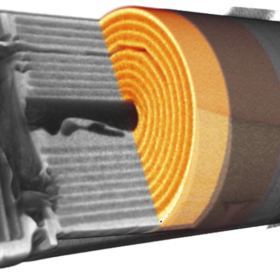

Batteries with Chinese characteristics

At present, China accounts for almost 75% of global lithium-ion battery manufacturing capacity and this share is set to increase through the short term with its build-out of new facilities. And although the US and Europe are enacting policies to encourage domestic battery production, there has been a distinct lack of support for investment in the supply and refining of the raw materials to achieve this. In China, the opposite holds true.

Baotou City set for 10 GW of renewables

The tide of clean energy facilities planned under the city’s next five-year strategy was revealed by Hong Kong-listed polysilicon maker Xinte Energy, which has signed a framework agreement to construct 200,000 tons of manufacturing capacity near Inner Mongolia’s largest city.

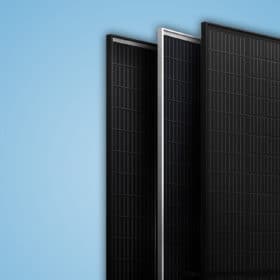

Assessing the impact of large-wafer modules

Energy consultancy DNV GL has published new results comparing the performance of modules based on 166mm, 182mm and 210mm silicon cells. The assessment compares Trina Solar’s Vertex modules, which use the largest cell dimension, with unnamed competitors utilising the other two sizes. Results from system simulations show a clear advantage for the two larger sizes, with 210mm edging ahead in terms of levelised cost of electricity.

WoodMac predicts 30% drop in Asia Pacific front-of-the-meter battery costs by 2025

A new report from Wood Mackenzie suggests costs of front-of-the-meter battery storage systems in the Asia Pacific region could decline by 30% by 2025. The declining costs are already having a palpable impact as 2021 has opened with a slew of large-scale battery project announcements.

Trina Solar scoops recognition for environmental standards

Technical innovation and solar module production at scale bring with them the opportunity to integrate environmental responsibility. One major manufacturer is reaping returns on its investment.

Weekend read: Big, and then bigger

Throughout 2020, a fast-moving story played out in PV module technology, with the introduction of larger wafers and subsequently larger module formats seeing the industry break into two camps, backing either 182 mm or 210 mm wafers. It remains to be seen whether one or the other will become a new industry standard, and both sizes will likely be plentiful on the market for the next few years at least. pv magazine takes a look at how we got to this point.

Woodmac predicts APAC renewables growth but coal resilience in 2021

Wood Mackenzie’s Asia Pacific predictions for the energy market in 2021 are in. The firms analysts see wind and solar continuing to grow throughout the region driven by China, but notes that gas and coal aren’t going anywhere fast.

New method to build microgrids based on solar, hydrogen

The use of polymer electrolyte membrane fuel cells as backup power generation in solar microgrids could drive down costs and improve efficiency, according to an international group of researchers. They have proposed a new energy management system that could be ideal for hybrid solar-hydrogen microgrids in remote locations.

Consultant plays down Chinese solar fever

The nation is set to have added 40 GW of solar in 2020 and that figure will rise again this year, to 45-50 GW, according to one of the year’s first industry predictions.

Solar stocks rise as President Xi pledges 1.2 TW of renewables capacity in 2030

The Chinese leader has revealed some details of his nation’s commitment to go carbon neutral by 2060. That solar and wind power promise could even prove to be a conservative estimate, according to the nation’s solar industry.