On the back of the year that has seen the record rate of both rooftop solar installations and wind and solar farm construction commitments, short-term investment confidence in renewables is understandably high. But, looking further ahead, it is possible to see clouds on the horizon.

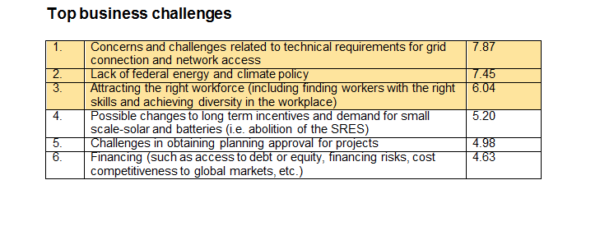

According to a new survey released by the Clean Energy Council (CEC), industry executives are mostly concerned about the technical requirements for grid connection and network access for new wind, solar and storage projects.

Namely, difficulties in finalizing grid connection amid strenuous demands that the Australian Energy Market Operator is placing on renewables developers have already delayed a number of large-scale projects across the country, undermining their economic viability.

This has even caused developers to walk away from projects, or bear additional expenses to install components, such as costly synchronous condensers, in order to improve grid strength. Delays in project commissioning, and related costs, were also one of the causes of the collapse of EPC contractor RCR Tomlinson, which entered administration last month.

“We absolutely acknowledge that grid operators and network businesses are dealing with more applications to connect to the grid than they have ever seen, but project developers need transparency and certainty about how long the process will take and what it is likely to cost,” Clean Energy Council Chief Executive Kane Thornton said.

The continued lack of federal energy and climate policies beyond 2020 is also causing a lot of headache for businesses across the industry, while attracting the qualified staff has been identified as the third biggest challenge.

“While more than $26 billion worth of projects were completed or underway in 2018, executives are very conscious that the future remains uncertain in the absence of federal policy,” Thornton said.

For the purpose of its December Clean Energy Outlook, the CEC quizzed approximately 60 executives, who manage companies with a combined net worth of around $17 billion, employing close to 3000 industry employees.

Ranked out of 10, the group’s level of confidence to make investments averaged 7.09 across the renewable energy and storage industry, slightly higher from 6.99 in July.

Back in July, the survey also showed strong confidence in short-term investments, but the two top issues affecting businesses were policy uncertainty and regulatory change against the backdrop of the national turmoil surrounding the National Energy Guarantee at the time.

According to the CEC, the most notable shift in attitude since the last survey is around expected employment.

A total of 83% of respondents expect their companies to employ more people in the next 12 months, an increase of 10% on the July figure. Meanwhile, only 1.7% of those surveyed anticipate a decrease in staff numbers.

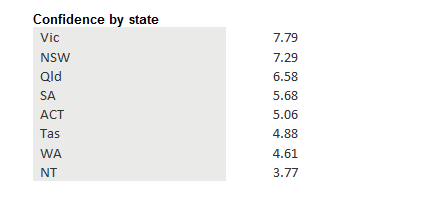

The survey also found that investment confidence widely differs across Australia.

Following the recent state election and a landslide victory of the Labor Party that had pledged robust support for renewable energy, Victoria has emerged at the top of the investment confidence chart with 7.8 out of 10, followed by New South Wales (7.3) and Queensland (7.0).

“State governments have done their bit to fill the national climate and energy policy void with their own initiatives to encourage clean energy, but the energy and business sectors are still seeking certainty,” Thorton said.

Northern Territory is at the bottom of the list, with investment confidence at 3.77 out of 10.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.