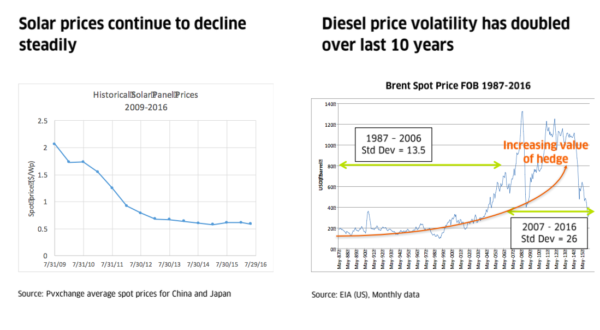

While economic when compared to trucked diesel or gas in remote locations, renewable adoption for remote mining operations has been slow to take off. This is changing rapidly, enabled by falling solar and storage costs and new business models – the latter a better fit for mining operations that may operate under short economic horizons.

The historic Granny Smith mine, located around 950 km east of Perth, is one of the first globally to adopt solar and storage under an innovative business model being rolled out by Aggreko and its recent acquisition Younicos.

The mine had contracted energy provider Aggreko to provide a 21 MW microgrid and generators in 2016. Initially, existing diesel generators were replaced by gas generation. Now solar and storage will be installed, and provided under a ‘microgrid-as-a-service’ (MaaS) model.

Aggreko acquired storage developer Younicos last year, in doing so gaining particular expertise in storage and microgrid operational soft and hardware. It is now rolling out its MaaS business model globally, given the increasing competitiveness of solar and battery storage technology.

“We recently announced the availability of microgrids-as-a-service for customers who want to leverage the benefits of hybrid energy solutions while minimising capital outlay,” said Karim Wazni, Managing Director of Younicos in a statement. “This system will be the first time Aggreko incorporates battery storage into a hybrid power system, and – significantly – it’s a rental, which underscores the value and appeal of this new model.”

“We recently announced the availability of microgrids-as-a-service for customers who want to leverage the benefits of hybrid energy solutions while minimising capital outlay,” said Karim Wazni, Managing Director of Younicos in a statement. “This system will be the first time Aggreko incorporates battery storage into a hybrid power system, and – significantly – it’s a rental, which underscores the value and appeal of this new model.”

Miner Gold Fields operates Granny Smith. The solar and storage system will supply the mine’s underground operations, and provide 16.2 MW of generation capacity for an onsite processing plant and the mine camp. The mine had seen a recent increase in energy demand.

“These proposed new measures are intended to reduce our carbon footprint by utilising the latest hybrid energy technologies,” said Stuart Mathews, executive VP Australasia at Gold Fields. The miner has committed to sourcing 20% of its total life-of-mine power needs at new projects with renewables.

Life-of-mine has been a stumbling block for renewable deployment at mining operations in the past. Aggreko hopes to remove this barrier by allowing customers to pay for power provision rather than the upfront capex investment in a solar and storage system.

The minimum MaaS contract currently being offered by Aggreko is five years. The company claims that it can commit to power quality and reliability through coupling thermal generation with PV and batteries. Pay-as-you-go, with O&M provision included, removes the potentially high capital costs of a solar and storage asset.

“Aggreko’s focus is on fuel efficiency and reliability in line with the power demand over the life of the mine,” said George Whyte, Aggreko’s MD AusPac in a statement. “Our mining clients have faced a challenging market place and power generation is a significant proportion of operating costs.”

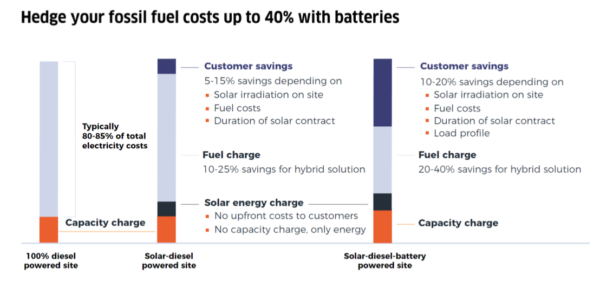

By adding storage, rather than a straight solar and diesel solution, Aggreko says that savings can be increased from between 5-15% dependent on irradiation at the site, to 10-20%. Fuel charges increase correspondingly from 10-15% to 20-40%.

The 2 MW/1MWh battery storage system installed at Granny Smith will provide spinning reserve, ramping, frequency regulation, and voltage control – allowing the mine to rely more heavily on its onsite PV.

Aggreko has previously coupled a 22 MW diesel plant with a 7.5 MW solar plant in Eritrea.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.