Australia renewables supply reaches 21.2%, rooftops provide record solar contribution

While renewables continue to do their bit on decarbonizing the energy sector, national emissions, especially in the transport sector, continue to rise amid a lack of any federal or state government limits, The Australia Institute warns. Total renewable supply, including rooftop solar, is at 21.2% of generation from all sources across the NEM, eating into the share once firmly held by coal and gas.

JinkoSolar shipped 11.4 GW of modules in 2018

Chinese module manufacturing giant JinkoSolar today published its financial results for the full year 2018. While the company achieved an impressive 16% growth in shipments over the previous year, its total revenue took a 5.4% hit compared to 2017, thanks to falling module prices throughout the year.

Victoria to require installers to sign CEC’s Code of Conduct for Solar Homes

The Victorian government is giving smaller solar installers eight months to sign up to the Clean Energy Council’s Solar Retailer Code of Conduct if they want to qualify for the Solar Homes program. For larger retailers, the deadline to become Approved Solar Retailers is July.

Lithium Australia launches German cathode powder study

The study will evaluate the direct production of cathode powders from mica feed material sourced from mining operations, eliminating the need for cobalt and nickel.

Hydrogen home storage, refueling hub get financial shot into the arm

Toyota Australia will transform its former manufacturing site in West Melbourne into a renewable energy hub to produce green hydrogen with the help of funding from the Australian Renewable Energy Agency (ARENA). In other hydrogen-related news, researchers at UNSW Sydney with partners H2Store have received a $3.5 million investment from Providence Asset Group to develop a hydrogen residential storage.

Proof of C&I energy savings is in the PPA

New-generation energy retailer Flow Power will today release figures that show its high-use energy customers have collectively saved $14 million with power purchase agreements since the start of 2018. Such powerful testimony signals a new maturity in Australia’s renewable-energy PPA market.

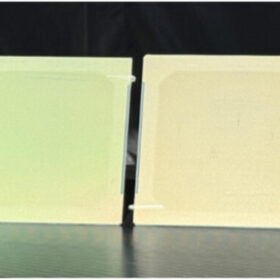

Rise of bifacial lifts profits for the world’s tracker companies

Things are hotting up in the tracker world as the desire to squeeze down the price per Watt of solar power intensifies. And the rise of the trackers is attracting some well-known businesses to buy their way into the field.

Carnegie Clean Energy gets funding lifeline, solar microgrid subsidiary to be sold or wound down

Following months of uncertainty around its financial position, Carnegie Clean Energy and its fully owned subsidiaries went into voluntary administration last week. In its latest statement to ASX, the renewable energy developer says it has struck a deal with one of its directors to provide funding support while administrators attempt to recapitalize its wave power business.

NSW Coalition commits to support apartments going solar, module and battery recycling

If re-elected on Saturday, the NSW Coalition will change strata laws to reduce the minimum votes needed to install solar panels, battery storage and electric vehicle charging points in strata buildings. The government has also pledged to give $20 million more funding to the Emerging Energy Program and $10 million in funding for a solar panel and battery recycling program.

Half of Australia’s solar and wind farms to trial providing their own short-term generation forecasts

Around $9.4 million has been allocated for 11 projects to trial short-term forecasting for large wind and solar farms under a funding initiative by the Australian Renewable Energy Agency (ARENA) in partnership with the Australian Energy Market Operator (AEMO). The trial aims to improve the accuracy of market outcomes.