Earlier this week, GTM Research – soon to be known as Wood Mackenzie Power and Renewables – painted a less-the-rosy picture of the global PV market for the remainder of 2018. With Chinese demand sagging from a forecast 48.2 to 28.8 GW as a result of the 31/5 policy changes, GTM expects global PV demand to come in at 85.2 GW in 2018.

By contrast, 2018 is shaping up nicely Down Under, despite PV power plant project soft costs remaining high.

“Both Q3 and Q4 are expected to be strong quarters for utility-scale solar [in Australia],” GTM Research solar analyst Rishab Shrestha told pv magazine Australia. “We expect several large utility-scale projects to come online in Q4, particularly in Queensland, so Q4 is expected to have the largest capacity installation.”

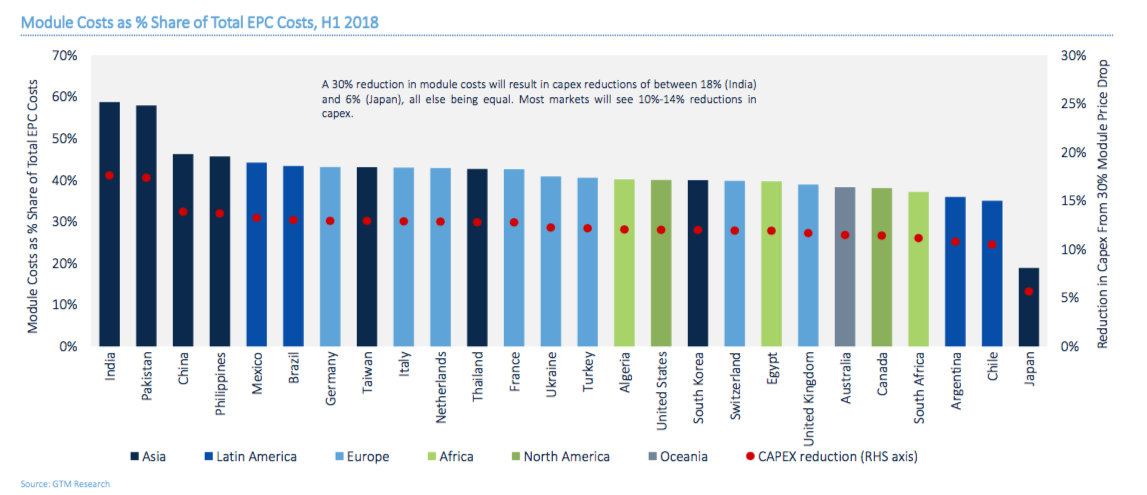

Falling module prices are noted in GTM’s Global Demand Monitor as having an impact in a number of markets. In Australia, it will see modules, as a percentage of costs, fall from 38-33% for EPCs, and 34-28% for developers – in H2 2018.

The decline is not as dramatic in Australia as in some other markets, due to the relative immaturity of large scale solar in the country, and grid constraints – both of which result in higher non-module costs.

“The development timeline for solar projects are also longer when compared to other markets as project sizes are large which require lengthy due diligence,” noted GTM’s Shrestha. “Given that sufficient projects already have been committed for meeting the 2020 Renewable Energy Target, remaining large projects have to look around for off takers – multiple ones for large projects. The project locations are often far from load centres and do not have the best grid infrastructure. This pushes up the cost of labour and grid connection costs.”

On the plus side, there is potential for some of these costs to be reduced, by developers, policy makers, and planners.

“Given that the projects costs are higher to start with, there’s room for learning,” said Shrestha. “Module costs are also expected to decline 32% through 2023, while BOS by 17% for Australia – so, both of these factors will play a meaningful role in Capex reduction.”

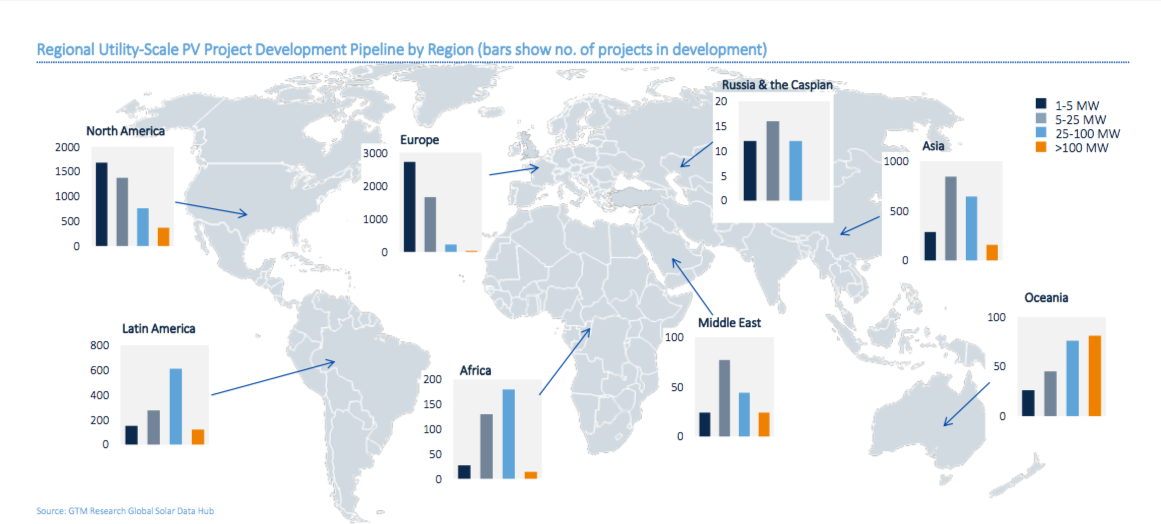

Interestingly, GTM finds that Australia is likely to be top of the list in terms of the proportion of “ultra-large” PV projects through 2022 – bigger than 100 MW. This is due to availability of large plots of land.

“Australia is one of the few high investment grade markets that offers large ticket size investment that has unbundled power markets,” noted Shrestha. “This provides significant opportunities for large investors to compete for projects pushing the cost down. But the uncertain long term policy is making market for corporate PPAs and merchant projects more attractive. These are by nature more riskier and costlier projects but also expected to see cost decline as the industry matures.”

Quantifying the expected project cost declines, GTM expects all-in utility scale solar costs to reach US$83/MWp by 2020 in Australia, falling further to US$77/MWp in 2022 – with soft costs accounting for between 35-40% of the total. Turning to LCOE, in Q1 2022, GTM expects it to reach US$59/MWh in Australia – although this could be as much at 10% lower as a result of falling module costs.

“Financing costs are generally higher than other mature markets and has room for reduction, added Shrestha. “But these costs depend on the offtaker credit ratings and the portion of power that is sold to the wholesale market.”

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.