From pv magazine USA

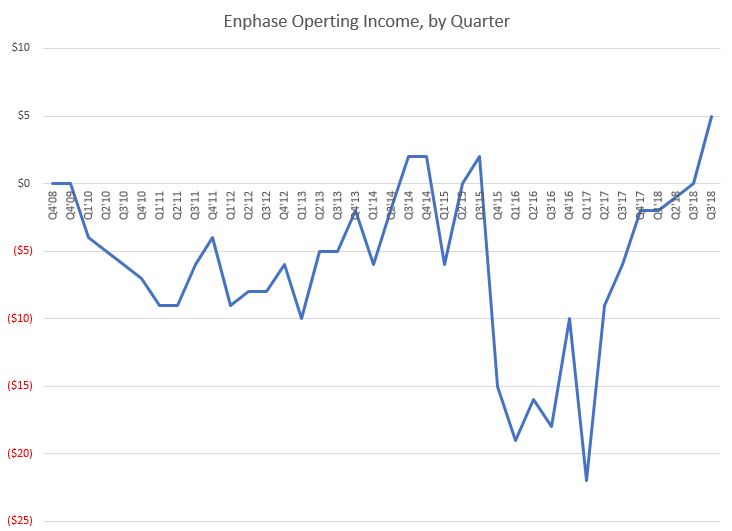

There are a lot of ways to define success, at pv magazine USA it is operating income that is our primary standard when we review quarterly reporting. And by that benchmark, Enphase’s track record – other than in a total of just four quarters since 2007 – has been sub-standard.

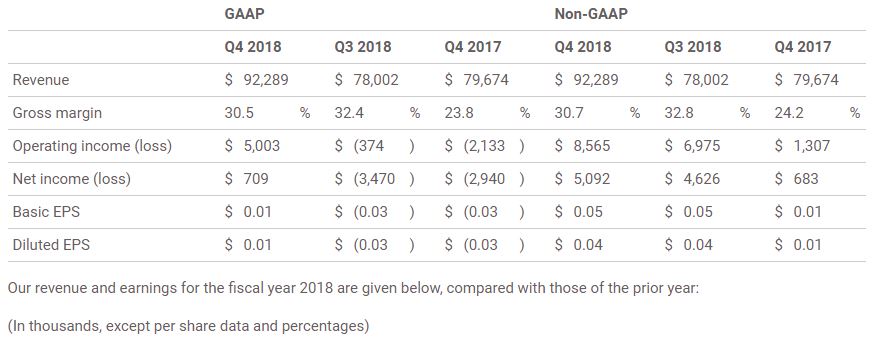

In yesterday’s earnings call, the Californian microinverter maker reported operating income of just over $5 million for the final three months of last year to drag the full year figure up to just shy of $1.6 million. Quarterly revenue was $92 million, contributing to $316 million for the year. The company ended 2018 with more than $106 million cash in hand, and Q4 gross margins of 30.5%.

Obviously, the fact Enphase has fundamentally changed the nature of the inverter, has its products on a near-1 million rooftops worldwide, and has stayed in existence for over a decade is an undoubted success. It’s just that success seems to be coming with a stable paycheck these days.

Wall Street was tougher to convince – with Enphase stock down almost 3% in after-hours trading, as the company’s earlier projections of earnings per share proved $0.02 too optimistic. The numbers for this quarter too are showing essentially zero growth due to a component shortage. However, this morning’s market was up more than 8%.

Enphase shipped 257 MW of inverter capacity – 820,000 units – during the last quarter. The company noted it paid higher costs for certain components – see the aforementioned shortage – that had to be flown rather than shipped. Enphase said that specific expense was a significant driver of quarterly gross margins that were 210 basis points lower in Q4 than in the previous three months, and repeated it is still running 13-15 weeks behind demand and expected the second half of the year to be much more comfortable.

Obviously, the fact Enphase has fundamentally changed the nature of the inverter, has its products on a near-1 million rooftops worldwide, and has stayed in existence for over a decade is an undoubted success. It’s just that success seems to be coming with a stable paycheck these days.

Wall Street was tougher to convince – with Enphase stock down almost 3% in after-hours trading, as the company’s earlier projections of earnings per share proved $0.02 too optimistic. The numbers for this quarter too are showing essentially zero growth due to a component shortage. However, this morning’s market was up more than 8%.

Enphase shipped 257 MW of inverter capacity – 820,000 units – during the last quarter. The company noted it paid higher costs for certain components – see the aforementioned shortage – that had to be flown rather than shipped. Enphase said that specific expense was a significant driver of quarterly gross margins that were 210 basis points lower in Q4 than in the previous three months, and repeated it is still running 13-15 weeks behind demand and expected the second half of the year to be much more comfortable.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.