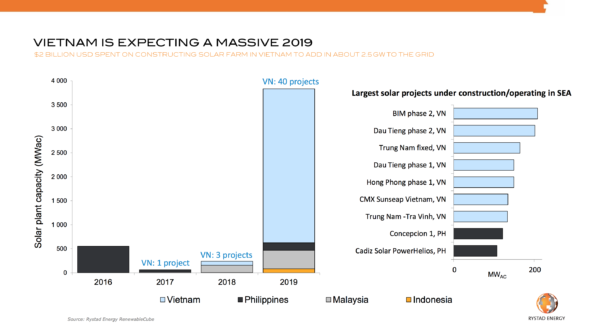

Vietnam, says Minh Khoi Le, leader of Southeast Asia analysis for Rystad Energy, is an example of what a country with stable leadership — albeit in a one-party state — can achieve with vision and long-term policy. A country that had zero renewable projects in 2016, now has a pipeline of 40 solar projects alone, with a combined capacity of 2.5 GW at various stages of development in 2019.

“A lot of Asian countries are like that, in the sense that you don’t see the Prime Minister changing, and that’s an advantage because they have a vision and it’s not going to change,” says Le.

The Southeast Asian section of the Rystad Energy RenewableCube kicks off with data on 1000 utility-scale solar and wind assets with a total pipeline of 55 GW across Vietnam, Malaysia, Philippines and Indonesia.

Vietnam, says Le, is bursting with solar largely due to a revision of the country’s Power Development Plan (PDP) in 2016, which shifted significant future capacity from coal to solar.

With a population of around 92 million, Vietnam’s energy needs are expected to triple in the next 10-15 years. It had been heavily reliant on locally mined coal to meet its requirements, but, “In the mid-2010s,” says Le, “Vietnam, which had traditionally been a big exporter of coal became an importer of coal for power generation, which was obviously not good for its economy. Hydro was also getting saturated, therefore the government wanted to improve the energy mix with renewables.”

Image: Natalie Filatoff, pv magazine

Under Version 7 of its PDP, the Vietnamese Government planned to have around 12 GW of solar contributions to the grid by 2030. In 2017 it seeded a boom by setting a feed-in tariff (FIT) under which the state-owned Electricity Vietnam (EVN) would buy solar energy at a rate of 9.35 US cents per kWh, which is about AU$130 per MWh. “Compared to what we get in Australia, that’s almost double,” says Le.

There is no quota on developments eligible for the FIT which is set for a period of 20 years, although applications for the FIT will close at the end of June 2019.

“This begins to explain why we’ve seen this massive wave of projects coming online in Vietnam,” says Le.

Graph: Rystad Energy

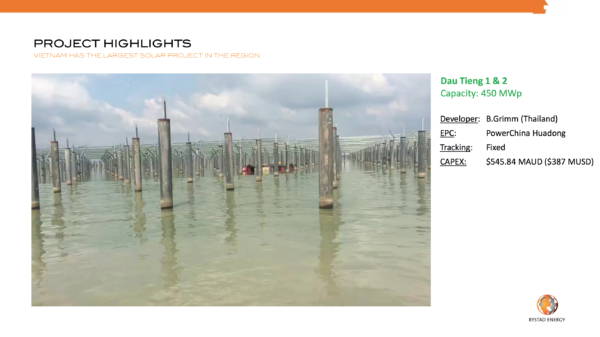

The biggest project currently under development in Vietnam is on and beside Dau Tieng lake, a shallow body of water 100 kilometres from Ho Chi Minh City in Vietnam’s southern province of Tay Ninh. With a proposed capacity of 415 MW peak, its developer is the Thai-owned B Grimm Power Company with EPC provided by PowerChina Huadong.

Similar to Australia’s National Electricity Market Grid, which runs long and lean down the eastern and southern coasts of Australia, Vietnam’s grid is also long, running 1,650 kilometres from north to south, and the vast majority of its solar development is so far slated for its resource-rich south.

To support future demand, says Le, “The Government recently finished a 3,000 km 500 kV line and about 16,000 km of 220kV lines.” And to help manage and integrate the fluctuating solar load, it has asked the German government for help with a smart-grid project, known as SGRE-EE that will be complete in 2022.

Image: Rystad Energy

After mid-2019, Le says feed-in tariffs in Vietnam will be revised to encourage development of utility-scale solar throughout the country, with the highest FITs offered for floating solar, which is most expensive to develop, another level of FIT for regions where irradiation is less than in the south, and so on.

“What we’re seeing is a possible lack of expertise in solar development in Vietnam,” says Le, but he emphasises the government’s ongoing support of solar investment and connection, and says, “There is a real possibility of international companies coming into Vietnam to start investing and doing work there. The country is pretty open, in contrast to Malaysia, for example, where they really limit foreign involvement in projects.”

Rystad Energy’s data on the region’s renewables considers market dimensions such as geography, renewable energy type, developers, EPCs, equipment suppliers, equity ownership and contractual development across all stages of asset development.

In terms of FIT incentives in the region, Le summarises that Thailand also offers a “pretty good” FIT, “however there is a quota of about 800 MW”, similar to Philippines when it released its solar policy; and Taiwan has a similarly good FIT, without a restrictive quota, “but the land for solar development is quite remote”.

“Selecting winning projects in this new market is challenging,” Le concludes, but in addition to Rystad Energy’s data-driven analysis, he says, “We know that most of the countries in South East Asia are developing countries, and in the next 10 to 30 years, their energy demand will increase a lot.”

He says, “The good thing is these countries are following world trends; they have all released their own policies to support renewable energy.”

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

this solar blog is awesome. solar energy is great in terms of producing power and saving the planet..