Sydney-based startup PV Lighthouse has been awarded $1.97 million (USD 1.32 million) by the Australian Renewable Energy Agency (ARENA) to fund the continued development of its SunSolve Yield power and yield modelling platform.

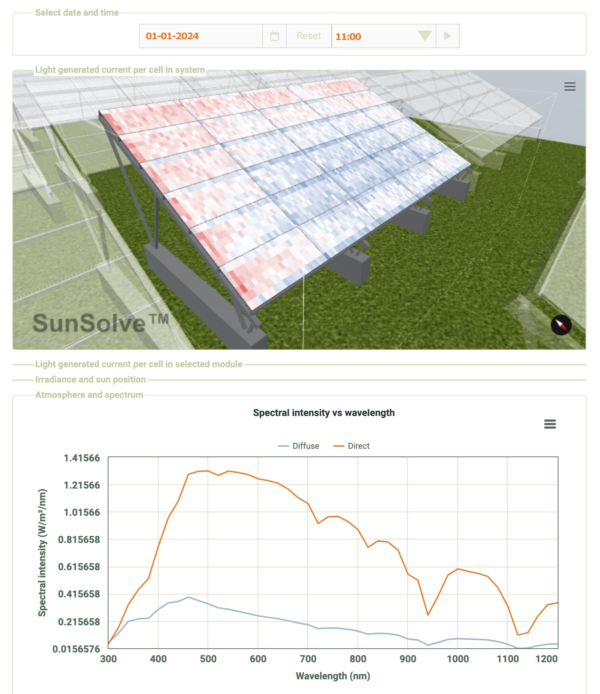

The company said the platform provides a digital twin of the structures and PV modules used in utility-scale solar projects, allowing developers to determine the annual yield of their projects and explore the impact of different weather, locations and mounting structures.

Keith McIntosh, founder and chief executive officer of PV Lighthouse and SunSolve, told pv magazine the company’s software can rapidly and accurately answer design questions that would previously have taken months to investigate and days to compute.

How do you explain what SunSolve Yield is and how it works?

SunSolve Yield is a powerful simulation environment that developers use to model their utility-scale projects more accurately than the standard industry software. SunSolve takes a physics-first approach to limit the simplifications that are currently reducing trust in yield forecasts.

With SunSolve Yield, developers can quickly and easily create a 3D model that accurately represents a system’s structural components and the PV modules themselves. Using SunSolve Yield’s high-performance physics-based models, developers can determine the annual yield of their solar projects and explore the impact of different weather, locations and mounting structures.

Image: PV Lighthouse

What are the challenges that SunSolve Yield seeks to resolve?

The high level of detail in the SunSolve Yield model means that developers can have greater confidence in their yield forecasts for both internal and project financing purposes. With the cost of financing utility-scale projects escalating with higher global interest rates, financiers are looking for a greater level of accuracy and sophistication in forecasts to drive down the cost of financing.

Before SunSolve existed, developers did not have a modelling solution that could accurately represent their structures and modules. This meant they had to guesstimate several of the loss factors required for their yield forecasts. Now developers can rapidly calculate these factors with SunSolve, giving them greater confidence in their forecasts – a key advantage when negotiating project financing.

Who is already using the SunSolve Yield technology?

Released in 2021, SunSolve Yield has already been used by nine of the 25 largest developers, five tracking companies, a couple of large independent engineering firms and a handful of institutes. Some customers use it to optimise their PV plants, others to improve the accuracy of their yield forecasts, others to quantify the losses due to shading and mismatch, and the gains due to edge brightening and optimal tracking routines.

Its partner product, SunSolve Power, was released in 2014. It has been used by many of the top module manufacturers to assist their R&D, including four of the five largest manufacturers. In fact, subscribers of SunSolve Power shipped about half of the global supply of modules in 2023. Some of our better-known subscribers are Longi, Trina, Qcells and Maxeon. SunSolve Power has been referenced in over 100 academic publications.

