In December 2016, French project developer and IPP Total Eren began work in earnest on the Kiamal Solar Farm, a two-stage project that will be the largest in the state of Victoria when completed in late 2019 or early 2020. And the plans are big. Stage one of Kiamal is currently under construction and will come in at 256 MW, with stage two scheduled to reach 193 MW.

Around 75% of the project’s eventual output is covered by PPAs, with electricity retailers Alinta, Flow Power, and Snowy Hydro having all signed contracts with Total Eren. Confectioner Mars is a notable PPA signatory for the project, as a large commercial customer.

However, progress on the project has not been particularly smooth. “We are behind schedule,” explained Michael Vawser, regional director for Asia Pacific at Total Eren. “A few things got in the way, I guess you could say.” Vawser spoke at the Informa Commercial and Large-Scale Solar Conference in Sydney in February where he walked attendees through the challenges the project faced, not least among them grid-connection.

An old friend

Today, construction is well and truly underway on stage one, with connection hurdles having been cleared by Total Eren and permission to connect provided by the Australian Electricity Market Operator (AEMO). But it took a sizable investment and piece of kit, in the form of synchronous condenser (syncon) to be installed in a particularly renewables-heavy stretch of Australia’s National Electricity Market network in northwest Victoria.

Total Eren contracted VINCI-Energies/Electrix to design and install the syncon, which was strategically placed on the grid in the largely rural region. Siemens delivered the syncon – which is set to arrive this month. It is the first time a syncon has been installed in Australia to facilitate a solar project. “The idea [of the syncon] is not to generate reactive power necessarily… in northwest Victoria specifically it is to provide inertia and system strength to that part of the network,” said Vawser. “It is probably one of the most distant parts of the network from the coal fired and gas fired power stations [in Victoria]. So, when you start putting hundreds of megawatts of solar into an area, and hundreds of megawatts of wind, the system needs a bit of support.”

The Siemens syncon in support of Kiamal is big. It can provide around 730 MVA of fault current, to help stabilize the grid if problems occur. Combined with the circuit breaker, transformer, and control systems, it occupies a footprint of 55 × 65 m. “It is a huge piece of kit and something we never expected to have to build, even up until May or June of last year,” said Vawser. “The good news is it is big enough to support our full two stages, the 450 MW of solar, so there is an upside in that sense.”

The cost of the syncon has not been made public, however it likely did not come cheap. While for a project the size of Kiamal it clearly made sense for Total Eren to deploy the syncon, particularly at that late stage of development and with PPAs signed. But for smaller projects, such an unexpected cost could potentially cause a project not to go ahead. And in light of a number of other factors impacting the Australian large-scale solar marketplace in 2019, the outlook for the large-scale segment is not looking as rosy as it was just six months ago.

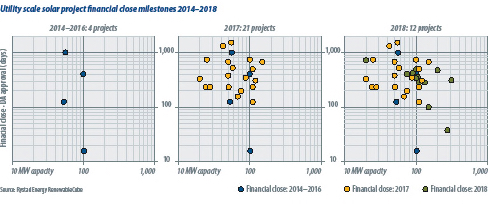

David Dixon, senior analyst renewables for Rystad Energy, says that these hurdles or market uncertainties appear to be making it more difficult for projects to achieve financial close in 2019. According to Rystad figures, 21 utility-scale solar arrays reached financial close in 2017, and this number fell to 12 in 2018 (see chart below left) – although that included a number of very large projects. “This year we’ve had none that we’ve tracked so far,” says Dixon.

The factors behind this decline are numerous. Instability as to energy policy remains a constant, with New South Wales (NSW) state elections last month presenting two quite different visions for the power sector in the state, and a federal election between energy polar opposites due in a matter of weeks. Add to this an increasingly risk-averse EPC landscape on the back of the bankruptcy of leading Australian solar EPC RCR Tomlinson (see pv magazine 03/19, p.46) and the ongoing grid capacity issues and tightened rules from AEMO, and it is a recipe for stagnation.

“Developers are reporting that MLFs [marginal loss factors] are hitting really hard the revenue of these new generators,” adds Dixon. AEMO released a draft of its MLF protocols in March, and for some projects in the fastest growing state market of New South Wales the impact of project financials could be decisive.

“A lot of solar farms, six or seven, will see over 10% [MLF applied] so a pretty big hit to their revenue streams,” continues Dixon. “You are essentially getting paid, for the same generation, over 10% less.”

For Total Eren and its Kiamal, the previous round of MLFs did impact the project, along with a deflating Australian dollar and, of course, the imposition of the syncon. “Those three items were a massive impact on project’s economics and we had to then go back and optimize everything else to get us back to where we were an economic project,” said Total Eren’s Vawser “The usual items that you would expect [were optimized] in terms of debt yield and capex improvements, plus strategic partnerships have got us back in the black.”

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.