A new wave of bifacial module testing is complementing years of research in Europe and Japan. The primary goal of all the tests is to validate the predictive software performance model used to rate the bifacial panels, so that buyers can have confidence that a given factory flash test value for albedo, or ground-reflected light, will correspond to a given performance value in the field – depending on the variables under test at which site.

Thus, for the next year a number of fascinating data sets can be expected to emerge, comparing apples to oranges when the competing tests are complete and overlaid, hopefully in a Venn Diagram with some significance of commonality.

“We’re primarily interested in validating our software models in System Advisor Model (SAM) which recently released a bifacial performance model. We’re also interested in comparing with PVSyst, as the industry recognized PV performance modeling tool,” says Chris Deline, an electrical engineering researcher at U.S. National Renewable Energy Laboratory (NREL), one of the new test sponsors. Another one of the test beds will also evaluate newer software that competes with PVSyst.

The drawback to these tests is the lack of overall uniformity in what is being tested under what conditions, although this first round of tests likely will point the way for a more comprehensive test of most bifacial panel manufacturers and at least several tracker manufacturers.

The cost of such an endeavor may require an industry-sponsored project, or an expensive multi-client study, as DNV GL has proposed.

As the data from the tests flow in, initial rankings of the bifacial panels by manufacturer will emerge. In most of the tests, the performance data will be anonymous for the manufacturers, but those scoring highly may opt to have their brand data revealed.

The albedo boost

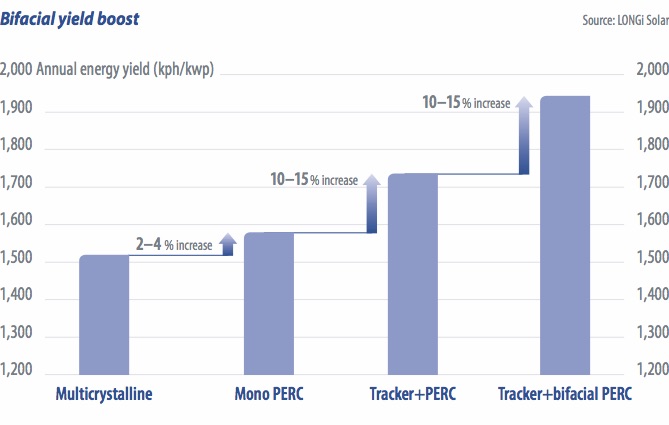

The reason that these field tests are proliferating is to enable different sets of panels and trackers to be selected for a solar project with the rough equivalent of a matched bankability study. The albedo boost, currently hovering around 10% in many initial test cases, is broadly expected to rise to 20% or 30%, as key variables are metered and optimized for field design.

While bifacial panels may increase energy yield by double digits, the cost of the panels thus far has held at single-digit premiums over mono-facial panels. Ultimately, bifacial panels are likely to be sold at a price reflecting the expected power output, but that exact figure is still a bit unclear.

Soltec and Black & Veatch

One of the first field tests to begin operations this year was the Soltec Bifacial Tracker Evaluation Center (BiTEC) facility in Livermore, California, for which data are being analyzed by independent engineer Black & Veatch. The facility is using Soltec’s SF7 single-axis trackers with bifacial panels from Canadian Solar, Hanwha Q Cells, Jinko, Jolywood, Longi, and REC.

Soltec is also collaborating with NREL to assist primarily in the application of simulation models, and with the Renewable Energy Test Center (RETC), to use BiTEC data in their joint “Bifacial Characterization and Ranking Initiative to assess the performance gains and validate the performance models on bifacial modules from global module manufacturers,” Soltec says.

“BiTEC was inaugurated on July of 2018, so we will be starting to distribute the most important data compiled at the beginning 2019, when the plant reaches six months of data compilation,” says Javier Guerrero Pérez, the BiTEC Project Manager for Soltec. We plan to publish a white paper with evaluated information to share with the industry. The mission of Soltec’s BiTEC is to perform rigorous assessment of installation and control parameter influences on bifacial tracking performance,” Pérez says.

Among specific variables to be tested at the site, which is based on the Soltec SF7 tracker and six bifacial panel makers, is albedo, pitch, height, and shading, among other potential areas of benchmarking.

NREL takes a stand

Thanks to the resources of both private and federal funding, NREL is mounting a sizable bifacial-tracker test bed. “We’re working with many many independent engineering firms and developers for field validation, module measurement, and site prospecting standards,” says Deline. “DNV GL, RETC, Cypress Creek, Leidos, and GroundWork come to mind for recent collaborations, among others,” Deline says. “In addition to Nextracker, we’ve been interacting with Array Technologies, Soltec, and GameChange to take a look at the question of single-axis tracking performance and shade loss,” he adds.

The invitation to participate is open. “We don’t have all of the equipment vendors completely locked down, but we are considering or working with the following manufacturers: Trina, Canadian Solar, Sunpreme, Mission Solar, REC, Hanwha Q Cells, Longi, Jinko, and others,” says Deline. NREL is considering purchasing some modules itself so that it has no constraint on data release. NREL is also using two vanadium redox flow batteries with the NX Fusion Plus trackers, which will store some of the energy for dispatch after sunset.

Sandia studies bifacial tracking

Sandia National Laboratories is also in the middle of a study on the performance of bifacial PV modules on single-axis trackers with several module suppliers, at Sandia in Albuquerque. The tests started in September and will continue through 2019, with preliminary results possible this summer. “We plan to test bifacial modules from Canadian Solar, Jolywood, and JA Solar,” says Joshua Stein, a member of technical staff at Sandia.

The list of variables being studied is long. “We have a total of four strings that are monitored for DC current and voltage as well as front and rear irradiance. In this study, we are investigating the performance of different module technologies – including bifacial versus monofacial, full cell versus split cell, and PERC and n-type cells,” says Stein. “We are also testing the effects of raising the different module types off the torque tubes,” he says.

“In addition to measuring performance, Sandia is simulating the performance using the ray tracing software, and bifacial radiance, and will use the field data collected to validate the modeling.”

DNV enhances Davis test site

DNV GL is now installing what it calls the “largest bifacial solar panel test facility in the world,” at Davis, CA, with the goal of benchmarking brand variations in the market to facilitate widespread U.S. adoption of bifacial plus tracking. The $250,000 project is being supported in part by a $200,000 grant from the U.S. Department of Energy.

The DNV test site will house 1,500 V bifacial panel arrays from as many manufacturers as are willing to cooperate, says Tara Doyle, the head of Business Development & Project Management at DNV GL. Thus far, the tests will include 50 kW of four manufacturers – Trina, Hanwha Q Cells, Longi, and Astronergy – mounted on trackers from Nextracker. The participant pool may broaden, she says.

DNV is studying the gap between the lab flash test for albedo and what is actually generated in the field. “What we are trying to do is correlate the bifacial factor to the module output in the field. Then we can see if the bifacial factor from manufacturers can be a predictor of the bifacial gain in the field,” says Doyle.

The company is also keen to convert the lab-to-field ratio into predictable numbers. “There is a wide range of manufacturer claims for the bifacial factor, so bankers…don’t know which data to believe,” says Tristan Erion-Lorico, the head of PV Module Business, Laboratory Services for DNV GL.

The goal is to put together a large set of bankable data that can be reported anonymously, to ultimately give project developers and others downstream peace of mind when they make their purchasing decisions.

Charles W. Thurston

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.