As the Canberra-heated debate around energy policy continues, with the new Federal Energy Minister Angus Taylor signaling further investment in existing coal and gas, evidence is mounting that emissions reductions and lower energy bills go hand in hand. This flies in the face of repeated claims by conservative MPs that renewables are behind electricity price increases experienced in recent years.

In its latest renewable energy index, Green Energy Markets (GEM) confirms the findings from the Energy Security Board that wholesale electricity prices are on a downward trajectory thanks to the addition of 7,200 MW large-scale supply from renewable energy.

According to the ACIL Allen modelling work for the Energy Security Board, wholesale power prices are expected to keep falling, plummeting from about $85/MWh over 2018 to about $49/MWh by 2021 without any new policy.

Against the backdrop of the federal energy political turmoil, which has claimed the scalp of former prime minister Malcolm Turnbull, the new analysis seeks to draw attention to the effect increasing the amount of renewable energy in Australia’s power mix has had on the power prices.

“What I think is extraordinary given recent political events is that we’ve actually turned the corner on wholesale electricity prices and they’re now headed downward and will continue to decline substantially over the next few years,” Edis told pv magazine Australia. “This doesn’t seem to have sunken in at all in our political debate.”

In his first speech as Energy Minister, Angus Taylor said exactly the same – “electricity prices have turned a corner“ – but attributed the progress to the government’s intervention in the gas market and the “limited merits review” of transmission and distribution networks.

According to Taylor, the arrival of more intermittent generation has only caused baseload coal generators to leave, resulting in subsequent price spikes.

But, figures tell a different story. With the National Electricity Market on track to get 33% renewable electricity by 2020, a decline in wholesale electricity prices would be impossible if renewables were the cause of rising power prices, and not an answer to the energy woes.

“This is not about coal versus renewables, this is a simple case of Economics 101. We took a large chunk of supply out of the market with the closure of Hazelwood and Northern and prices went up. Further exacerbating the problem is with their closure we also lost some significant competitors to the dominant incumbents. Now we are adding a substantial amount of extra supply (which happens to be renewables) and prices are going down,“ Edis says.

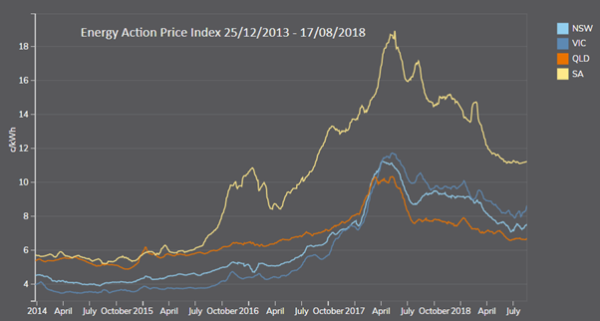

The chart tracks the energy component of electricity retail contract (2.5 year duration contracts) prices for business energy consumers (excludes network charges), Renewable Energy Index, July 2018.

The GEM analysis also recalls that power prices skyrocketed in the period of almost nonexistent investment in large-scale renewable energy projects as a result of the Abbott Government’s reviews of and then threats to the Renewable Energy Target, coupled with a decline in rooftop solar PV installation rate. The price trend started to reverse as renewables investments picked up the pace following the announcement of Hazelwood closure in 2016.

“Those investment commitments are now starting to be seen in extra supply on the grid now that the projects are reaching completion, which is then flowing through to reductions in the 2.5 year contract prices,“ Edis says, noting that there are plenty of other factors at play influencing power prices downward (for e.g. the Queensland government’s directive to Stanwell to lower prices in June 2017).

Moreover, he says the rise of new market players, such as SIMEC Zen and Flow Power, also contributes to this extra supply.

“I’d agree that we’re not completely out of the woods because we need to foster another round of investment to pre-emptively replace capacity from likely coal closures in mid to late 2020’s. Yet it seems we’ve dumped a Prime Minister based on completely false pretenses,“ Edis concludes.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.