New WoodMac report forecasts renewables cheaper than coal by 2030 across Asia-Pacific

A new Wood Mackenzie report has forecasted a massive swing in the levelised cost of electricity across the Asia-Pacific over the course o the next decade. Before 2030, renewables will be cheaper than new coal and gas almost everywhere, and significantly cheaper in Australia.

Module manufacturer tips China ruling to have major bearing on Australian market

The Australian arm of South Korean solar technology giant Hanwha Q-Cells has applauded the decision by the Chinese Patent Office to uphold the validity of the company’s intellectual property rights on key technology.

Spanish tracker giant STI Norland expands to Australia with a keenness to compete

Spanish tracker giant STI Norland has expanded to Australia with a new subsidiary office in Melbourne. The company is arriving on our shores with a keenness to compete with tracker suppliers who already have their foot in the door. With no solar farm too big or too small, STI Norland Australia CEO Alan Atchison sat down with pv magazine Australia to talk about how the company plans to make tracks Down Under.

Dual circulation and China’s push for energy security

‘Dual circulation’ has one thing in common with many other major Chinese policy initiatives in that it’s not immediately apparent from its name as to what it means. First raised during a Politburo meeting in May, President Xi introduced this new strategy at the annual ‘Two Sessions’ later that month. It is clear that China’s leadership intends dual circulation to become an important part not only of China’s policy agenda for the next 12 months but to also feature prominently in the upcoming 14th five-year plan (2021-2025).

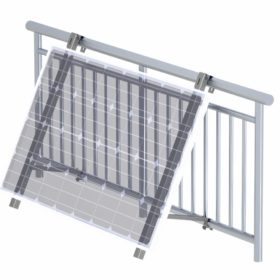

Mounting structure for balcony solar modules

South Korean manufacturer Clenergy has unveiled a new mounting solution for PV panels installed in balconies. The structure is adjustable to different types of commonly-sized balconies with metal railings.

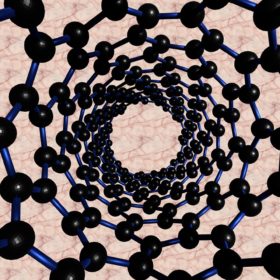

Carbon nanotubes in search of a solar niche

A group of German scientists has analyzed the possible trajectory of carbon nanotubes (CNTs) in photovoltaic research and industry and has suggested a roadmap to bring this technology closer to mass production. Despite a large number of challenges, the academics predicted a brilliant future for CNTs in PV applications, explaining that the barriers to their adoption are constantly being reduced.

Japanese owner of WA’s Bluewaters coal plant reports worst ever loss in face of energy transition

The Sumitomo Corporation has reported a stunning ¥26bn (US$251m) loss on its Western Australian Bluewaters coal fired power investment. The loss assures the company’s worst ever annual performance and comes as a result of international and financial pressure against coal funding.

Weekend read: Energy supply in an archipelagic nation

Mobile electricity storage systems (MESS) – batteries that are charged and then transported – could offer one of the best scenarios for electrification across the vast Indonesian archipelago, which spans more than 17,000 islands. A team at the University of Indonesia is working with multiple government agencies to bring the idea to scale and provide affordable electricity to rural Indonesians.

NSW has joined China, South Korea and Japan as climate leaders. Now it’s time for the rest of Australia to follow

It’s been a busy couple of months in global energy and climate policy. Australia’s largest trading partners – China, South Korea and Japan – have all announced they will reach net-zero emissions by about mid-century. In the United States, the incoming Biden administration has committed to decarbonising its electricity system by 2035.

JA Solar chairman detained by anti-corruption authorities in China

It remains unclear why Chairman Jin Baofang was detained, but the company said its operations will not be affected. The Paper, a Chinese state-owned media outlet, reported that Jin’s detention might be connected to the fall of Liu Baohua, the formal deputy director of the National Energy Administration, which has also been under investigation by the anti-corruption authorities since mid-October.