According to some interpretations, homo sapiens is the only species able to overpower rivals and spread over the globe, thanks to our ability to cooperate effectively and flexibly in large numbers. That same principle could apply to certain technologies – including PV. While solar has not yet risen to conquer the world, intelligent software solutions are able to establish large-scale cooperation by networking into resilient structures: Virtual power plants (VPPs) provide a compelling example.

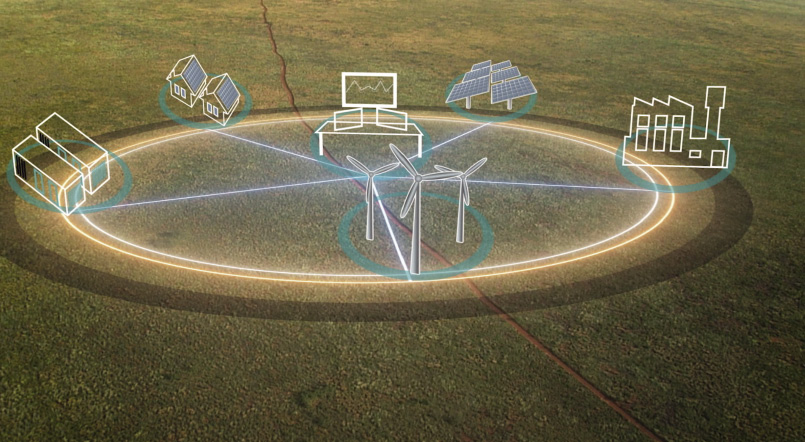

A VPP is a network of decentralized power generating units tasked with balancing the grid and facilitating the integration of large renewable energy capacity into existing energy systems. With a central IT control system that can network and monitor all participating distributed energy resources (DERs), VPPs can be operated as traditional power plants with one big advantage – flexibility. As the cloud is fed with all information about the interwoven units and the power grid, VPPs are able to assume a role in frequency regulation, as well as adapt to the constantly changing electricity price when selling output on wholesale markets.

Today, VPPs use a variety of DERs as building blocks, including batteries, solar/wind/hydro installations, microgrids, EV chargers, pool pumps, air conditioners, and hot water systems. As one of the hottest markets for solar+storage uptake worldwide with over two million rooftop PV systems installed and a fast-growing energy storage market underpinned by a rising number of home battery subsidy schemes, Australia is hosting a growing pipeline of VPP projects.

Notable projects

From the world’s largest virtual power plant – the 250 MW/650 MWh system that aims to install and integrate Tesla Powerwall 2 batteries and solar panels on 50,000 South Australian (SA) households – to the ARENA-funded Decentralized Energy Exchange (deX) project led by Melbourne’s GreenSync, the Australian VPP ecosystem is vibrant and diverse. A number of projects are being initiated by state governments, including the aforementioned SA VPP that recently entered its second phase. New South Wales’ plans to install up to 900 smart batteries on hospitals and schools to create a 13 MW VPP and a proposed 40,000 strong, 200 MW VPP, and Queensland’s Townsville VPP has been tasked with redirecting electricity generated in industry to households in the state’s north.

Another significant feature of the Australian VPP landscape is the initiatives launched by gentailers – the country’s integrated generators and retailers. Australia’s biggest utility, AGL, is building a

5 MW/12 MWh VPP in Adelaide, using Tesla Powerwall 2 batteries and the LG Chem RESU 10h-SolarEdge combination.

Another Adelaide VPP is being rolled out by Simply Energy – an 8 MW network comprising Tesla Powerwall 2 batteries installed in up to 1,200 homes (6 MW), and a further 2 MW of demand response capacity deployed across 10 commercial businesses. Meanwhile, Origin Energy is preparing to fire up a 5 MW VPP in Victoria, which will connect the solar and battery systems of up to 650 residential and commercial properties across the state, in what will be the retailer’s first VPP and the largest in Victoria to date. And the list goes on.

Fertile ground

While VPP technology has been around for nearly two decades, Australia’s pipeline of projects is fairly young. The integration process has been one of learning by doing and unlocking new services as projects develop. Already bringing multiple benefits for the grid itself, ranging from network solutions that can underpin the energy transition to placing downward pressure on power prices, VPPs have emerged as a more sophisticated version of traditional power infrastructure.

