Queensland solar farms dominate utility scale solar in May

New South Wales has topped the charts for large-scale renewable energy generation in May but Queensland has dominated the solar stakes with the top six utility PV assets for the month all located in the sunshine state.

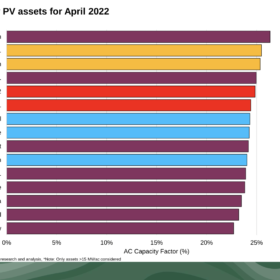

April’s top performing solar farms

The best performing large-scale PV asset in Australia this month was Genex Power’s Kidston solar farm in Queensland, according to Rystad analyst Dave Dixon, who noted total generation from solar and wind assets in Australia grew 23% compared to April 2021.

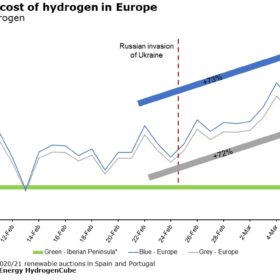

Invasion of Ukraine an inadvertent boost for green hydrogen

Rystad Energy has joined BloombergNEF with a significant forecast for grey and blue hydrogen off the back of Russia’s invasion of Ukraine. According to the analysts, the impact of the war has sent prices of fossil fuel-tied forms of hydrogen production surging, leaving the gradual but consistent downward price trend of green hydrogen now looking remarkably competitive.

Australia’s oldest solar farm shines bright as new asset nears completion

Just hours after Australia’s oldest solar farm was announced as the best performing utility scale solar asset in the country, construction firm Tranex Solar revealed the energisation of one of the nation’s newest clean energy developments is “well underway”.

Australia’s battery capacity to double in 2022

After the deluge of announcements last year, 2022 will see the trickle of big batteries actually operating in Australia turn to a flood. According to Rystad Energy, the country’s battery capacity is set to double before the year is out.

Western Australian solar farm leads way in performance stakes

SUN Energy’s 100 MW Merredin Solar Farm in Western Australia has emerged as the country’s best performing utility PV project in 2021 with international consultancy firm Rystad Energy noting it delivered an average capacity factor of 29.6% for the calendar year.

Rystad: Residential solar soars past C&I in 2021

Renewable energy and battery storage has racked up another banner year in 2021, according to end-of-year analysis from Rystad Energy. While there was growth across segments, residential solar has seen the most impressive gains, surpassing the commercial and industrial (C&I) segment for the year.

Module price hike impacting middle-sized PV projects in South Korea

The continuous rise in solar panel prices may affect PV projects of up to 1 MW tendered by the Korea Energy Agency and the domestic solar module industry may not be able to provide the necessary production capacity to respond to the recent supply bottleneck.

Module and shipping cost inflation could cost the world 50 GW of solar next year

The input costs of the two biggest contributors to solar plant development expense have gone through the roof since the world began to come out of Covid-19 lockdowns, to leave project developers with some difficult choices.

Rystad says cost looms as hurdle for green hydrogen industry

Australia’s determination to establish itself as a major player in the green hydrogen market has seen a flood of government funding and announced projects in recent months but new analysis from international consultancy firm Rystad Energy has highlighted a potential hurdle for the industry.