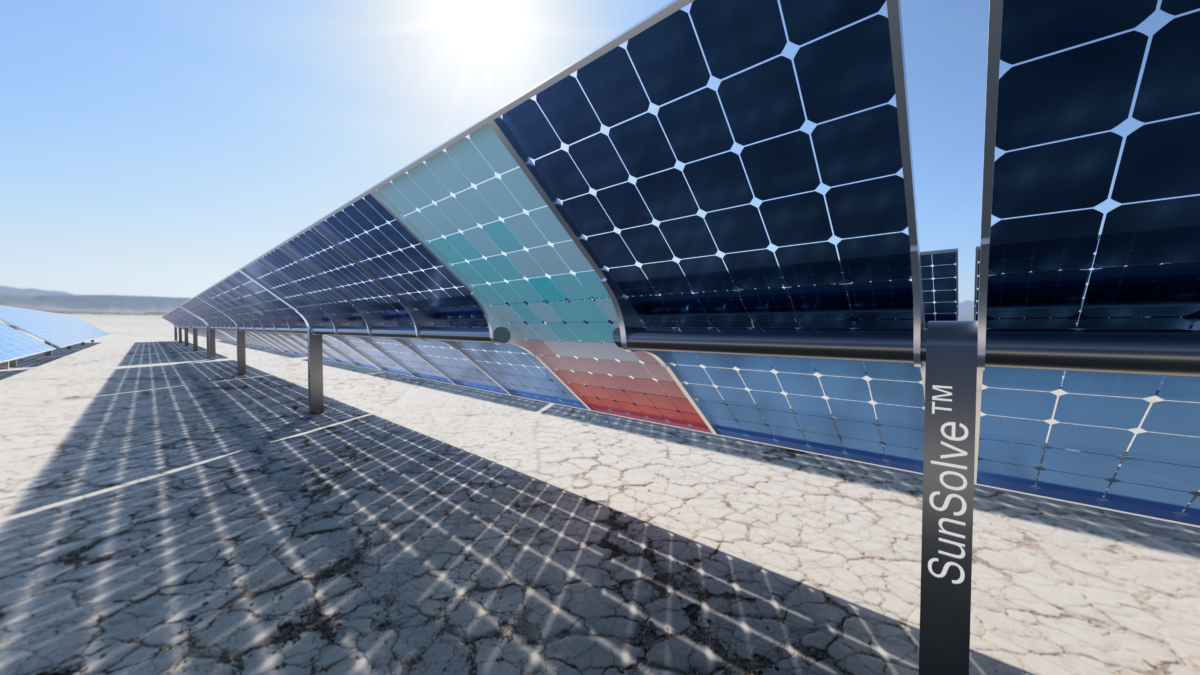

utility-scale PV projects.

Image: PV Lighthouse

What will this new funding allow you to achieve?

The ARENA funding will accelerate the development of SunSolve Yield through the hiring of additional programmers and researchers. We’ll begin by first improving the methodology to quantify yield uncertainty. This will assist developers and lenders to make more trustworthy forecasts, reducing project risk and hence the cost of financing.

By applying that improved methodology, and with feedback from industry partners and customers, we’ll then expand and validate the physical models – weather, optics, thermodynamics, electronics – that have the greatest potential to reduce uncertainty.

Where do you see the opportunities ahead for PV Lighthouse?

Our flagship product SunSolve Power has helped to drive innovation in cell and module research. It has been used by leading cell and module manufacturers to design world-record breaking cells and explore next-generation technologies.

SunSolve Yield is already in use by some of the largest and most sophisticated utility-scale developers. Our goal is to have the sophistication offered by SunSolve Yield applied in the evaluation of any utility-scale project over 100 MW. This will ultimately help to drive down the cost of financing and foster innovation at all levels of the solar industry.

Our view is that more accurate forecasts lead to better decision making. They empower everyone in the industry to identify the most valuable path forward. No matter where you are in the supply chain you are faced with choices between competing alternatives. Without an accurate model to value one choice over another, you might as well flip a coin.

What benefits beyond the actual design does the platform deliver?

One of the greatest barriers to the green energy transition is the cost of financing utility-scale projects, i.e. the interest that developers pay on the loans required to build their solar projects. To put this barrier into perspective, the cost of financing a project in Australia amounts to half the total cost of a utility-scale project. One reason for high financing costs is the difficulty in accurately forecasting the energy yield from a given project before that project has been built and, therefore, in accurately predicting the project’s future revenue. Thus, if a lender has low confidence in a project’s revenue, it will consider the project risky, and offer poorer financing terms.

At PV Lighthouse, we believe that our greatest contribution to the PV industry will ultimately be increasing the confidence that lenders have in yield forecasting, thereby reducing the cost of financing the green energy transition.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

3 comments

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.