“VPPs are scalpels and centralized generators are hammers,” says Alan Reid, Head of Business Relations at software supplier Reposit Power, which is working on VPPs with Powershop, Diamond Energy, and ActewAGL. “Because of their distributed nature, and as they are on the low voltage network, VPPs can offer a much wider and highly targeted range of solutions that allow more efficient operation of our electricity grid, as well as participate in the traditional markets that typical power plants can.”

What makes VPPs so appealing to a wide range of stakeholders, including utilities, energy suppliers, and solar+storage system owners, is the fact that they represent an additional revenue stream leveraging a system that already has a sunk cost. “An advantage more specific to Australia is the differentiation that the VPP provides energy suppliers in a competitive market. This is because in Australia, unlike in other regions, homeowners have the ability to choose their energy supplier,” explains Lior Handelsman, Founder of inverter manufacturer SolarEdge. He goes on to note that Australia’s level of maturity using DERs makes it a particularly good location.

Also, in comparison to other strong DER markets, Australia’s electricity sector offers a greater level of flexibility. Marc Sheldon, Managing Director, Operations and Finance APAC at sonnen Australia, says that compared to Germany, Australia has far less market entry barriers and regulations. “Decentralized home batteries can be used to store renewable energy regardless of its source, not only from rooftop PV, and release it in times of high demand,” Sheldon says, adding that in Germany, energy fees still prevent such an arbitrage trading model.

Last year, sonnen batteries were deployed in 12 Sydney homes and orchestrated into a mini-VPP based on a blockchain. According to the battery provider, the first results of the project, which aims to reduce electricity demand from the grid by 90%, have more than fulfilled their expectations.

Meanwhile, enticed by the SA Home Battery Scheme (HBS), sonnen established a manufacturing hub in Adelaide looking to produce 10,000 batteries annually. It expects the bulk of the installed storage systems in SA to become part of its VPP, given the much greater advantages to the end customer than simple self-consumption. When it comes to establishing VPPs, sonnen believes that a network with around 500 units could already benefit the SA grid infrastructure, while a VPP made from around 2,000 batteries would provide significant capabilities to the grid.

“The systems installed under the HBS will complement other systems sold prior to the scheme launch,” says Sheldon. “The first goal with our VPP coming up this year is to help stabilize the grid in SA. In addition, we plan to deliver spot optimization, arbitrage trading, and frequency control ancillary services based on our VPP platform.”

Practical difficulties

While numerous trials across Australia have shown VPPs can respond to both planned and unplanned dispatch events, they have occasionally highlighted the complexity of maintaining a consistent power export target over the course of extended dispatches. Speaking about the 5 MW AGL VPP, project funding partner ARENA says reasons for this complexity include the impact of high grid-voltage, battery state of charge variations, and the variability of solar production and household load on each of the individual sites, noting that as a result, battery inverter disconnections continued to have a significant impact in stage two of the three-stage deployment.

Commenting on the main difficulties in bringing a VPP online in Australia, Handelsman of SolarEdge says that any challenges that arise are due to the coordination of a variety of different hardware, software, and connection and commercial agreements with customers, which all add complexity. “Having a native system of hardware and software, such as SolarEdge’s grid services, reduces the complexity,” Handelsman explains.

According to the SolarEdge Founder, the company’s VPP is designed to manage inverter disconnections due to grid-edge voltage violations. The VPP knows which inverters are connected at any second, so when some of them go offline for any reason the software will account for these missing systems while redistributing resources as part of the deployment plan. It can also detect when inverters come back online. Therefore, in areas with known voltage issues, it is recommended to start with a larger fleet in order to assure availability of necessary resources.

“SolarEdge’s VPP solution relies on the existing communication link between the inverter and the cloud monitoring. This eliminates the need for a costly local controller or a dedicated communication link, thus resulting in an affordable, high performance solution,” says Handelsman, when discussing the internally developed VPP system launched last year that has so far been applied in Australia, the United States, and Europe.

Meanwhile, from the perspective of a VPP software provider, the main challenges are reflected in the need for strong partners and alignment in all areas of the process. “Sales, customer education, installation, hardware, aggregators, retailer – all parts of the chain need to be strong, and if there’s one weak link you can have problems, even if the other links are strong,“ says Reposit Power’s Reid.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.