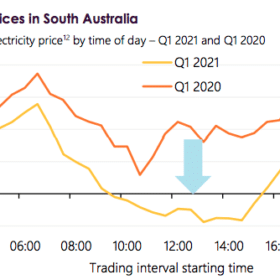

South Australia sets record as rooftop solar sees electricity prices consistently plunge below zero

Rooftop solar has caused South Australia’s average daytime prices fell below zero consistently for the first time in the NEM’s history, the Australian Energy Market Operator said in its quarterly report released today.

Melbourne company signs deals to position itself as Australia’s leading carbon-free green hydrogen transporter

Melbourne-company Trojan H2 Logistics has today announced two separate industry deals to deliver both fuel-cell hydrogen transport trucks as well as hydrogen refuelling stations along Australia’s East Coast.

Victorian government launches VPP pilot program

Victoria’s Andrews Government has launched a battery aggregation pilot program which seeks to build an “approved aggregation provider list” alongside the Solar Homes battery rebate. The Victorian Government sees the future of virtual power plants and microgrids and this is an opportunity for both consumers and providers to benefit.

Europe’s largest PV plant takes shape

The project, called the Trillo photovoltaic complex, is located in Spain and will have an installed capacity of 626 MW. Construction is scheduled to begin on May 7.

New ACT big battery to pull off hydrogen, solar and VPP storage trifecta!

Elvin Group Renewables has constructed a 5 MWh Tesla Megapack to help ensure stability of energy supply in Canberra’s new northern suburbs and the wider grid. Its plans to proliferate the model are audacious.

Add electric vehicles, not bulk transmission, for a low-cost, clean grid: UC Berkeley study

A 90% clean grid with a transition to EVs would achieve lower electricity costs than one without, the study shows. Transmission investments would mainly be spur lines to new renewable generation.

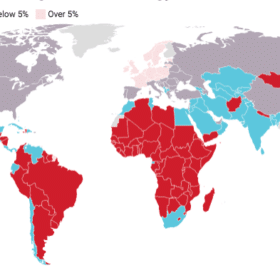

Australia ‘in a league of its own’ with renewables potential, positioned to be ‘battery of the world,’ new report finds

Solar and wind could meet the global energy demand 100 times over, a new report from the Carbon Tracker Initiative has found. Australia, in particular, is uniquely positioned to capitalise on the transition as one of the few developed countries with vast renewable potential and a low population.

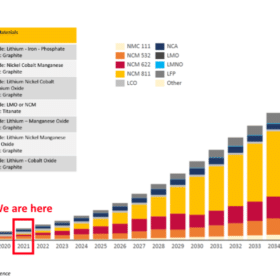

Renascor finalises $15m capital raise, on track to be world’s first battery-grade graphite producer outside of China

South Australian company Renascor Resources this morning confirmed it had raised $15 million from institutional investors in Australia and abroad, enough to fund its Siviour Battery Anode Material Project up to the construction phase. The project is on track to become the world’s first integrated mine and purified spherical graphite operation outside of China.

Big battery market gets a leg up as rule maker proposes rewards for fast grid responses

The Australian Energy Market Commission, the country’s rule maker for electricity and gas markets, has this morning released proposals to reward fast frequency services in the National Electricity Market for the first time.

Australian aerospace firm to launch into space race with green hydrogen

Queensland-based Hypersonix Launch Systems has announced a partnership with BOC and its Bulwer Island Renewable Hydrogen Production and Refuelling pilot project. The deal will see Hypersonix use green hydrogen produced by solar electrolysis as rocket fuel to launch re-useable satellites into lower earth orbit.