TOPCon solar panel series for rooftop PV

Trina Solar says its new TOPCon solar panel combines a double-glass design with n-type technology. Its efficiency ranges from 20.8% to 22.3% and the power output is between 415 W and 445 W.

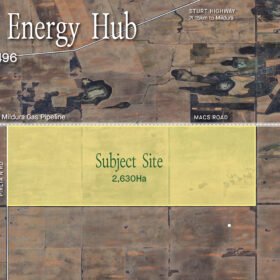

Vanadium flow batteries to be deployed at WA mine ahead of manufacturing push

Western Australia-based AVESS is set to deploy demonstration batteries at a WA mine site in the second half of the year. The deployment is about proving the company’s technology, as it plans to move towards manufacturing the flow batteries in Australia from 2024.

Renewable energy underwriter GCube launches in Australia

Since opening in Sydney in 2022, renewable energy underwriter GCube Insurance has officially launched in Australia and is set to offer a broad range of new products to meet the needs of Australian developers and projects.

Origin takeover revived after Brookfield revise offer

The Brookfield-led North American consortium courting Origin Energy has finally come back with a revised bid for the company, valued at roughly $18.2 billion (USD 12.5 billion). The offer is only fractionally lower than the initial bid, which came as a relief for the market, and has been endorsed by Origin’s board.

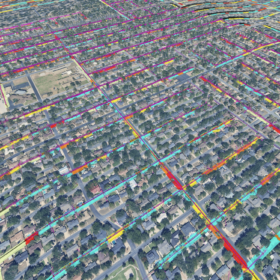

Big batteries and high renewable penetration improve reliability outlook, AEMO updates

The Australian Energy Market Operator (AEMO) has renewed calls for Australia to expedite generation, transmission and storage projects to ensure reliability of the country’s electricity supply. Interestingly, AEMO’s update notes South Australia, the state with the biggest share of variable renewable generation, faces the smallest reliability gap, meanwhile big batteries are successfully plugging short-term concerns.

Sydney’s Magnis Energy signs deal with Tesla, quietly abandons Townsville gigafactory plan

Australian graphite miner turn integrated lithium battery company, Magnis Energy Technologies, has signed a significant offtake deal with electric vehicle giant Tesla. The agreement comes the same month the company quietly dropped its plan to build a 18 GWh lithium-ion battery factory in Townsville, northern Queensland.

Australia’s top 10 solar panel and inverter manufacturers revealed

Analysis from Sunwiz has revealed Australia’s breakdown of top rooftop solar and inverter manufacturers for 2022.

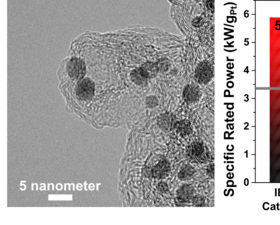

Novel design for high-power PEM fuel cells

UNSW Sydney researchers have developed an algorithm to enhance images of PEM fuel cells, meanwhile South Korean researchers have revealed a scalable production method for platinum-based fuel cell catalysts. Germany has moved forward on its hydrogen strategy by signing agreements with Australia, Belgium, and the Netherlands.

Global trends for solar in 2023

Component cost declines, local manufacturing and distributed energy are the three big trends for the renewable energy sector this year, according to S&P Global.

Tongwei unveils 21.7%-efficient shingled solar panels for residential PV

Tongwei is offering six versions of its monofacial monocrystalline panels, with power outputs ranging from 400 W to 430 W and power conversion efficiencies between 20.1% and 21.7%.